Income Tax is looking for desirous and qualified candidates for the post of Assistant Director (Systems) on a deputation basis/absorption basis

Khushi Vishwakarma | Mar 15, 2024 |

Income Tax Recruitment 2024: Notification Out for 15+ Vacancies, Check Post, Age, Qualification, Salary and How to Apply

Income Tax Recruitment 2024: Income Tax is looking for desirous and qualified candidates for the post of Assistant Director (Systems) on a deputation basis/absorption basis. There are 16 openings to be filled for Income Tax Recruitment 2024. The chosen candidates will be given a monthly remuneration on monthly salary on Level 10 in the pay matrix (Pre-revised Pay Band-3, Rs.15600-39100 plus Grade Pay of Rs. 5400). The engagement is made for a period of 04 years.

To apply for Income Tax Recruitment 2024, the candidate should have a Master’s Degree in Computer Application/Computer Science or Master of Technology (M. Tech) (with specialisation in Computer Application) or Bachelor of Engineering (B.E.)/Bachelor of Technology (B. Tech.) in Computer Engineering/Computer Science/Computer Technology. Candidate should not exceed the age of 56 years to apply for the indicated post. Candidates who are interested and eligible to enroll in Income Tax Recruitment 2024 have to submit their completely filled application form along with the necessary documents to the Directorate of Income Tax (Systems), Central Board of Direct Taxes, Ground Floor, E2, ARA Center, Jhandewalan Ext., New Delhi – 110055 on or before the last date of submission. No application will be accepted after the due date.

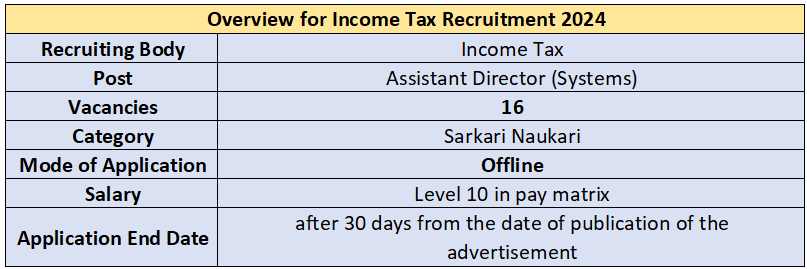

Income Tax has opened 16 seats for candidates who have at least a Master’s Degree in Computer Application/Computer Science or Master of Technology (M. Tech) (with specialisation in Computer Application) or Bachelor of Engineering (B.E.)/Bachelor of Technology (B. Tech.) in Computer Engineering/Computer Science/Computer Technology for filling the post of Assistant Director (Systems). The overview of Income Tax Recruitment 2024 is mentioned below-

Based on the official notification of Income Tax Recruitment 2024, there are 16 vacancies open for the post of Assistant Director (Systems).

The maximum age does not exceed 56 years as on the closing date of receipt of applications to apply for Income Tax Recruitment 2024.

Candidates must have the required qualifications and experience for applying to Income Tax Recruitment 2024 as mentioned below-

The candidates who are selected for Income Tax Recruitment 2024 will be given a monthly salary on Level 10 in the pay matrix (Pre-revised Pay Band-3, Rs.15600-39100 plus Grade Pay of Rs. 5400).

The appointment of Income Tax Recruitment 2024 is made on a deputation basis/absorption basis (including short-term contract) including in another ex-cadre post held immediately preceding this appointment in the same or some other organisation or department of the Central Government shall ordinarily not exceed 04 years.

Candidates who meet the eligibility criteria as stated in the official notification of Income Tax Recruitment 2024 can download the blank application form from the official notification and submit the application form along with the supporting documents to the Directorate of Income Tax (Systems), Central Board of Direct Taxes, Ground Floor, E2, ARA Center, Jhandewalan Ext., New Delhi – 110055 on or before the closing date. Application received after the due date will be summarily REJECTED.

The applicants can download the official notification of Income Tax Recruitment 2024 by clicking the below-mentioned link. The candidates can be suggested to go through the official notification before applying for the post. The last date to submit the application form is 30 days from the date of publication of the advertisement.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"