Reetu | Aug 31, 2022 |

ICAI Notifies Submission of Online Exam Application Forms for Nov 2022 Examination

The Institute of Chartered Accountants of India(ICAI) has notified Submission of Online Examination Application Forms for Chartered Accountants Examination Nov 2022.

This announcement is in continuation of the Institute’s announcement dated 14th July 2022 read with Corrigendum dated 20th July 2022 on the subject matter.

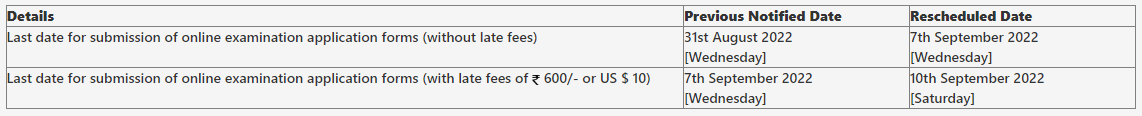

For the Chartered Accountants Examinations in November 2022, the Institute has for the first time implemented a system for examinees to submit their examination forms via the Self Service Portal (SSP). The students may be having some difficulties filling out their exam forms as a result of the system modification, it is said. In order to better serve the needs of the students, the Institute has decided to extend the deadlines for submitting examination forms, either with or without late fees.

The following dates(s) may be noted:

Additionally, the correction window for the already completed examination forms will be open from September 8th (Thursday) to September 13th (Tuesday) for students who wish to change their examination city, group, or medium for the Chartered Accountants Examinations taking place in November 2022.

The candidates are urged to take note of the aforementioned information and visit www.icai.org frequently.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"