Reetu | May 18, 2024 |

ICAI announces Schedule of CA Examination in September 2024; Check the Schedule

The Institute of Chartered Accountants of India (ICAI) has announced the Schedule of the CA Examination in September 2024 for Foundation and Intermediate Programme Courses. ICAI notified this via Announcement.

The Important Announcement Read as Follows:

In pursuance of Regulation 22 of the Chartered Accountants Regulations, 1988, the Council of the Institute of Chartered Accountants of India is pleased to announce that the next Chartered Accountants Foundation and Intermediate Examinations will be held on the dates and places which are given below provided that the sufficient number of candidates offer themselves to appear from each of the below-mentioned places.

[As per syllabus contained in the scheme notified by the Council under Regulation 25 F of the Chartered Accountants Regulations, 1988.]

EXAM DATE: 13th, 15th, 18th and 20th September, 2024

[As per syllabus contained in the scheme notified by the Council under Regulation 28 F of the Chartered Accountants Regulations, 1988.]

EXAM DATE:

Group I: 12th, 14th and 17th September, 2024

Group II: 19th, 21st and 23rd September, 2024

According to F. No. 12/2/2023-JCA dated 3.7.2023 issued by the Ministry of Personnel, Public Grievance, and Pensions, Government of India, no examination is scheduled for Monday, September 16, 2024 (Milad – un – Nabi), which is a compulsory (gazetted) Central Government holiday.

It should be noted that if any day of the examination schedule is declared a public holiday by the Central Government or any State Government/Local Bodies, the examination schedule will remain unchanged.

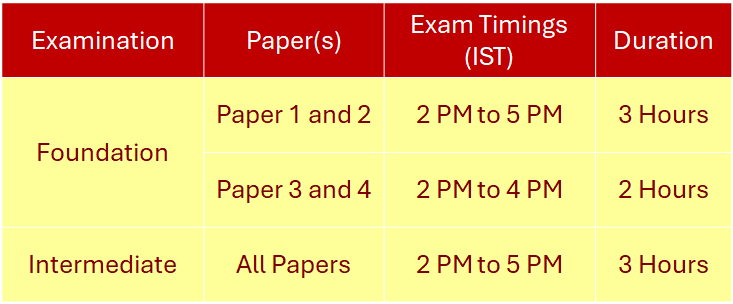

Paper(s) 3 & 4 of the Foundation Examination are of 2 hours duration. However, all other examinations are of 3 hours duration, and the examination-wise timing(s) are given below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"