ICAI has filed a suit for a permanent injunction at the Delhi High Court to restrain Netflix from telecasting the web series - Tribhuvan Mishra CA Topper.

Reetu | Jul 15, 2024 |

ICAI Approaches Delhi HC for Ban on Netflix Movie ‘Tribhuvan Mishra CA Topper’

The Institute of Chartered Accountants of India (ICAI) approached the Delhi High Court to file a suit for restraining Netflix from telecasting the web series – Tribhuvan Mishra CA Topper and Ban the show.

The hearing of this case is fixed for tomorrow and will be held at Delhi High Court.

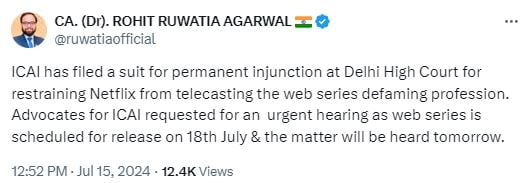

CA (Dr). Rohit Ruwatia Agarwal, who is also a Central Council Member of ICAI, shared this news on his Twitter account. He wrote, “ICAI has filed a suit for a permanent injunction at Delhi High Court for restraining Netflix from telecasting the web series defaming profession. Advocates for ICAI requested for an urgent hearing as the web series is scheduled for release on 18th July and the matter will be heard tomorrow.”

CA Akhil Pachori also shared this news on his Twitter handle. He stated, “ICAI has filed a suit for permanent injunction at Delhi High Court for restraining Netflix from telecasting the web series #TribhuvanMishraCATopper. The hearing is fixed for tomorrow.”

Earlier when Netflix released the trailer of a web series based on a Chartered Accountant namely “Tribhuvan Mishra: CA Topper“, netizens condemned both the creators and the streaming platform for representing Chartered Accountants (CAs) negatively and showing vulgarity in the series. The show, which tells the narrative of an accountant who gets sucked into a misadventure involving weapons and sweet-toothed gangsters posing as halwaais, has been accused of mocking CAs.

The trailer of the show released last week, introduces the characters without revealing anything about their backgrounds. It depicts lead actor Manav Kaul’s character, a Chartered Accountant (CA), leading a regular and uninteresting life. To pay off his debts, he becomes a gigolo. The audience is intrigued by the drama that will unfold in the crazy crime comedy-drama, also starring Tillotama Shome. As the people offended by vulgarity showed, they demanded the ban of Netflix Show CA Topper.

Some social media users praised the trailer, others criticized the creators for the show’s content. Many took the way of social media to brust out their anger.

A user wrote, “I strongly criticise the upcoming Webseries on @NetflixIndia, request @NetflixIndia to remove it from your platform immediately #boycott_CA_Topper, I urge everyone to report this issue.”

Another user wrote, “First when I saw that Netflix is coming with series on CA, I was happy but as soon as I saw the trailer I was like What the hell is this… Our profession is most underrated and now also this series will disrespect our noble profession.”

Some Urge ICAI to Request a Ban on this Web Series

One person posted, “Hey @NetflixIndia Kindly don’t release it. It’s completely embarrassment for the Noble profession to portray something like this. @theicai pls look into it.”

Another person wrote, “As a Chartered Accountant, I am deeply offended by the vulgarity in the trailer for your upcoming release. This portrayal undermines the dignity of our profession. I urge you to reconsider releasing this @theicai request you to take immediate action to address this disrespect.”

One more person wrote, “Utterly shameful to use Tag CA which signifies Chartered Accountant as a shameful tag in your series/movie! We condemn this and also will move courts against misuse of A prestigious tag & Degree Initial CA! @theicai @NetflixIndia @FinMinIndia #BanCATopper #CA”

After listening to people’s appeal, the ICAI has taken the initiative to look after this matter and submit a plea before the Delhi High Court to ban Netflix’s Web Series. As mentioned above the hearing will going to be tomorrow. Let’s see what the high court will decide?”

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"