CA Pratibha Goyal | Apr 27, 2022 |

HC warns GST Department to do GST cancellation in accordance with law: Quashes vague SCN & Order

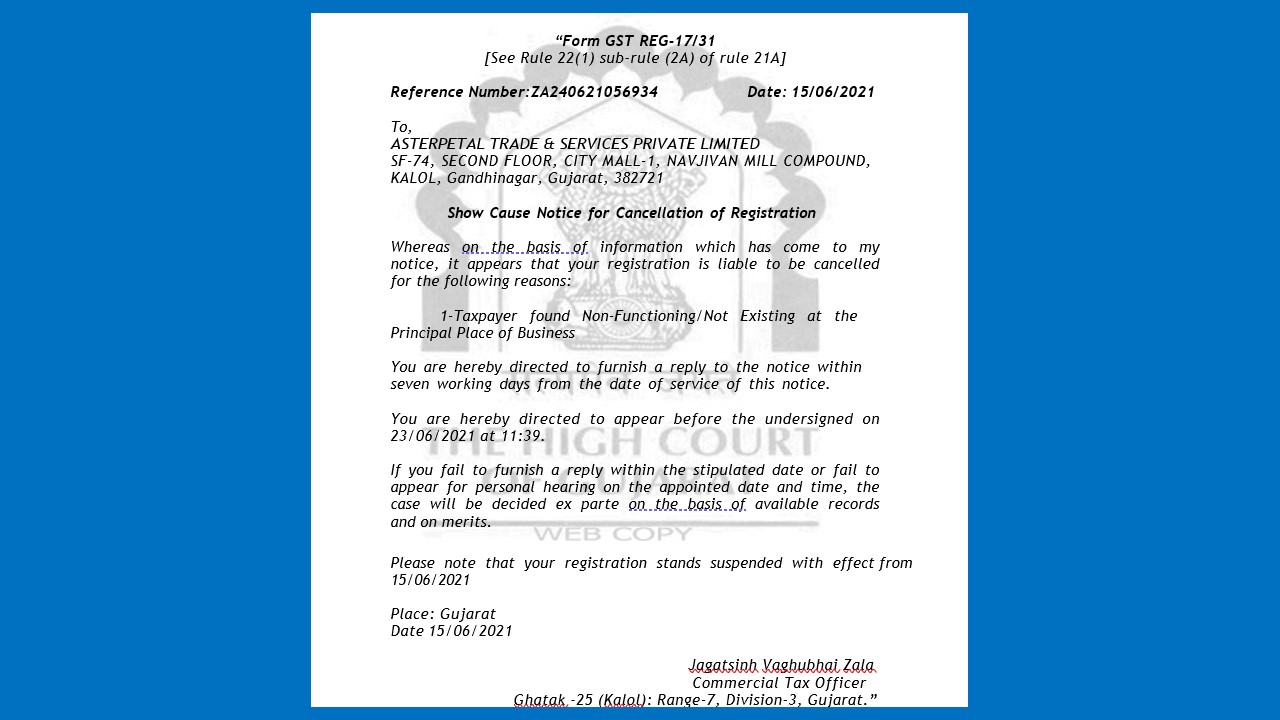

The writ applicant is engaged in the business of trading of bullion and agricultural commodities. The writ applicant is registered under the GGST Act with effect from 25.01.2018. The writ applicant came to be served with a show cause notice dated 15.06.2021 in Form GST REG – 17/31 calling upon the writ applicant to show cause as to why the registration should not be cancelled.

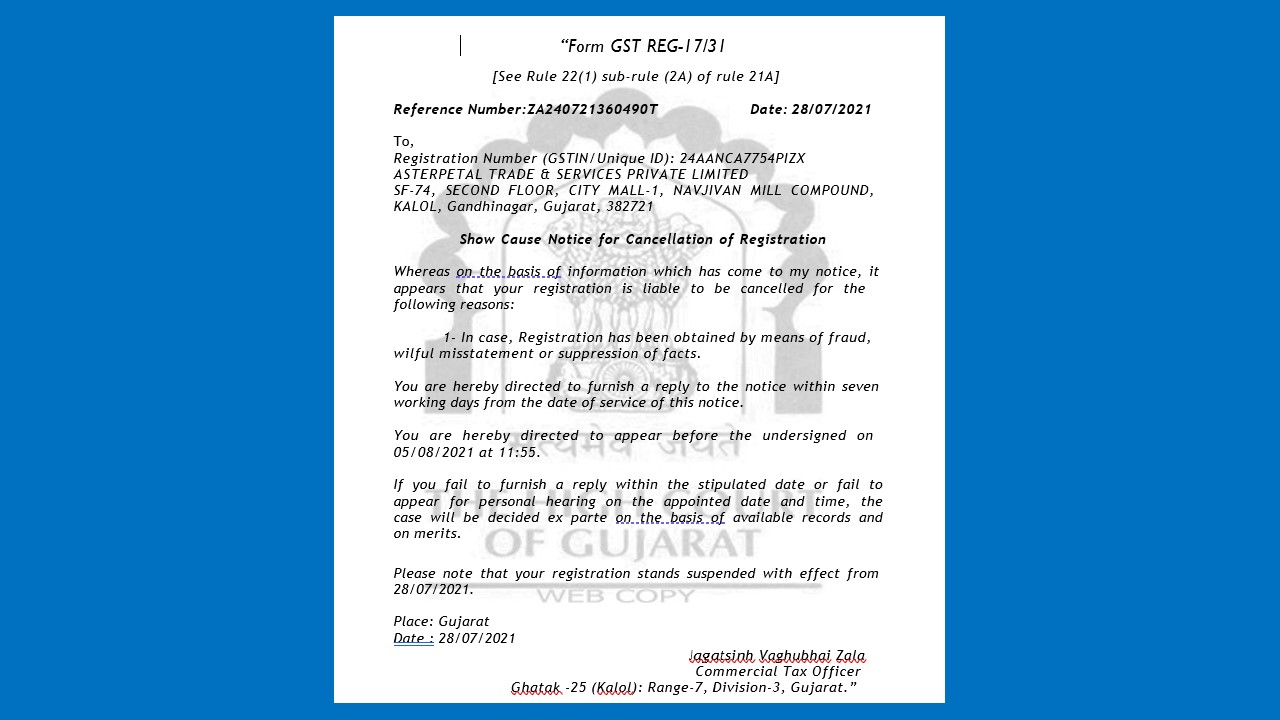

It appears that no action was taken pursuant to the aforesaid show cause notice. Later, the Commercial Tax Officer, Ghatak – 25 (Kalol) , Range -7, Division – 3, Gujarat, issued a fresh show cause notice dated 28.07.2021. The same reads thus:

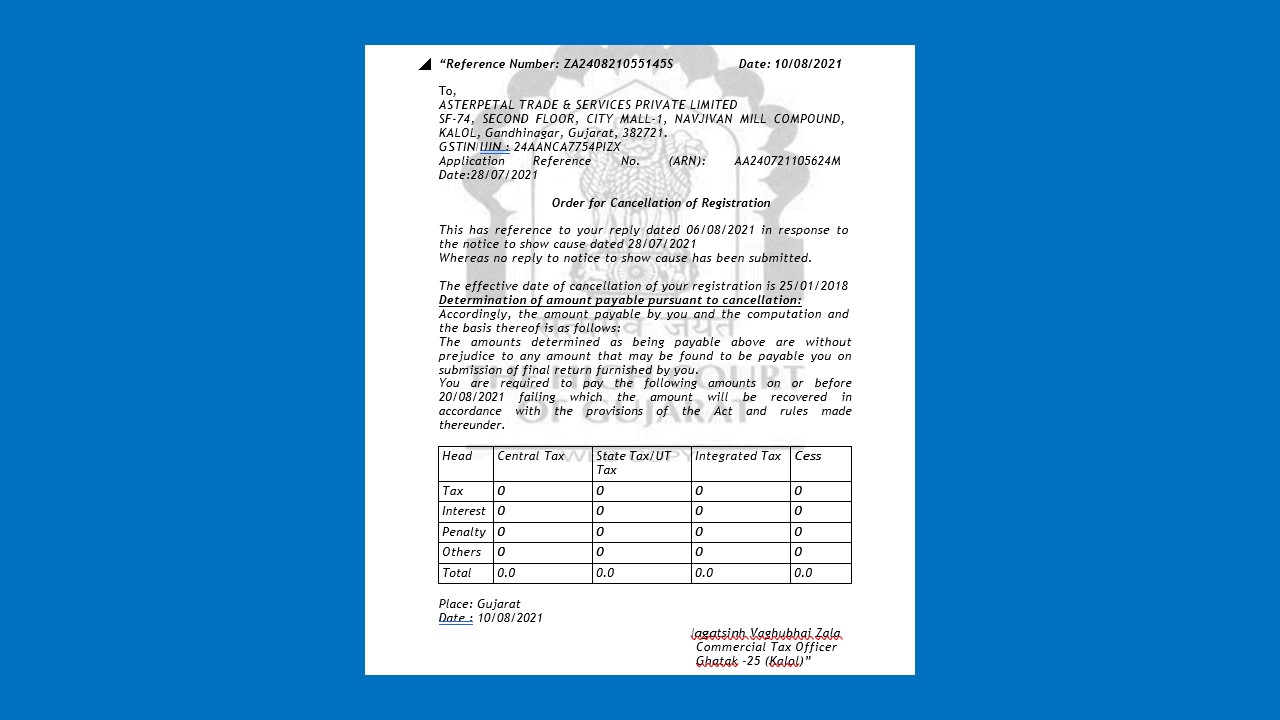

Ultimately, the final order came to be passed dated 10.08.2021 canceling the registration. The order reads thus:

4. The show cause notices, referred to above, and the impugned order are as vague as anything. The issue is now covered by the decision of this Court in the case of Aggarwal Dyeing and Printing Works vs. State of Gujarat & 2 Ors., Special Civil Application No.18860 of 2021, decided on 24.02.2022.

5. In view of the aforesaid, this writ application succeeds and is hereby allowed. The impugned order cancelling the registration and the show cause notice is hereby quashed and set aside. The registration stands restored. If the department wants to proceed further it may do so strictly in accordance with law keeping in mind the observations made by this Court in the recent pronouncement in the case of Aggarwal Dyeing and Printing Works (Supra).

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"