Studycafe | Dec 23, 2019 |

Income Tax Returns Defect : Reasons Why You Get Income Tax Notices

1. 26 AS Miss Match!

Gross income as referred in 26AS has not been considered in the respective heads of ITR

You will get a notice by the department if amount of income shown in your ITR is less than income shown in your 26-AS or their is 26 AS Miss Match.

For example, In case, your income as per 26AS is Rs. 2600000 on which TDS on Rs. 260000 has been deducted.

Now you will get a clear notice of Income Tax Returns Defect if you show income of Rs. 1500000 and take TDS claim of Rs. 260000.

You need to show income of Rs. 2600000 to claim TDS of Rs. 260000.

It may be possible that out of Rs. 2600000, Rs. 1500000 is you income and Rs. 1100000 is advance receipt for next year.

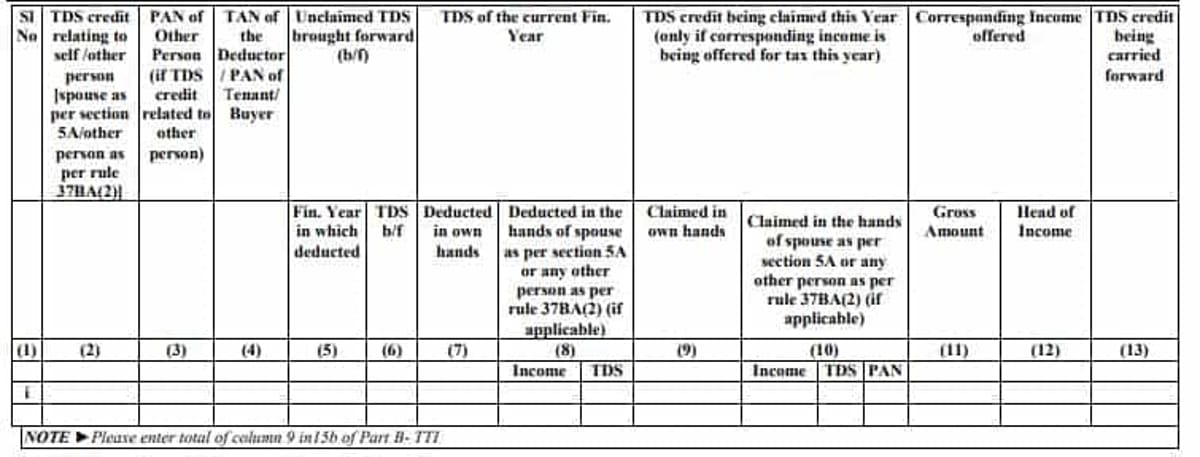

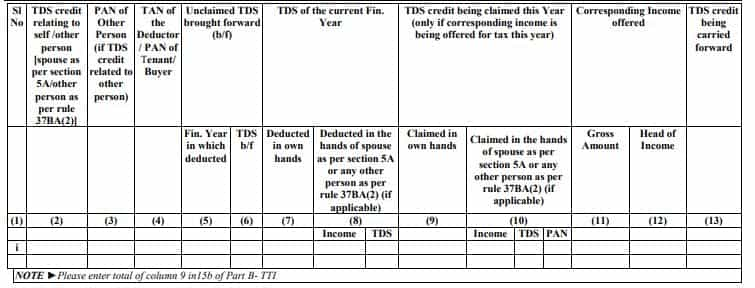

In this case you need to show income of Rs. 1500000 & claim TDS of Rs. 150000. TDS of Rs. 110000 will also be carried forward to next year along with the income.

Amount of TDS claimed in ITR is more than, amount of TDS reflected in TDS

You may be slapped with a notice by the department if there is any mismatch in the amount of TDS which you have shown in your return and the actual TDS that has been deducted during the year. For example, In case, your employer forgot to file TDS return but the same amount is shown in your income tax return then there arises a situation of mismatch.

While filing your return always make sure that the amount in form 26-AS matches with the amount you show in your return. In short make sure their is no 26 AS Miss Match

2. Mismatch of information in the return filed by you

If you make a mistake while filing your income tax return then be prepared for a notice.

Mistakes can vary from filing incomplete information, claiming deduction under the wrong section or missing out on any specific income ignored completely.

3. Ignoring income from previous employer

Your 26 AS clearly gives you details of income from your previous employer. Thus you cannot save your tax liability by not disclosing it.

4. Not depositing the full amount of tax assessed before the due date

For example you tax liability is Rs. 15000. You deposit tax of Rs. 10000. But in you return show that you have paid tax of Rs. 15000. This is the case when you will get clear cut notice from department.

5. Not filing BS & PL and having PGBP income

The assessee maintains regular books of accounts of the business or profession but has not filled Part A that is P&L or Balance Sheet or both and gross receipts as per and has entered a positive value in Schedule of income from Business & Profession.

6. Tax Audit details not correctly mentioned

Sales/Gross receipts of business or profession is greater than Tax Audit limit and Audit & Auditor information is not completely/correctly filled.

7. Depreciation is claimed in Part A P&L but Schedule DPM /DOA not filled.

8. Presumptive income u/s 44AD is less than 8% or 6% of Gross Receipt or Sales turnover. Presumptive income under section 44ADA is less than 50% of Gross Receipts

Presumptive income u/s 44AE is less than Rs 7500 p.m. per vehicle in case assessee is engaged in the business of plying, hiring or leasing such goods carriages & he did not own more than ten goods carriages at any time during the previous year.

For Regular Updates Join : https://t.me/Studycafe

Tags : Section 143, section 139(9), Income Tax Act, Defective return,Reasons for notice of defective return in Income Tax

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"