CA Pratibha Goyal | Jun 21, 2024 |

High Tax Rate on F&O: Taxpayers thought on this probable Budget 24 Tweak

To discourage retail investors from trading in Futures and Option (F&O), the government is planning to move F&O from the head of “business income” to “speculative income” and/ or also introduce a Tax-Deductible-at-Source (TDS) in the upcoming Budget 2024.

The growing involvement of ordinary investors in the derivatives market has long alarmed the government and regulatory bodies. The insider stated, “There are concerns that if markets drop, retail investors may suffer large losses, which would depress optimism overall.

Let us see how netizens reacted to this news on Twitter:

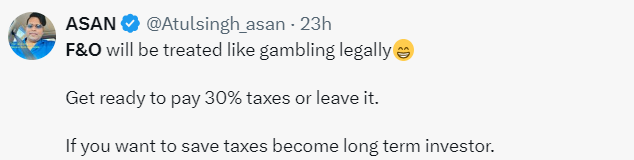

Mr. Atul Singh writes, F&O will be treated like gambling legally, Get ready to pay 30% taxes or leave it. If you want to save taxes, become long-term investor.

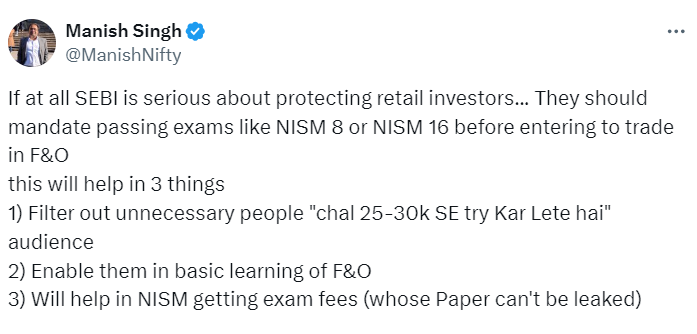

Mr. Manish Singh suggested that If at all SEBI is serious about protecting retail investors… They should mandate passing exams like NISM 8 or NISM 16 before entering to trade in F&O this will help in 3 things 1) Filter out unnecessary people “chal 25-30k SE try Kar Lete hai” audience 2) Enable them in basic learning of F&O 3) Will help in NISM getting exam fees (whose Paper can’t be leaked)

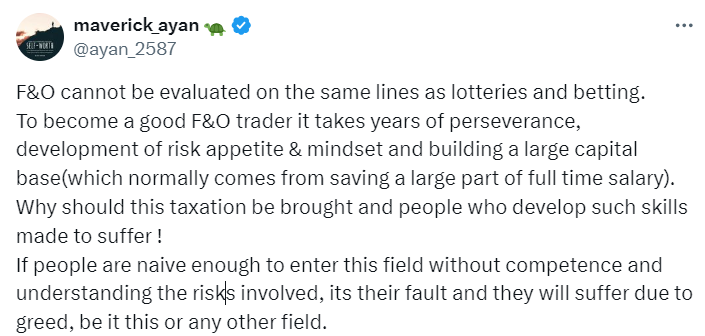

One of the Twitter handle wrote; F&O cannot be evaluated on the same lines as lotteries and betting. To become a good F&O trader it takes years of perseverance, development of risk appetite & mindset and building a large capital base(which normally comes from saving a large part of full time salary). Why should this taxation be brought and people who develop such skills made to suffer.

Many also agree that Future and Option Trading is dangerous; CA Akhil Pachori Writes:

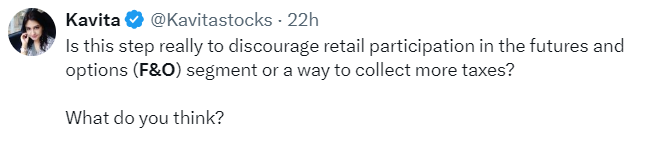

Miss Kavita Writes, Is this step really to discourage retail participation in the futures and options (F&O) segment or a way to collect more taxes?

Although there is nothing wrong with the growing number of retail investors drawn to the F&O market, a SEBI report claims that 90% of retail investors lose money in the derivatives market.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"