Reetu | May 24, 2023 |

Know About all Active GST Amnesty Schemes

Everyone who is required to pay or file their GST returns must do so in accordance with all laws and deadlines. In the case of GST, it must be filed in a certain order.

If the deadline for the same passes, a taxpayer may be penalised for failing to file. Furthermore, a protracted gap in GST filing may result in the cancellation of the GST registration.

To avoid such repercussions, the government offers the GST Amnesty Scheme, which allows taxpayers to file their delayed GST returns without penalty. The government has reinstated the GST Amnesty Scheme for 2022 to account for delayed files caused by the protracted Covid-19 epidemic.

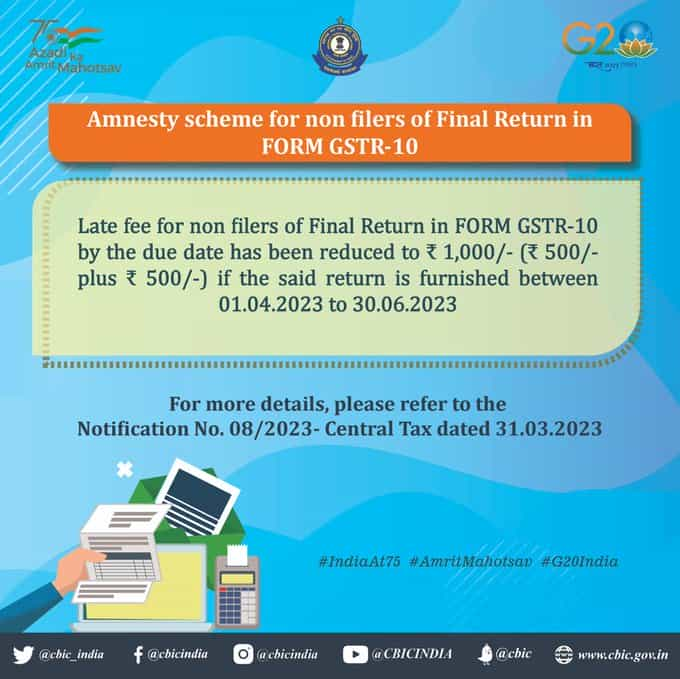

GST Department via issuing notification provide relief to the tax payers who have not filed the GSTR-10 (The Final Return after surrender of GST Registration) within time limit. As per the notification, the tax payers can file the GSTR-10 from 01/04/2023 to 30/06/2023 by paying a maximum of Rs. 1000/- (Rs. 500/- each for CGST & SGST) as late fees. The department will waive off the amount of late fees which is in excess of Rs. 1000/-.

The GST Department has issued notification providing relief to taxpayers who have not submitted the GSTR-4 (The Annual Return for Composition Tax Payers) for the quarters of July 2017 to March 2019 and for the financial years 2019-20 to 2021-22. According to the announcement, taxpayers can file the GSTR-4 from 01/04/2023 to 30/06/2023 by paying a late charge of Rs. 500/- (Rs. 250/- each for CGST and SGST). The department shall forgive the amount of late fines that exceed Rs. 500/-.

The GST Department issued notification providing relief to taxpayers who did not file the GSTR-9 (Annual Return) from the financial years 2017-18 to 2021-22. According to the announcement, taxpayers can file the GSTR-9 from 01/04/2023 to 30/06/2023 by paying a late charge of up to Rs. 20,000/- (Rs. 10,000/- each for CGST and SGST). The department would forgive the amount of late fines that exceeds Rs. 20,000/-.

The GST Department issued notification providing relief to taxpayers who failed to file Form REG-21 against the cancellation of GST Registration within the time frame. According to the announcement, the Registered Person whose registration was cancelled on or before 31 December 2022 and who failed to request for revocation within the time limit should follow the particular process for revocation of cancellation of such registration:

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"