IT Department Clarifies Time limit for Verification of Returns filed Within and After Due Date

Reetu | Nov 17, 2022 |

IT Department Clarifies Time limit for Verification of Returns filed Within and After Due Date

The Income Tax E-filing Portal has stated that the Income Tax Returns filed on or before 31st July 2022 need to be verified within 120 days.

It was further mentioned in a portal advisory that returns submitted after July 31, 2022, required verification within 30 days.

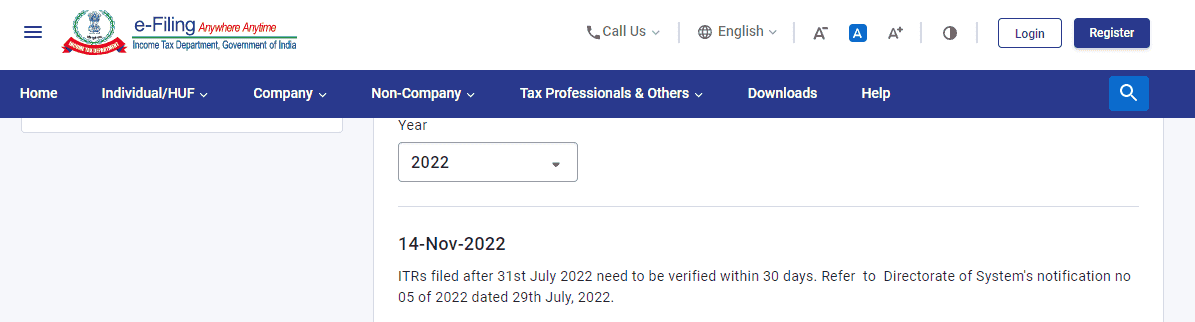

Income tax portal said, “ITRs filed after 31st July 2022 need to be verified within 30 days. Refer to Directorate of System’s notification no 05 of 2022 dated 29th July, 2022.”

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"