Sonali Maity | Sep 11, 2021 |

Learn about Account Aggregator Network a financial data sharing system

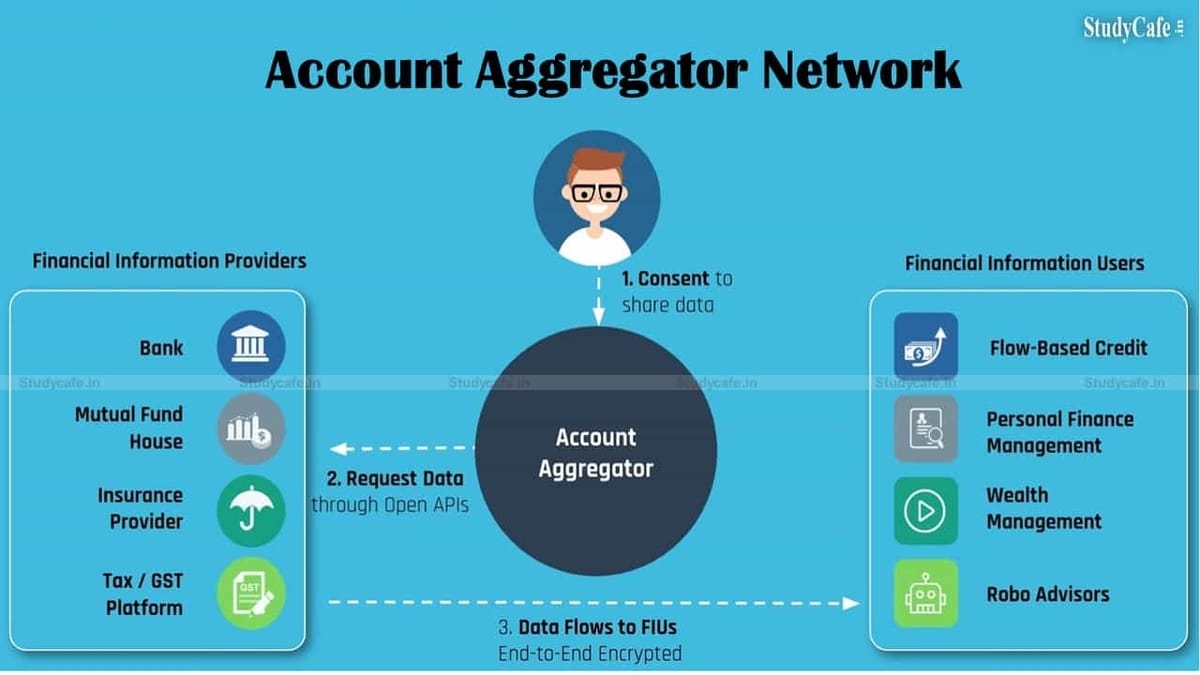

India last week unveiled the Account Aggregator (AA) network, a financial data exchange system that could revolutionize investing and lending by giving millions of consumers greater access and control over their financial records and increasing the pool of customers for lenders and fintech companies. An account aggregator allows a person to control personal financial data that would otherwise remain silos.

It is the first step towards open banking in India and empowering millions of customers to securely and efficiently digitally access and share financial data between institutions.

The Banking Account Aggregator system was launched in eight largest banks in India. The Account Aggregator system can significantly speed up and reduce the costs of granting loans and money management.

An Account Aggregator (AA) is an RBI-regulated firm (with an NBFC-AA license) that assists an individual in securely and digitally accessing and sharing information from one financial institution to any other regulated financial institution in the AA network. Without the consent of the subject, data cannot be shared.

An individual can choose from a wide range of Account Aggregators.

Account aggregators replace long-term “blank checks” acceptance with step-by-step authorization and control over all uses of your data.

In today’s Indian financial system, consumers have to deal with a lot of difficulties: exchanging physical signed and scanned copies of bank statements, rushing around to notarize or stamp papers, or sharing your personal username and password with a third party to reveal your financial history. They’d be replaced with a simple digital data access and sharing mechanism that relied on mobile devices but was also simple and secure. As a result, new forms of services — such as new types of loans — will become available.

All that is required is for the individual’s bank to join the Account Aggregator network. Eight banks have already agreed to share data based on consent (Axis, ICICI, HDFC, and IndusInd Banks), and four more will be able to do so soon (State Bank of India, Kotak Mahindra Bank, IDFC First Bank, and Federal Bank).

Only four ‘identity’ data elements are shared for KYC purposes under Aadhaar eKYC and CKYC (eg name, address, gender, etc). Similarly Credit bureau data only simply includes loan history and/or a credit score. Transaction data or bank statements from savings/deposit/current accounts can be shared via the Account Aggregator network.

Banking transaction data (for example, bank statements from a current or savings account) is now available to be shared across the banks that have joined the network.

Consumers will eventually have access to all financial data, including tax data, pension data, securities data (mutual funds and brokerage), and insurance data, thanks to the AA framework. It will also go beyond the banking sector, allowing individuals to access healthcare and communications data through AA.

Account Aggregators do not see the data; they simply transfer it from one financial institution to another based on the direction and consent of an individual. Despite the name, they cannot, ‘aggregate’ your data. AAs are not like technology firms that aggregate your data and create detailed profiles of you.

The data that AAs exchange is encrypted by the sender and can only be decrypted by the recipient. The use of end-to-end encryption and technology such as the “digital signature” makes the process far more secure than sharing paper documents.

Yes. Consumers are entirely free to register with an AA. If the bank the consumer is using has joined the network, they can register on an AA, choose which accounts to link, and share data from one of their accounts for some specific purpose to a new lender or financial institution at the stage of giving “consent” via one of the Account Aggregators. A customer has the right to refuse a consent to share request at any time. If a consumer agrees to share data in a recurring manner over a period of time (for example, during a loan period), that consent can be revoked at any time later by the consumer.

The consumer will be informed of the specific time period during which the recipient institution will have access to their data at the moment of consent.

Through their app or website, you can sign up for an AA membership. As part of the consent procedure, AA will issue you with a handle (like a username).

Today, Four apps (Finvu, OneMoney, CAMS Finserv, and NADL) are ready for download with operational licences to be AAs. Another three, PhonePe, Yodlee, and Perfios, have gained RBI permission in principle and may be launching applications in the near future.

No, a customer can register with any AA to gain access to data from any bank in the network by registering with them.

The AA will determine this. Some AAs may be free since they charge banking institutions a service fee. Some may charge a small user fee.

Access to loans and access to money management are the two primary services that will be improved for individuals. Many documentation must be supplied with the lender if a customer wants to receive a small company or personal loan today. Today, this is a time-consuming and tedious process that which affects the time taken to procure the loan and access to a loan. . Money management is also tough today because data is stored in a many different locations and cannot be easily brought together for analysis.

With Account aggregator, a business can quickly and inexpensively access secure tamper-proof data and speed up the loan due diligence process so customers can get a loan. In addition, customers can access loans without physical collateral, sharing reliable information about future invoices or cash flows directly from government systems such as GST or GeM.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"