Reetu | Feb 14, 2024 |

ICAI notifies Empanelment of Members to act as Observers for CA Examinations May/June 2024

The Institute of Chartered Accountants of India (ICAI) has notified the Empanelment of Members to act as Observers at the Examination Centres for the Chartered Accountants Examinations in May/June 2024.

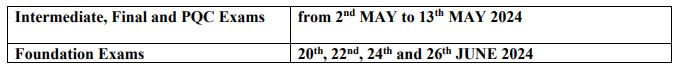

It is proposed to empanel members to act as Observers for the forthcoming MAY/JUNE -2024 Chartered Accountants Examinations scheduled as under:

It is worth noting that the General Election to the 18th Lok Sabha is set for 2024, and notification is expected to arrive. As a result, the Examination Committee may reschedule the May 2024 CA Examination if the General Election dates coincide with the current Examination Schedule.

Please take note that the Examination Committee, during its 648th Meeting on the 8th and 9th of January 2024, among other things, resolved that there should be a cooling off period for one attempt following three (3) consecutive tries for Observership duties. The same will be applicable beginning in May 2024, with retrospective details.

Members who fulfill the following criteria are eligible for empanelment, to act as Observers:-

i) He/ she should not be more than 65 years of age as on the date of empanelment, i.e. 15th February, 2024.

ii) His/ her name should have been borne on the Register of Members as on 1st November 2021 and continues to be so;

iii) Neither he/ she nor his/her relatives* or dependant* is / will be appearing in the ensuing Chartered Accountants Examinations for students / Post – Qualification Course Examinations in MAY/JUNE 2024 in any examination centres in India or Abroad. However, applying or appearing in ISA – AT will not be considered a disability for observership for CA Examinations.

iv) He/she is not coaching students for any of the examinations/tests conducted by the Council of the Institute in any institutions/organization including Regional Councils / Branches of the Institute and also private coaching.

v) He/ she has not been convicted by any court of Law and no disciplinary proceedings are pending against him/her, either by the ICAI / Disciplinary Directorate or by any other organization, both in India or abroad.

vi) He/ she is not associated with the Institute as an elected/co-opted member of the Council / Regional Council / Managing Committee of any Branch of the ICAI.

vii) He/ she shall abide by the Guidelines for Observer and/or any other instructions.

viii) He/ she is not a Covid patient / or having symptoms of Covid and will not take any assignment of Observer’s duty if detected on duty dates.

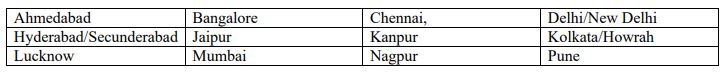

The honorarium of Rs.3000 per day / per session and Rs.350 as conveyance reimbursement for ‘A’ class cities and Rs.250 for other cities per day (to cover the cost of local travel) will be paid.

The list of A class cities is as under:

All other cities are ‘B’ class cities.

A member will only be assigned duties in the city of his professional address, as per the Institute’s records.

(To avoid any hardship in allotment of Observer assignment, Members are advised to update their professional Address/City in ICAI through the SSP Portal in accordance with the examination cities, if not updated)

The primary responsibility of the observer is to guarantee that the Question Paper Packets intended for the day of the exam, with the correct code, are collected from the bank (where they are held in safe custody), opened, and handed to the applicants.

As a result, the Observer must be present at the assigned branch of the Bank/Examination Centre from the time the code key is opened in the bank until the end of the examination, i.e. until the answer books are pooled, reconciled, packed, and handed over to the designated courier agency (including the answer sheet of physically handicapped candidates, if any) for delivery to the Examination Department.

Once assigned the obligations of functioning as an Observer in a certain test centre, he or she must attend to the assignment and submit his or her report on a daily basis in the appropriate format to the Portal immediately after the exam. Bills must be filed immediately following the completion of all examinations.

In case any member is unable to perform his / her assignment, the same may be declined in the portal and communicated to the Examination Department well in advance, so that an alternative arrangement can be made.

If a member fails to notify the Examination Department or perform the obligations assigned, he or she will be held accountable under the terms of the Chartered Accountants Act 1949 and the Regulations adopted thereunder, as deemed appropriate.

Kindly note that giving false/misleading declarations regarding conflict of interest/involvement in coaching and any unauthorized absence from the Exam Centre during the exams will lead to action under disciplinary provisions in accordance with the Chartered Accountants Act, 1949 and the Rules and Regulations framed thereunder.

To Read More Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"