The Income-tax department's 'Compliance Portal' displays inaccurate/inconsistent financial information for various taxpayers, according chartered accountants.

Reetu | Mar 12, 2024 |

IT-Portal inflated Income in Tax Notice; Rs.250 shown as Rs.25000; What to do if you receive such Notice

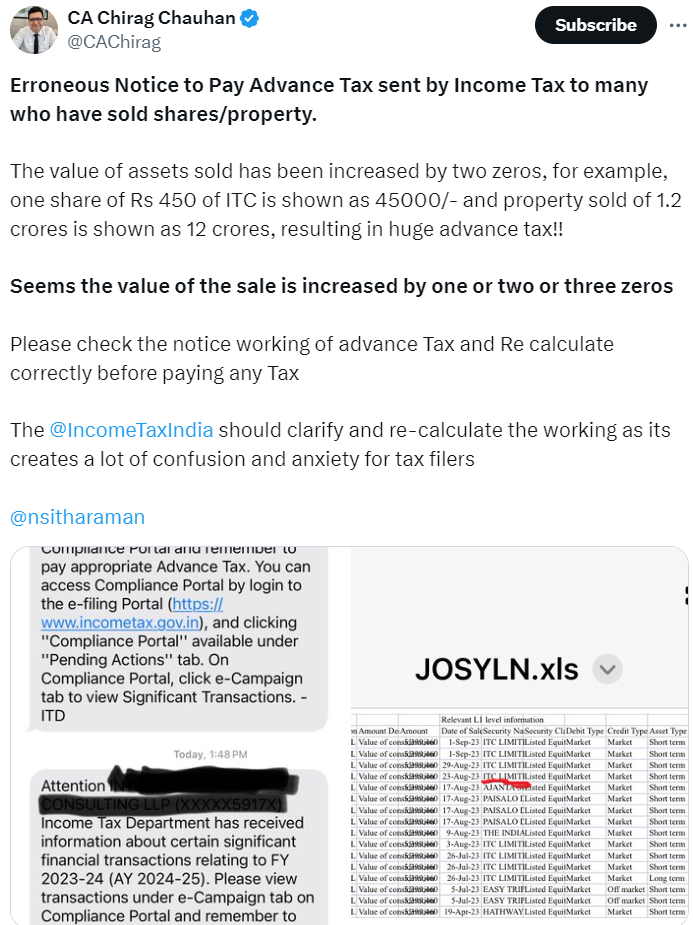

The Income-tax department‘s ‘Compliance Portal’ displays inaccurate/inconsistent financial information for various taxpayers, according to several complaints on social media and chartered accountants. According to chartered accountants, the compliance site displays significantly inflated transaction values and advance tax liabilities.

In this regard, the Income-tax Department stated on Twitter on March 11, 2024, “Based on feedback from taxpayers on the e-campaign for Advance Tax, the Department has identified certain inconsistencies in the securities market data (SFT-17) provided by one of the Reporting Entities.” The reporting body has been asked to submit a revised statement with new information. Therefore, the data on AIS will be updated. Taxpayers should wait for additional developments on AIS based on the updated announcement.”

According to chartered accountants, the ‘Compliance Portal’ is a step in the right direction, but there are some errors that need to be fixed.

“The compliance portal is doing commendable work by providing taxpayers with information about their financial transactions in advance. This portal assists taxpayers in making a thorough disclosure of income on income-tax returns and avoiding tax notices owing to failure to mention specified income in the ITR. However, in some circumstances, we have discovered that the portal made a significant error in determining the discrepancy between the information given and the transaction carried out by the assessee. For example, in one case, we discovered that while an assessee had approximately Rs.4 lakh in transactions from the sale of mutual funds and shares, the portal reported Rs.17 crore in sales,” explains Tax Professional.

He went on to explain that such inflated data, if not adjusted, would raise the taxpayer’s income when tallied.

According to a practicing Chartered Accountant CA Chirag Chauhan from Mumbai, the compliance portal displays significantly inflated transaction values, primarily for taxpayers who have sold shares or property. “In our case, the value of assets was increased by two zeros, for example, one share of Rs. 450 of ITC is shown as Rs.45000 and property sold of Rs.1.2 crores is shown as Rs.12 crores, resulting in huge advance tax.”

According to chartered accountants, the difficulty with the Compliance site could have been caused by a technological fault, glitches, or errors in reporting by depositories such as National Securities Depository Limited (NSDL) or Central Depository Services Limited (CDSL) or at the stock exchange’s end.

“Reasons for such issues at the Income tax Compliance Portal can be technical glitch at the end of the reporting entity (NSDL or CDSL or stock exchange) or at the end of Income tax,” according to an another chartered accountant.

He goes on to clarify that depositories (NSDL or CDSL) must provide the Income Tax Department (ITD) with a Statement of Financial Transactions (SFT) for all demat account holders who made debit transactions during the financial year.

“It should be noted that depositories (such as NSDL) compute sale consideration/cost of purchase using the end of day (EOD) prices of the trading date or the best available EOD price for that particular security on the day of transfer. Investors can change the selling consideration, cost of purchase, and other associated information in their SFT,” he added.

According to the first CA, “The reason for the malfunction in the Income Tax Department’s Compliance portal may be due to the use of any software that erred in determining the distinction between a comma and a full stop. For example, the software could have read 4500.00 as 450,000.”

“Inflated transaction values imply a larger income for the taxpayer, which increases the taxpayer’s advance tax burden. Taxpayers should overlook such inflated incorrect data and pay advance tax based on the true data available to them,” he advises.

The income tax department’s Twitter message advised taxpayers to wait for the AIS to be rectified; nevertheless, chartered accountants encourage taxpayers to use the feedback option to notify the tax department of the inaccuracy.

“In my opinion, taxpayers should use the feedback mechanism to notify the income-tax department of any errors they see. After logging in, proceed to the ‘Services’ option and click on ‘Annual Information Statement (AIS)’. After clicking on the ‘AIS’ tab, taxpayers should access the Compliance portal and submit appropriate feedback for any errors or discrepancies they detect,” adds the second CA.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"