Income Tax Portal Down on Last date of Filling ITR For FY 2019-20

Studycafe | Mar 31, 2021 |

Date for issue of notice under section 148 of Income-tax Act, 1961, passing of consequential order for direction issued by the Dispute Resolution Panel (DRP) & processing of equalisation levy statements also extended to 30th April, 2021.

Date for issue of notice under section 148 of Income-tax Act,1961, passing of consequential order for direction issued by the Dispute Resolution Panel (DRP) & processing of equalisation levy statements also extended to 30th April, 2021. https://t.co/3X9v4tykQG

— Study Cafe (@studycafe_in) March 31, 2021

Central Government extends the last date for linking of Aadhaar number with PAN from 31st March, 2021 to 30th June, 2021

Central Government extends the last date for linking of Aadhaar number with PAN from 31st March, 2021 to 30th June, 2021, in view of the difficulties arising out of the COVID-19 pandemic.(1/2)@nsitharamanoffc@Anurag_Office@FinMinIndia https://t.co/iTl7wVKBwM

— Study Cafe (@studycafe_in) March 31, 2021

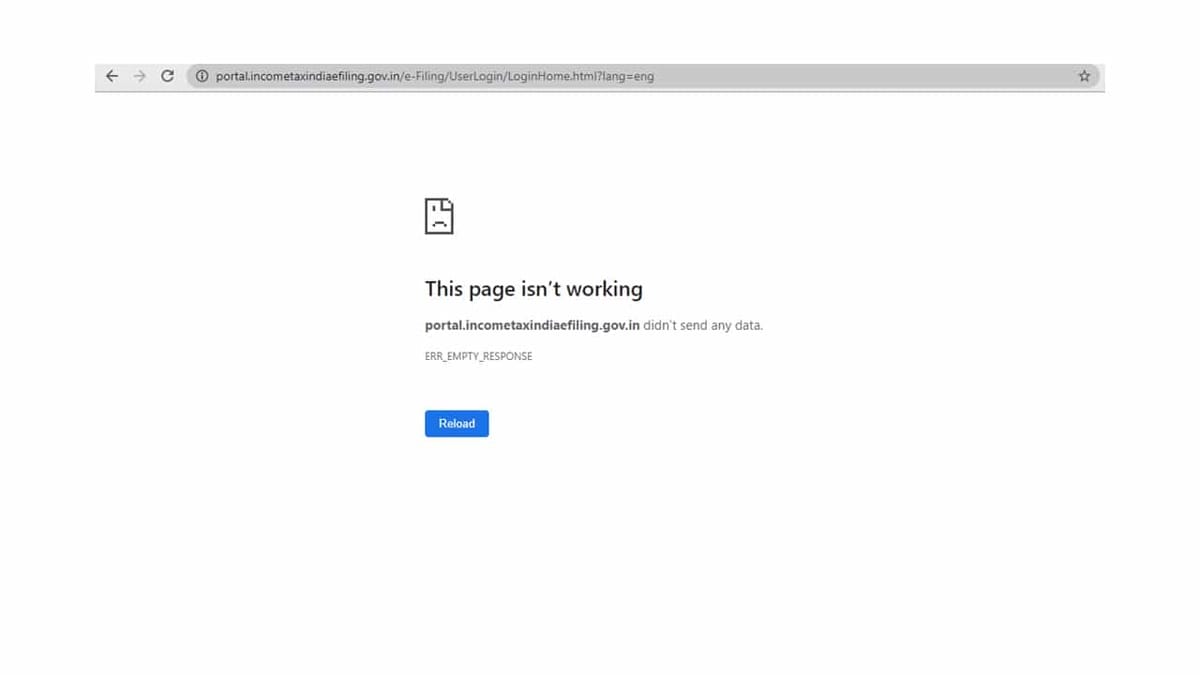

Income Tax Portal Down on Last date of Filling ITR For FY 2019-20

31st of March 2021 is the Last date of Filling Belated or Revised Income Tax Return [ITR] For FY 2019-20 and Income Tax Portal is not properly working.

Taxpayers are facing huge trouble because of this.

This year has seen an increase in the revision of a large number of ITRs. The reason for the same is the High-Value Transaction Campaign of the Income Tax Department.

High-Value transactions are transactions of high monetary value. They are reported to Income Tax Department when Form 61A or commonly called Statement of Financial Transaction is filed by various entities like banks, post offices, companies, etc.

The transactions that are not in line with the profile of taxpayers are required to be reported.

HOW TO GIVE REPLY OF INTIMATION OF HIGH-VALUE INFORMATION ON INCOME TAX COMPLIANCE PORTAL

Today is Due date for Filing Belated/Revised Income Tax Returns for FY 2019-20 and Income Tax Site is not working @IncomeTaxIndia #Extend_Due_Dates pic.twitter.com/odVo1j9xMz

— Study Cafe (@studycafe_in) March 31, 2021

However, No Late fees is applicable in case of Revision of ITR.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"