Indian Railway Catering and Tourism Corporation Limited (IRCTC) is inviting applications from qualified applicants for the role of Director (Finance).

Devakshi Gupta | Mar 7, 2024 |

IRCTC Recruitment 2024: Check Post, Qualification, Salary, Age Limit and How to Apply

IRCTC Recruitment 2024: Indian Railway Catering and Tourism Corporation Limited (IRCTC) is inviting applications from qualified applicants for the role of Director (Finance). The selected candidate for IRCTC Recruitment 2024 will be given a monthly remuneration of up to Rs. 290000. Candidates willing to apply for IRCTC Recruitment 2024 should not be less than 40 years old and should not be more than 60 years old. In order to apply for IRCTC Recruitment 2024, the applicant must be a Chartered Accountant or Cost Accountant or a full-time MBA/PGDM course having specialization in Finance with a good academic record from a recognized University/Institution. Preference would be given to Chartered Accountants.

The chosen applicant for IRCTC Recruitment 2024 will be engaged for a period of 05 years from the date of joining or upto the date of superannuation or until further orders, whichever is earlier. Interested candidates fulfilling the eligibility criteria can apply through any mode i.e. online or offline. Candidates can apply online through the PESB website or candidates can apply online through the PESB website and take a printout of the same application form and send it by post to the Secretary, Public Enterprises Selection Board, Public Enterprises Bhawan, block no. 14, CGO Complex, Lodhi Road, New Delhi-110003.

As mentioned in the official notification of IRCTC Recruitment 2024, application are accepted from qualified applicants for the position of Director (Finance).

A monthly salary between Rs. 180000 to Rs. 290000 will be given to the selected candidate for IRCTC Recruitment 2024.

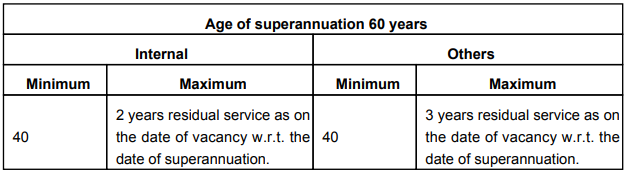

The age restrictions for IRCTC Recruitment 2024 are given below-

Candidates must have the given below Qualification for IRCTC Recruitment 2024.

The given below is the Experience for IRCTC Recruitment 2024.

According to the official notification of IRCTC Recruitment 2024, the appointment is for a period of 05 years from the date of joining or upto the date of superannuation or until further orders, whichever is earlier.

In order to apply for IRCTC Recruitment 2024, eligible candidates can apply through any mode.

Online– Candidates can apply online through the PESB website.

Offline– Candidates can apply online through the PESB website and take a printout of the same application form and send it by post to the Secretary, Public Enterprises Selection Board, Public Enterprises Bhawan, BlockNo. 14, CGO Complex, Lodhi Road, New Delhi-110003.

Candidates are requested to read the instructions carefully before applying. The official Notification PDF for IRCTC Recruitment 2024 is given below.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"