Reetu | Oct 7, 2021 |

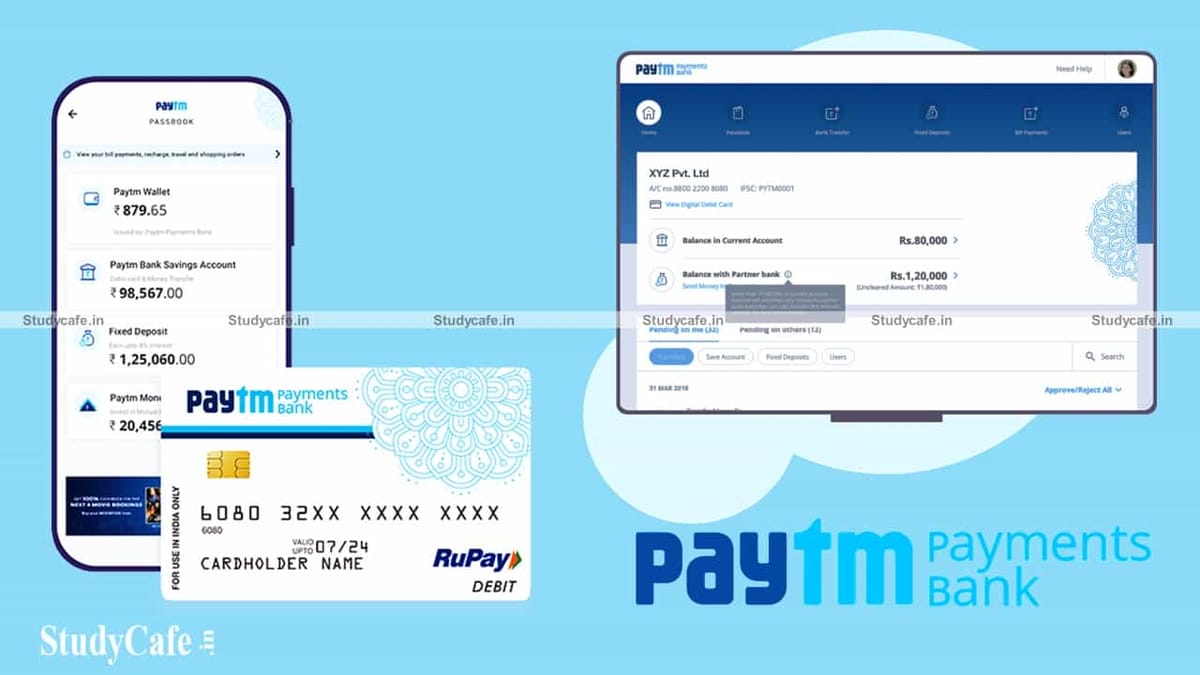

Inclusion of “Paytm Payments Bank Limited” in the Second Schedule of the RBI Act, 1934

As per RBI Notification No. RBI/2021-22/109[DOR.RET.REC.58/12.07.160/2021-22] dated 7th Oct 2021, It is advise that “Paytm Payments Bank Limited” has been included in the Second Schedule to the Reserve Bank of India Act, 1934 vide notification DoR.LIC.No.S926/16.03.006/2021- 22 dated September 06, 2021 and published in the Gazette of India (Part III – Section 4) dated October 02-October 08, 2021.

Paytm Payments Bank is an Indian payments bank, founded in 2015 and headquartered in Noida. In 2015, it received the license to run a payments bank from the Reserve Bank of India. It was launched in November 2017.

As of August 2020, Vijay Shekhar Sharma holds 51 per cent in the entity with One97 Communications Limited holding 39 per cent and the remaining 10 per cent of share is held by a joint venture between Vijay Shekhar Sharma and One97 Communications. It has over 64 million account holders as of April 2021.

Paytm Payments Bank offers all the services which it does as a wallet, and additional features like:

To open your Bank Account, kindly follow these simple steps.

For closure of your account, you will need to raise a ticket with us from the ’24X7 Help’ section in the Bank tab of your Paytm App.

If you choose to close your Savings Account only, you will still be able to use your wallet as usual.

No, only one Savings Account can be opened per customer.

To check your account details, follow these simple steps.

To check your nominee details, follow these simple steps.

In case you have not added a nominee during the account opening process, please follow the steps below:

In case you wish to update your nominee, please follow the steps below:

You can add your PAN number to your account (if not done already) in four simple steps:

Your deposit will earn interest of 2.5% p.a. on your Savings Account balance. Interest earned will be added to your Savings Account in the first week of each month.

If you are a KYC customer you can add any amount as long as your wallet balance does not exceed Rs.1,00,000 at any point in time

If you have completed your min-KYC using an Officially Valid Document (OVD), you can transact and add upto Rs. 10,000 in a month

They collect and generate various data points about us.

Data by which they identified us is termed as “Personal Data”. Personal Data does not include any information that is freely available or accessible in public domain.

Our Privacy is of utmost importance to them and protection of Our Personal Data is a key commitment for them.

They are also governed by the Banking Codes and Standards Board of India and Information Technology (Reasonable security practices and procedures and sensitive personal data or information) Rules, 2011 to maintain the privacy of Our Personal Data.

Personal Data we may collect from you are as under:

1. Personal details (e.g. name, contact details, residential address, date of birth, documents such as identity card / passport details / Aadhaar details / PAN / Voter ID / driving license, and/or education details) needed to open bank account and/or avail other services from them.

2. Your bank account details including transaction history, balances, payment details, for effecting transfer of monies through various payment channels provided by us.

3. financial details (e.g. income, expenses, and/or credit history) needed as part of application request for some of our services;

4. images of documents/ photos required to open and maintain bank account with us and/or avail our services from us.

5. voice recordings of our conversations with our customer care agent with you to address your queries/grievances;

6. employment details (e.g. occupation, positions held, employment history, salary and/or benefits) as part of our record retention for Central KYC Records Registry (CKYCR) purposes under Prevention of Money Laundering (Maintenance of Records) Rules, 2005

7. specimen signature(s) for processing of your instructions received by us through our various payment channels;

8. opinions provided by you to us by way of feedback or responses to surveys;

9. information obtained from your mobile device by way of using our app like device location, communication information including contacts and call logs, device information (including storage, model, mobile network), transactional and promotional SMS/app notifications.

We store and process your Personal Data only in India, in accordance with RBI circular in respect of the Storage of Payment System Data dated 6th April 2018.

Our data center and systems also maintain backup and disaster recovery systems in India.

To Read RBI Notification Download PDF Given Below :

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"