Individuals who have received substantial TDS deductions over their tax liability under IT Act can now seek relief, according to a recent TRACES Portal update.

Reetu | Feb 16, 2024 |

Income Tax Department enables lower/nil TDS Application New Facility against Excessive TDS Deductions on TRACES Portal

Individuals who have received substantial TDS deductions in excess of their tax liability under the Income Tax Act can now seek relief, according to a recent TRACES Portal update.

Individuals can improve their cash flow by applying to the tax authorities for a lower or zero TDS deduction. It is important to remember that the facility for filing applications for Lower/Nil deduction certificates will only be available during specific time frames.

If you are facing excessive TDS deductions, try applying for a lower/no TDS deduction to alleviate your financial load.

Such applications can be filed during the periods listed below:

This initiative intends to provide relief to individuals who are enduring undue financial burdens as a result of TDS deductions that exceed their actual tax liability.

For further information on TDS regulations and rates, see the TDS Rate Chart for FY 2023-24 and AY 2024-2025. Stay up to date on changes to the procedures for getting nil TDS certificates, which were recently revised by the Central Board of Direct Taxes (CBDT). The Income Tax Department has also implemented an e-procedure for acquiring NIL or lower TDS certificates.

The TRACES Portal update provides a quick solution for individuals dealing with excessive TDS deductions, helping them to better manage their cash flow. Stay up to date on the latest developments in TDS rules and use the various relief methods to successfully manage your financial obligations.

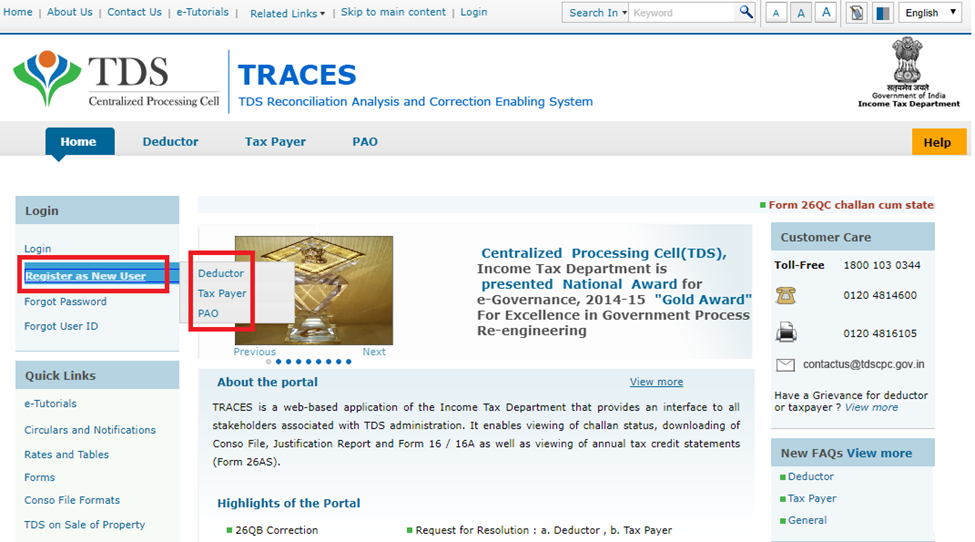

For further information, please visit the official TRACES Portal.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"