This article discusses the Incentive scheme for promotion of RuPay Debit Cards and BHIM-UPI transactions notified by Ministry of Finance

CA Pratibha Goyal | Mar 12, 2024 |

Incentive scheme for promotion of RuPay Debit Cards and BHIM-UPI transactions notified

The government is promoting digital payments through a number of measures. Digital payment transactions have increased dramatically in the last several years nationwide, from 2,071 crore in the 2017–18 financial year to 13,462 crore in the 2022–23 Financial year.

Even if digital payments have grown at an unparalleled rate in recent years, there is still room for growth. Therefore, it’s critical to encourage the use of digital payments, focusing on unexplored markets, industries, or segments.

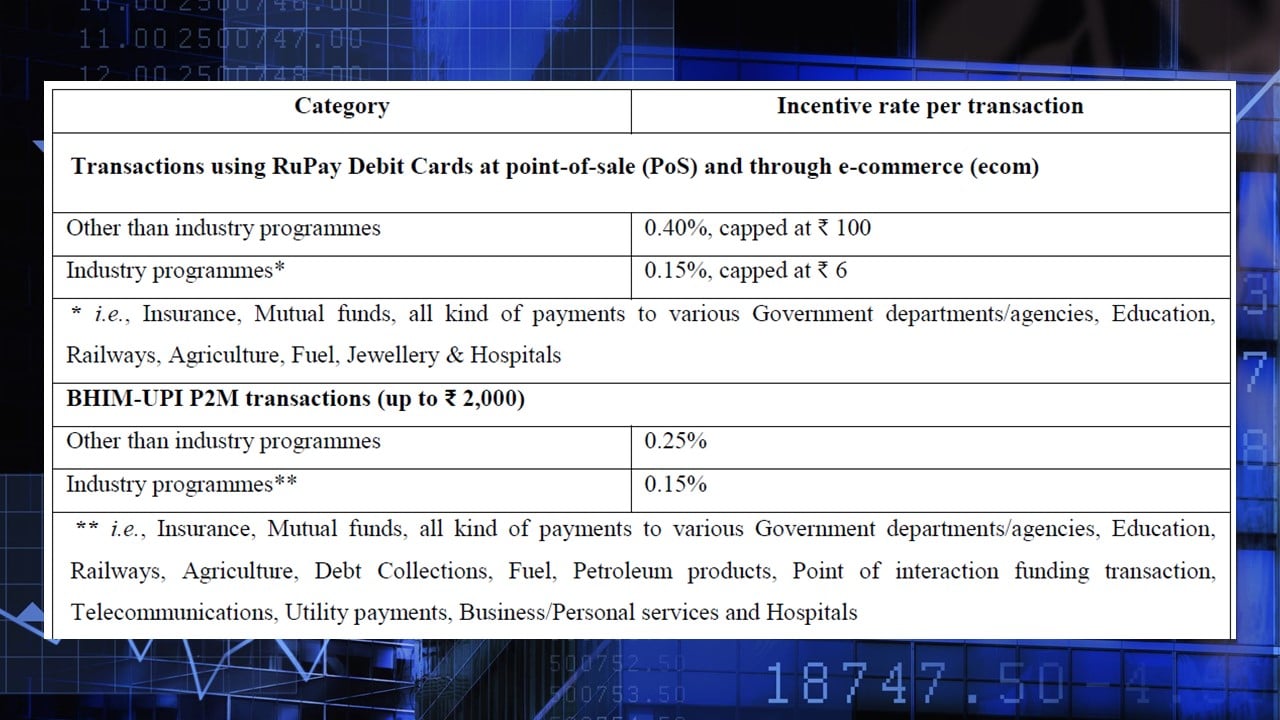

The Government has decided to incentivize Banks and other payment system operators and app providers to promote RuPay Debit Card transactions and low-value BHIM-UPI transactions (up to Rs. 2,000) (Person-to-Merchant, or P2M) for the financial year 2023–2024 in accordance with the Budget announcement (financial year 2023–2024) in order to further boost digital transactions in the nation. The permissible incentive must be determined quarterly based on the value of the transactions that are executed.

By providing incentives to banks and other payment system operators to establish a strong digital payments ecosystem and to advertise RuPay Debit Cards and BHIM-UPI as low-cost digital payment options for all industries and demographic groups, this incentive program would encourage the use of digital payments. The program will also encourage transactions using domestically developed digital payment methods, such as BHIM-UPI Lite or BHIM-UPI LiteX, “UPI Conversational Payments-Hello! UPI,” and BHIM-UPI 123PAY, as affordable and user-friendly digital payment options, in keeping with the many digital initiatives under Atmanirbhar Bharat.

The request to extend the “Incentive scheme for promotion of RuPay Debit Cards and low-value BHIM-UPI transactions (Person to Merchant)” for a year at a cost of Rs. 3,500 crores was approved by the government. In accordance with the incentive rates and other information provided below, this will give acquiring banks financial incentives.

The program will run for a year, from April 1, 2023, to March 31, 2024.

The project will cost Rs. 3,500 crore, of which Rs. 500 crore will go toward the RuPay Debit Card and Rs. 3,000 crore towards the BHIM-UPI. Although the allocation from RuPay Debit Cards to BHIM-UPI would be fungible, the opposite is not true.

The Secretary of the Department of Financial Services (DFS) may periodically review the use of funds under the scheme and, if necessary, make changes to the scheme, including adding or removing merchant categories included in industry programs, in consultation with the Financial Advisor (DFS) and the National Payment Corporation of India (NPCI).

Bank claims will be reimbursed on a quarterly basis up to the following maximum amount:

(a) 100% of the admitted claim amount for the bank to be disbursed during the first, second, and third quarters of the scheme; for the fourth quarter, 90% of the admitted claim amount for the RuPay Debit Card and 80% of the admitted claim amount for BHIM-UPI;

(b) if the requirements in subclause (i) for the RuPay Debit Card and subclauses (ii) and (iii) for the BHIM-UPI are met, the remaining percentage of the admitted claim amount for the fourth quarter shall be reimbursed;

(i) In order to be eligible for reimbursement of 10% of the remaining admitted claim of the fourth quarter, that is, January 24–March 24, Acquirer Bank (which submits the claims) must demonstrate at least 5% growth in the number of RuPay Debit Cards transactions (PoS and e-commerce transactions) between January 24–March 24 over January 23–March 23;

(ii) In order to be eligible for reimbursement of 10% of the admitted claim for the fourth quarter, Acquirer Bank must enable the features of BHIM-UPI Lite and BHIM-UPI LiteX “as Remitter” and demonstrate at least 5% of BHIM-UPI P2M transactions on BHIM-UPI Lite or BHIM-UPI LiteX during the final quarter of the scheme;

(iii) In order to be eligible for reimbursement of 10% of the accepted claim for the fourth quarter, Acquirer Bank must enable “UPI Conversational Payments-Hello! UPI” in the app and “BHIM-UPI 123Pay” (any of the four ways) “as Payer PSP.”

DFS will release operational rules for the scheme’s implementation, including the incentive sharing mechanism, after consulting with NPCI.

The Scheme would be applicable to transactions made in India and to banks that operate there.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"