CA Bimal Jain | Feb 17, 2022 |

IGST not Payable on Residential Dwelling Rented for the Purpose Hostel

The Hon’ble Karnataka High Court in Taghar Vasudeva Ambrish v. Appellate Authority for Advance Ruling Karnataka [W.P. No. 14891 of 2020 (T-RES) dated February 07, 2022] quashed the order passed by the AAAR, denying exemption to the assessee on the service of renting of property used for the purpose of a hostel for the students and working women. Held that, such service will fall within the purview of residential dwelling and is used for residential purposes. Thus, exempted from payment of Integrated Goods and Services Tax (“IGST”).

Taghar Vasudeva Ambrish (“the Petitioner”) is the owner of a residential property wherein, the ownership of the building was partitioned among five of the owners (“the Lessors”) with each individual being the absolute owner of a specified floor of the building. The Lessors collectively entered into a lease deed in with M/S. D Twelve Spaces Private Limited (“the Lessee”) on June 21, 2019., wherein, the Lessors leased out their portion of the building to the Lessee for the purpose of sub-lease/sub-licence and to be used as hostel for providing long term accommodation to students and working professionals with the duration of stay ranging from 3 months to 12 months, in return for the consideration of an agreed monthly rent.

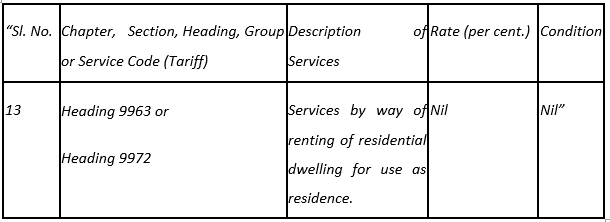

As per exemption notification the Central Government exempted payments of goods and services in respect of services mentioned therein, which includes renting services which are provided with respect to residential dwelling for use as residence.

This petition has been filed by the Petitioner being aggrieved by the ruling of the AAAR, Karnataka in Advance Ruling No. KAR/AAAR-01/2020-21 dated August 31, 2020 (“the Impugned Order”), wherein the AAAR upheld the order passed by the AAR, Karnataka, holding that the Petitioner would not be entitled to the exemption on services viz., renting of residential dwelling for use as a residence under Entry 13 of the Notification No.9/2017 – Integrated Tax (Rate) dated 28.06.2017 (“Exemption Notification”) as the property rented out by the Petitioner is a hostel building which is more akin to sociable accommodation rather than what is commonly understood as residential accommodation. Further held that, the exemption is available only if the residential dwelling is used as a residence by the person who has taken the same on rent / lease.

Whether the benefit of the exemption would be available to the Petitioner under exemption notification?

The Hon’ble Karnataka High Court in W.P. No. 14891 of 2020 (T-RES) dated February 07, 2022 held as under:

Entry 13 of the Exemption Notification:

(Author can be reached at [email protected])

DISCLAIMER: The views expressed are strictly of the author and A2Z Taxcorp LLP. The contents of this article are solely for informational purpose and for the reader’s personal non-commercial use. It does not constitute professional advice or recommendation of firm. Neither the author nor firm and its affiliates accepts any liabilities for any loss or damage of any kind arising out of any information in this article nor for any actions taken in reliance thereon. Further, no portion of our article or newsletter should be used for any purpose(s) unless authorized in writing and we reserve a legal right for any infringement on usage of our article or newsletter without prior permission.

To Read Judgment Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"