CA Pratibha Goyal | Feb 24, 2024 |

![ICAI likely to postpone CA May Exam 2024 Due to General Elections [Read Official Announcement]](/cdn-cgi/image/fit=contain,format=webp,gravity=auto,metadata=none,quality=80,width=1200,height=730/wp-content/uploads/2024/02/ICAI-likely-to-postpone-CA-May-Exam-2024-Due-to-General-Elections-Read-Official-Notification.jpg)

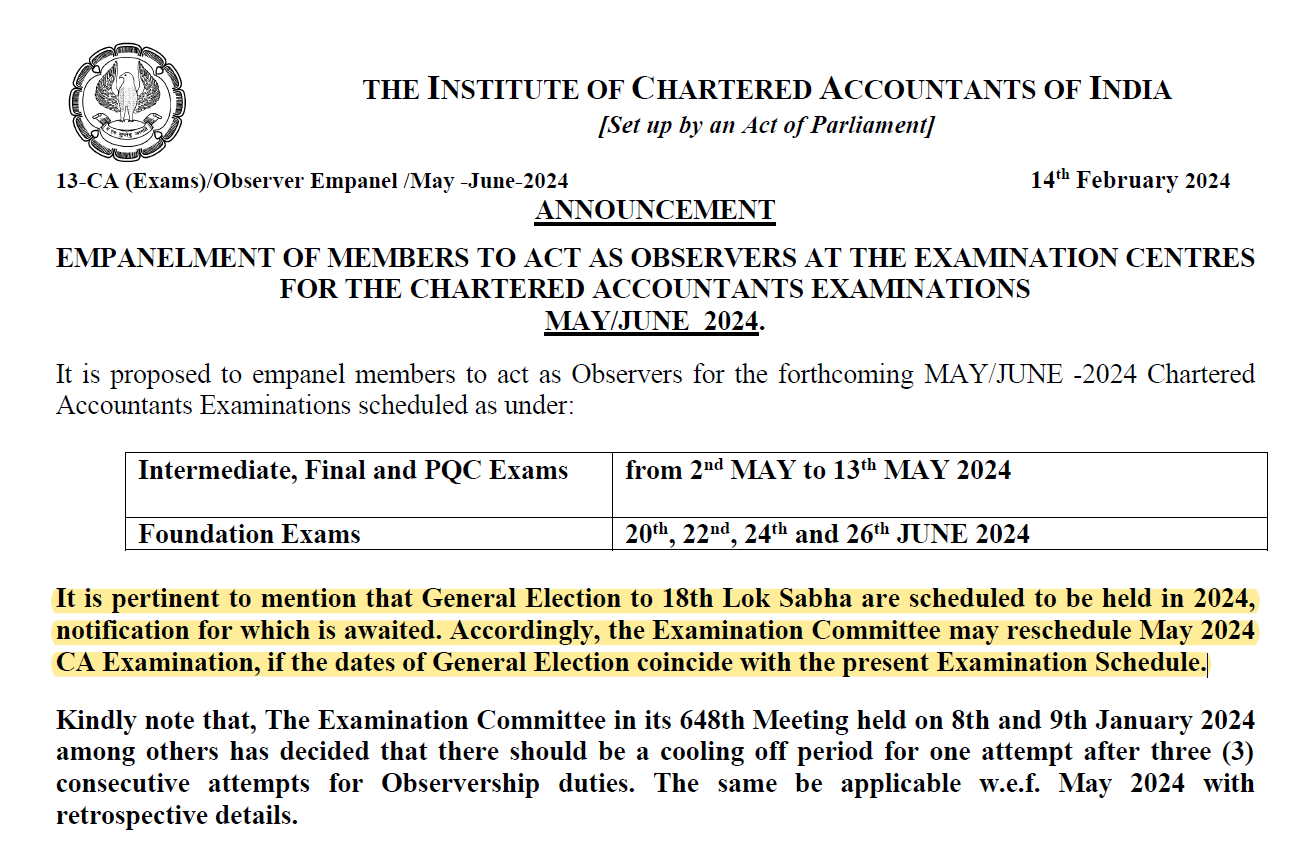

ICAI likely to postpone CA May Exam 2024 Due to General Elections [Read Official Announcement]

The Institute of Chartered Accountants of India (ICAI) is likely to postpone the Chartered Accountancy Examination for CA foundation, Intermediate, and CA Final exams for May 2024 as their dates collide with the General Loksabha Elections 2024.

ICAI Announcement dated 14th Feburary reads as under:

It is pertinent to mention that General Election to 18th Lok Sabha are scheduled to be held in 2024, notification for which is awaited. Accordingly, the Examination Committee may reschedule May 2024 CA Examination, if the dates of General Election coincide with the present Examination Schedule.

Also Read: ICAI notifies Empanelment of Members to act as Observers for CA Examinations May/June 2024

Students should wait for the official announcement:

Although it is a trend that the CA Examinations are generally postponed, in the wake of general elections, students are requested to concentrate on their studies and wait for the official announcement of the Government and the Institute.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"