Reetu | Nov 16, 2023 |

Know what Career Opportunities are there in CBIC

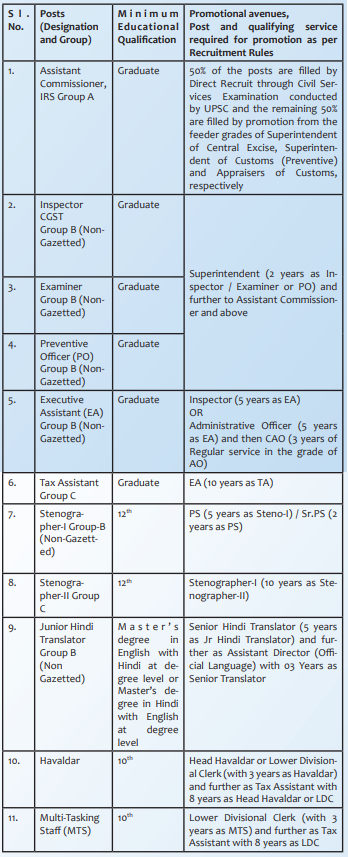

The Central Board of Indirect Taxes and Customs (CBIC) notifies about the different career opportunities in CBIC. Via releasing a brochure, CBIC said that there are a total of 11 posts for which people can apply and have the privilege of working with CBIC.

Join CBIC, If you want to not just only work for a living but also want to make a positive difference…. because Life In the CBIC is not an ordinary life. It is full of challenges and opportunities and provide a great chance to serve the motherland.

Central Board of Indirect Taxes and Customs (CBIC), is a part of the Department of Revenue under the Ministry of Finance, Government of India and is an apex level organization for all matters relating to administration, regulation of Indirect Taxation in the country.

We are in charge of developing policies and enforcing regulations pertaining to the collection of Customs duties, Central Excise duties, Central Goods and Services Tax (CGST), and Integrated Goods and Services Tax (IGST). We also have enforcement responsibilities for preventing smuggling and indirect tax evasion, as well as administration of other pertinent associated legislation.

Thus CBIC plays a very important role in collection of indirect taxes and ensuring economic and physical security of the nation.

It is not only entrusted with the soverign responsibility of tax collection but over the years it has been playing a crucial role as a trade facilitator in the important task of nation building. Our main mottos are:

(a) We strive to realize the revenue in a fair and transparent manner in accordance with the applicable tariff and trade policies.

(b) We are committed to unrelenting support and facilitation to all stakeholders in line with the Government’s agenda to promote ease of doing business.

(c) As part of our action plan, we endeavour to help members of trade to enhance their cost competitiveness, encourage voluntary compliance and build mutual trust on one hand and take measures to combat duty evasion, commercial frauds and smuggling activities on the other hand.

(a) Collection of central excise, CGST, IGST and customs duties;

(b) Prevention of smuggling;

(c) Prevention of tax frauds;

(d) Enforcement of border control measures;

(e) Trade facilitation through use of modern risk based management systems and non-intrusive examination techniques.

(a) You will have an opportunity to play an important role and make positive contribution in the task of nation building and ensure economic and physical security of the nation which is a great source of pride and immense satisfaction;

(b) Opportunities for Assured career progression;

(c) Diversified roles and responsibilities and interesting, engaging and challenging work environment and career opportunities;

(d) Enabling environment for integrating innovative ideas and skill-sets for positive outcomes.

Direct Recruitment is available in the following posts of CBIC, with recruitment based on examinations conducted by UPSC for Group A posts and by SSC for Group B and C posts:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"