Reetu | Jul 5, 2023 |

ICAI releases CA Exam Date Sheet for Nov / Dec 2023 CA Intermediate, Final

The Institute of Chartered Accountants of India(ICAI) has released Schedule of CA Foundation, Intermediate and Final Examination December 2023.

In pursuance of Regulation 22 of the Chartered Accountants Regulations, 1988, the Council of the Institute of Chartered Accountants of India is pleased to announce that the next Chartered Accountants Foundation, Intermediate and Final Examinations will be held on the dates and places which are given below provided that sufficient number of candidates offer themselves to appear from each of the below mentioned places.

Similarly, Examination in Post Qualification Course under Regulation 204, viz.: International Taxation – Assessment Test (INTT – AT) and Insurance and Risk Management (IRM) Technical Examination (which is open to the members of the Institute) will be held on the dates and places (centres in India only) which are given below provided that sufficient number of candidates offer themselves to appear from each of the below mentioned places.

24th, 26th, 28th & 30th December 2023

Group -I: 2nd, 4th, 6th & 8th November 2023

Group -II: 10th, 13th, 15th & 17th November 2023

Group-I: 1st, 3rd, 5th & 7th November 2023

Group-II: 9th, 11th, 14th & 16th November 2023

International Taxation – Assessment Test (Intt – At)

9th & 11th November 2023

Insurance and Risk Management (IRM) Technical Examination

Modules I to IV: 9th, 11th, 14th & 16th November 2023

No examination is scheduled on 12th November 2023 (Sunday) on account of Diwali (Deepawali), being a compulsory (gazetted) Central Government holiday as per F. No. 12/5/2022-JCA-2 dated 16.06.2022 issued by Ministry of Personnel, Public Grievance and Pensions, Government of India.

It should be noted that if any day of the examination schedule is declared a public holiday by the Central Government or any State Government/Local Bodies, there would be no alteration in the examination schedule.

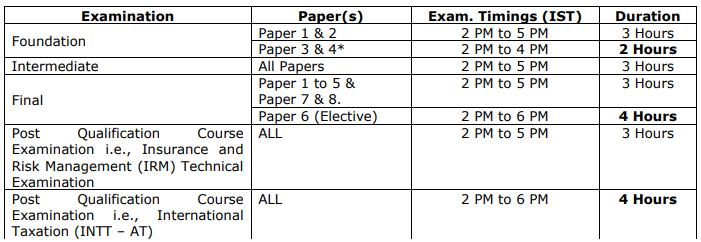

Paper(s) 3 & 4 of Foundation Examination are of 2 hours duration. Similarly, Elective Paper – 6 of Final Examination and all papers of International Taxation – Assessment Test are of 4 hours duration. However, all other examinations are of 3 hours duration, and the examination wise timing(s) are given below:

*In Paper 3 and 4 of Foundation Examination and all papers of Post Qualification Course Examination there will not be any advance reading time, whereas in all other papers / exams mentioned above, an advance reading time of 15 minutes will be given from 1.45 PM (IST) to 2 PM (IST).

Further, in case of composite papers having both MCQs based & Descriptive Question Papers, seal of MCQs based Question Paper shall be opened at 2 PM (IST), in other words there will be no prior reading time for MCQs based Question Papers.

To Read More Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"