Income Tax Rates for F.Y. 2021-22 and A.Y. 2022-23

Reetu | Apr 15, 2022 |

Income Tax Rates for F.Y. 2021-22 and A.Y. 2022-23

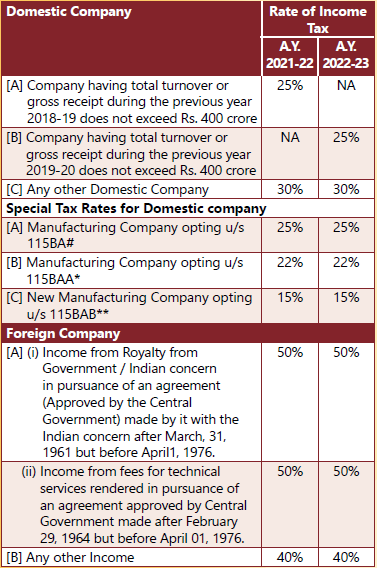

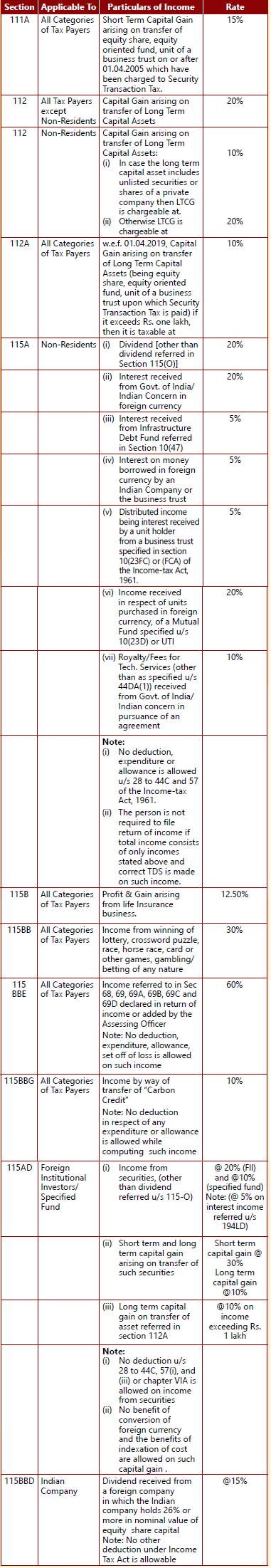

Rates of Income Tax for F.Y 2021-22 and AY 2022-23 applicable to various categories of persons viz. Individuals, Firms, companies etc.is Given below.

# Provided that such company is setup and registered on or after 1st March, 2016. Such option is to be exercised in prescribed manner, on or before the due date of return specified u/s 139(1) for furnishing the first of the returns of income which the person is required to furnish under the Act. Option once exercised cannot be subsequently withdrawn for the same or any other previous year. Such companies are not exempt from MAT on book profit u/s 115JB of the Act. However, where a person exercises option u/s 115BAA, the option under this section may be withdrawn.

* Benefit of lower rate under the aforesaid section can be exercised by a company from any year commencing from AY 2020-21 or onwards. Such option is to be exercised in prescribed manner, on or before the due date of return specified u/s 139(1) for any previous year relevant to the AY 2020-21 or thereafter in which the option is exercised. Option once exercised cannot be subsequently withdrawn for the same or any other previous year. Such companies are exempt from MAT on book profit u/s 115JB.

** Benefit of lower rate under the aforesaid section can be exercised by a company from any year commencing from AY 2020-21 or onwards. Such option is to be exercised in prescribed manner, on or before the due date of return specified u/s 139(1) for furnishing the first of the returns of income for AY 2020-21 or thereafter, which the person is required to furnish under the Act. Option once exercised cannot be subsequently withdrawn for the same or any other previous year. Such company is setup and registered on or after 1st October, 2019 and commences manufacturing activity on or before 31st March, 2023. Such companies are exempt from MAT on book profit u/s 115JB.

(i) Where income exceeds Rs. 1 crore but not exceeding Rs. 10 crore, the total amount payable as income-tax and surcharge shall not exceed total amount payable as income-tax on total income of Rs. 1 crore by more than the amount of income that exceeds Rs. 1 crore.

(ii) Where income exceeds Rs. 10 crore, the total amount payable as income-tax and surcharge shall not exceed total amount payable as income-tax on total income of Rs. 10 crore by more than the amount of income that exceeds Rs. 10 crore.

Health & Education Cess is levied at the rate of 4% on the amount of income-tax plus surcharge.

Minimum Alternate Tax for A.Y. 2021-22 and A.Y. 2022-23 – Period of carried forward of MAT credit is available for 15 AYs immediately succeeding the AY in which such credit has become allowable. This is with effect from AY 2018-19. The following rate of Minimum Alternate Tax shall be applicable:

Health & Education Cess is levied at the rate of 4% on the amount of income-tax plus surcharge under MAT.

Note: Where the company is a unit located in International Financial Services Centre and derives its income solely in convertible foreign exchange, the Minimum Alternate Tax is levied at a rate of 9% (plus surcharge and cess as applicable).

The resident co-operative society have an option to opt for taxation under Section 115BAD of the Income-tax Act, 1961 w.e.f. Assessment Year 2021-22 after fulfilling the prescribed conditions.

![]()

^Such option is to be exercised in prescribed manner, on or before the due date of return specified u/s 139(1) for furnishing the first of the returns of income for AY 2021-22 or thereafter, which the person is required to furnish under the Act. The option once exercised shall apply to subsequent assessment years. The societies opting for this section have been kept out of the purview of Alternate Minimum Tax (AMT).

Surcharge is applicable @12% of such tax where total income > Rs. 1 crore. (Subject to marginal relief where income exceeds one crore rupees, the total amount payable as income-tax and surcharge shall not exceed total amount payable as income tax on total income of one crore rupees by more than the amount of income that exceeds one crore rupees)

Health & Education Cess is levied at the rate of 4% on such income-tax plus surcharge.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"