As per Income Tax Audit Form Update Total MSME Dues paid within time or nor are to be Reported in Form 3CD

CA Pratibha Goyal | Mar 29, 2025 |

Income Tax Audit Form Update: Total MSME Dues even if paid within time to be Reported in Form 3CD

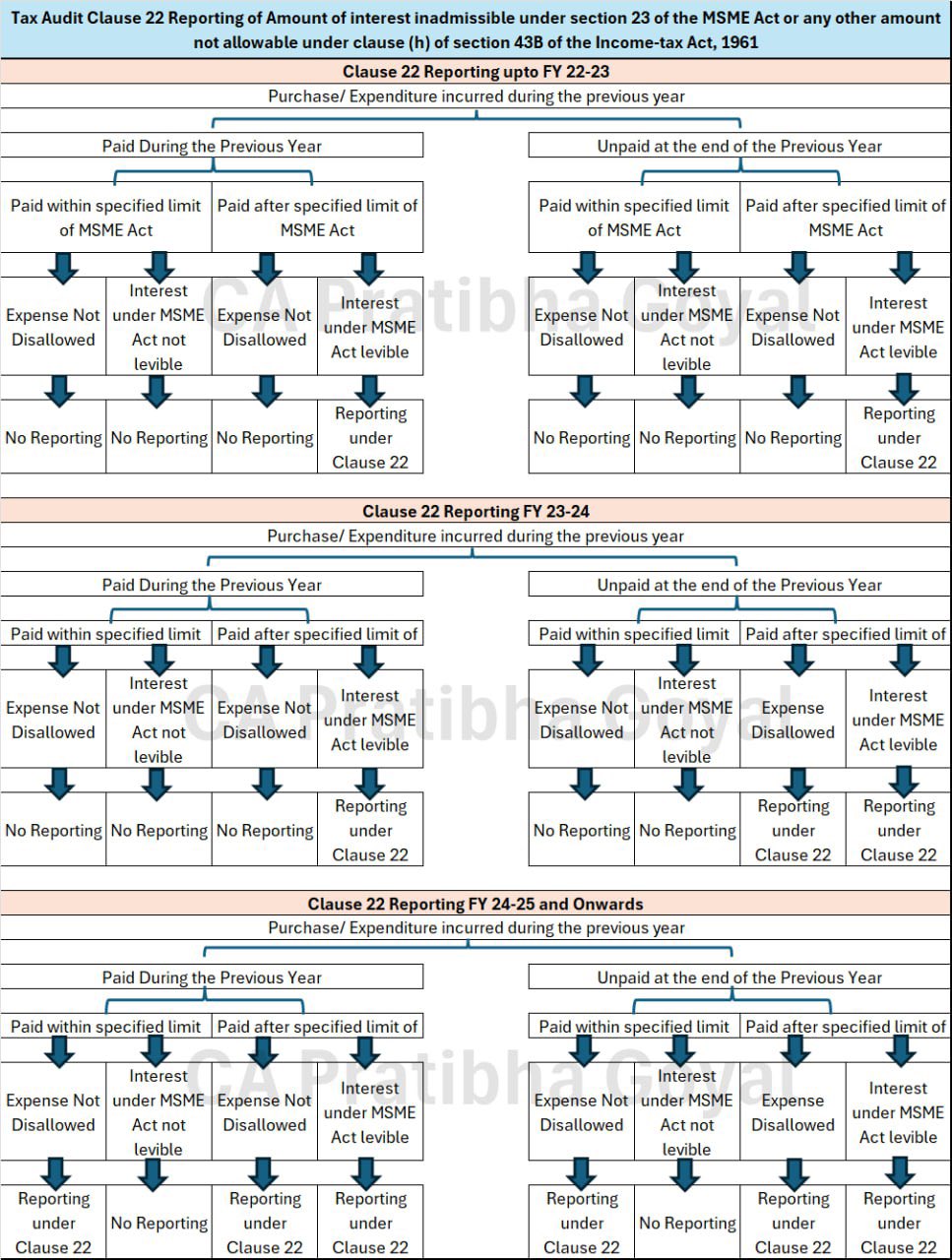

The Central Board of Direct Taxes (CBDT) has amended Form 3CD of the Tax Audit Report for AY 2025-26 by notifying the Income-tax (Eighth Amendment) Rules 2025 via a released Notification effective from the 1st day of April 2025.

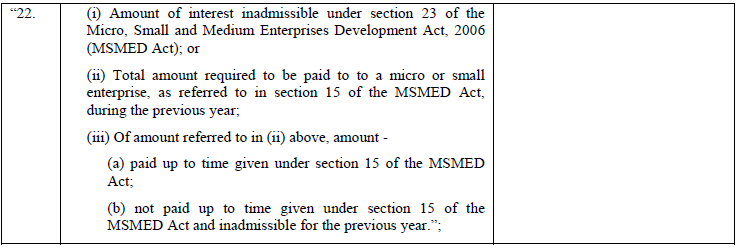

One of the most important change made in the Income Tax Audit Form (Form 3CD) is that now details of total dues to Micro & Small Enterprises even if paid within time, is to be reported in the Form. Earlier only Amount of interest inadmissible under section 23 of the Micro, Small and Medium Enterprises Development Act, 2006 (MSMED Act) was required to be reported.

Further, we also need to report that out of the total dues to Micro & Small Enterprises, how much is paid up to the time given under section 15 of the MSMED Act and how much is not paid up to the time given under section 15 of the MSMED Act. The Time frame as per MSMED Act is 15 Days in case there is no written agreement. In case of written agreement with MSME, the payment timeframe cannot exceed 45 Days.

The amount not paid will be inadmissible for the previous year due to the applicability of Section 43B(h) of the Income Tax Act.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"