From 1st January 2024, Belated ITR for AY 2023-24 can be filed or revised in the form of ITR-U.

CA Pratibha Goyal | Jan 3, 2024 |

ITR Utilities for Filing ITR-U for AY 2023-24 released by Income Tax Department

The Income Tax Department has released Excel Utilities for Filing Income Tax Returns (ITR) i.e., ITR-1, ITR-2, ITR-3, ITR-4, ITR-5, ITR-6 and ITR-7 for ITR-U filed u/s 139 (8A) of the Income Tax Act for Assessment Year 2023-24/Financial Year 2022-23.

[Good News] ITR-1 and ITR-4 Form for FY 2023-24 notified [Read Notification]

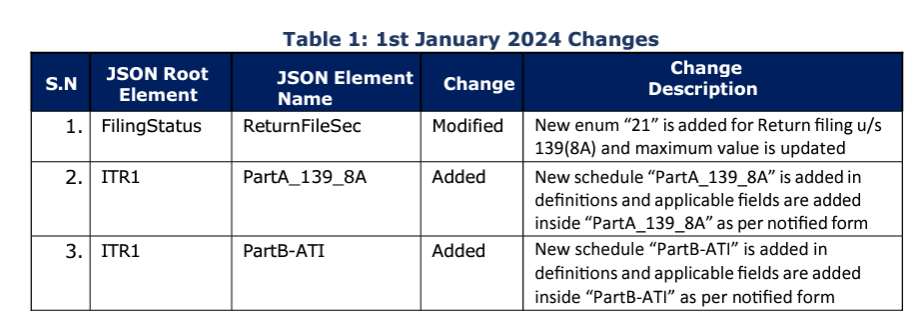

The schema change made on 1 January 2024 is as follows:

The Due Date for Filing Belated Income Tax Returns or revising ITR for Financial Year 22-2023 was 31st December 2023. From 1st January 2024, Belated ITR can be filed or revised in the form of ITR-U, where the Taxpayer cannot reduce Income, show Tax Refund, Increase Losses or Show Losses.

Due Date for Filing ITR-U

ITR-U can be filed at any time within twenty-four months from the end of the relevant assessment year. This means ITR-U for FY 22-23/AY 23-24 can be filed up to 31st March 2026.

Tax, Interest, Penalty, Late Fees: ITR-U

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"