Reetu | Feb 6, 2020 |

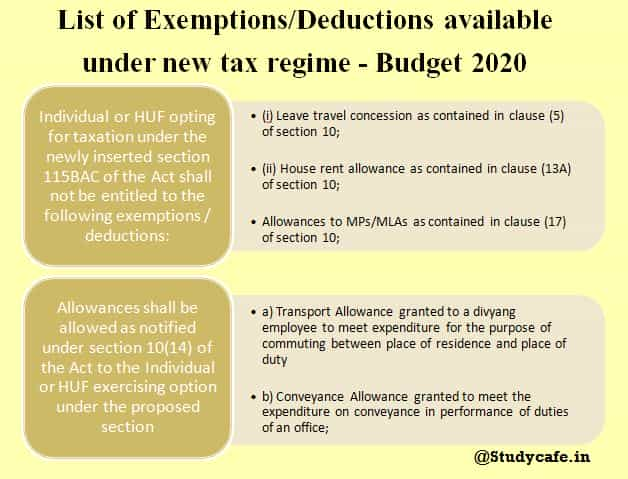

List of Exemptions/Deductions available under new tax regime – Budget 2020

Individual or HUF opting for taxation under the newly inserted section 115BAC of the Act shall not be entitled to the following exemptions / deductions :

(i) Leave travel concession as contained in clause (5) of section 10;

(ii) House rent allowance as contained in clause (13A) of section 10;

(iii) Some of the allowance as contained in clause (14) of section 10;

(iv) Allowances to MPs/MLAs as contained in clause (17) of section 10;

(v) Allowance for income of minor as contained in clause (32) of section 10;

(vi) Exemption for SEZ unit contained in section 10AA;

(vii) Standard deduction, deduction for entertainment allowance and employment / professional tax as contained in section 16;

(viii) Interest under section 24 in respect of self-occupied or vacant property referred to in sub-section (2) of section 23. (Loss under the head income from house property for rented house shall not be allowed to be set off under any other head and would be allowed to be carried forward as per extant law);

List of Exemptions/Deductions available under new tax regime – Budget 2020

(ix) Additional deprecation under clause (iia) of sub-section (1) of section 32;

(x) Deductions under section 32AD, 33AB, 33ABA;

(xi) Various deduction for donation for or expenditure on scientific research contained in sub-clause (ii) or sub-clause (iia) or sub-clause (iii) of sub-section (1) or sub-section (2AA) of section 35;

(xii) Deduction under section 35AD or section 35CCC;

(xiii) Deduction from family pension under clause (iia) of section 57;

(xiv) Any deduction under chapter VIA (like section 80C, 80CCC, 80CCD, 80D, 80DD, 80DDB, 80E, 80EE, 80EEA, 80EEB, 80G, 80GG, 80GGA, 80GGC, 80IA, 80-IAB, 80-IAC, 80-IB, 80-IBA, etc). However, deduction under sub-section (2) of section 80CCD (employer contribution on account of employee in notified pension scheme) and section 80JJAA (for new employment) can be claimed.

Following allowances shall be allowed as notified under section 10(14) of the Act to the Individual or HUF exercising option under the proposed section :

a) Transport Allowance granted to a divyang employee to meet expenditure for the purpose of commuting between place of residence and place of duty

b) Conveyance Allowance granted to meet the expenditure on conveyance in performance of duties of an office;

c) Any Allowance granted to meet the cost of travel on tour or on transfer;

d) Daily Allowance to meet the ordinary daily charges incurred by an employee on account of absence from his normal place of duty.

For Regular Professional Updates Join : https://t.me/Studycafe

Click Here to Buy CA INTER/IPCC Pendrive Classes at Discounted Rate

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"