The Central Board of Direct Taxes (CBDT) has notified Changes in Income Tax Returns form 2, 3 and 5 via issuing Notification.

Reetu | Feb 1, 2024 |

Income Tax: CBDT notifies Changes in ITR 2, 3 and 5

The Central Board of Direct Taxes (CBDT) has notified Changes in Income Tax Returns form 2, 3 and 5 via issuing Notification.

The Notification Read as follows:

In exercise of the powers conferred by section 139 read with section 295 of the Income-tax Act, 1961 (43 of 1961), the Central Board of Direct Taxes hereby makes the following rules further to amend Income-tax Rules, 1962.

These rules may be called the Income-tax (Amendment) Rules, 2024. They shall come into force from the 1st day of April 2024.

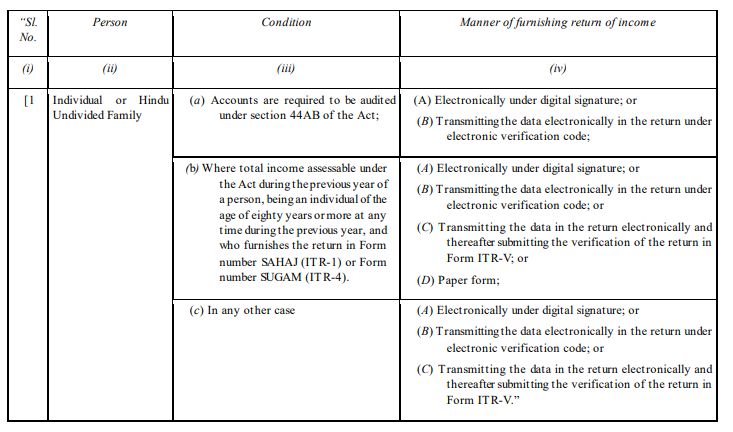

In the Income-tax Rules, 1962 (hereinafter referred to as the principal rules), in rule 12, in sub-rule (3), in the Table, for Sl. No. 1 and entries thereto, the following Sl. No. and entries shall be substituted, namely: –

To Read More Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"