Zerodha's Founder suggested that a married Man can form HUF (Hindu Undivided Family) to get advantage of getting separate Income Tax Deductions as HUF is recognized as a distinct legal entity.

CA Pratibha Goyal | Mar 29, 2024 |

Income Tax Saving Hack: Zerodha’s founder suggests tax saving trick during ITR filing

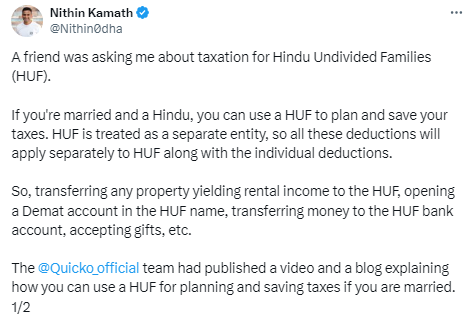

Earning persons are busy figuring out strategies to save money intended for the income tax outgo as the Financial year 2023–24 draws to a close. A few astute taxpayers would already be hard at work organizing their income tax for the upcoming financial year. Nithin Kamath, the founder and CEO of Zerodha, has recommended a workaround for married Hindu taxpayers when preparing their income tax return (ITR) for the upcoming financial year. According to Nithin Kamath of Zerodha, a married member of the Hindu community who earns a living can take advantage of the HUF (Hindu Undivided Family) tax benefits and avoid income tax because HUF is recognized as a distinct legal entity. He explained that in addition to the specific deductions, each deduction applies independently in HUF. Kamath used his ‘X’ account to post on social media to disclose this income tax return hack.

Nithin Kamath posted on his official X channel account, “A friend was asking me about taxation for Hindu Undivided Families (HUF),” sharing his income tax saving tip for a married Hindu taxpayer. Hindu married people can plan and save money on their taxes by using a Hindu Undivided Families (HUF). Since HUF is regarded as a distinct entity, each of these deductions, together with the individual deductions, will apply to HUF separately. Therefore, giving the HUF ownership of any property that generates rental revenue, creating a Demat account in the HUF’s name, transferring funds to the HUF bank account, receiving presents, etc.”

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"