Studycafe | Jul 21, 2020 |

Income Tax E-campaign scheme

As per the press release dated 18/07/2020, The Income Tax Department has begun an e-campaign on the voluntary compliance of income tax from July 20, 2020, till the month end, focusing on taxpayers who are either non-filers or have discrepancies or deficiency in their returns for the FY 2018-19 (AY 2019-20).

The ITD will send emails or text messages to identified taxpayers to verify their financial transactions related information received by the department from various sources such as a statement of financial transactions (SFT), tax deduction at source (TDS), Tax collection at source (TCS), foreign remittances (Form 15CC), etc.

ITD with the help of data analytics, artificial intelligence has identified certain taxpayers with high-value transactions who have not filed returns for AY 2019-2020. In addition to the nonfilers, another set of return filers have also been identified wherein the high-value transactions/financial information does not appear to be in line with their returns. The last date for filing belated income tax return U/s

139(4) and revised return U/s 139(5) Assessment year 2019-20 ( Financial Year 2018-19) is July 31, 2020.

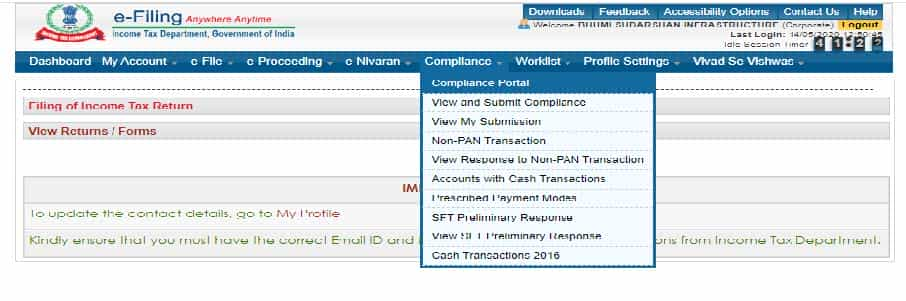

1: Log in to the respective account through www.incometaxindiafiling.gov.in. Post login, you will be directed towards the dashboard. Click on the Compliance Portal option under Compliance Tab.

2: Click on the confirm option.

3: Below screen will appear. Click on the e-campaign option.

4: E-campaign portal will display the discrepancies related to significant transactions, High-Risk Transactions & responding for Non-filing of Returns. Click on Pending for verification.

5: In case of information confirmation, click on pending for FY 2018-19 under the Information confirmation tab.

6: Click on the tab’s as mentioned below to have a detailed look into the information

7: Click on the relevant option to verify the displayed information. They will be able to submit an online response by selecting among any of these options.

Information is:

8: After replying to the information in the above steps, Input the relevant information regarding the response for non-filing of return and click on submit. This would be the last step.

Below is the press release for reference.

Written by:

Written by:

Yachit Dewan

Yachit Dewan and Associates

MSME UAN: MH27D0001245

Direct Tax Department

Office No. 10, Opp Shakti Society,

Laxmi Nagar. Khopoli.

Dist: Raigad. 410203. Maharashtra

Contact: 09773397514

Indirect Tax Department

Office no 13, Opp Shakti Society,

Laxmi Nagar. Khopoli.

Dist: Raigad. 410203. Maharashtra

Contact: 07219444448, 08888188335

Direct Contact: 08698855060

Landline: 02192-263589

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"