Reetu | Mar 31, 2021 |

List of HSN Code/Service Accounting Code Updated till 31st March 2021

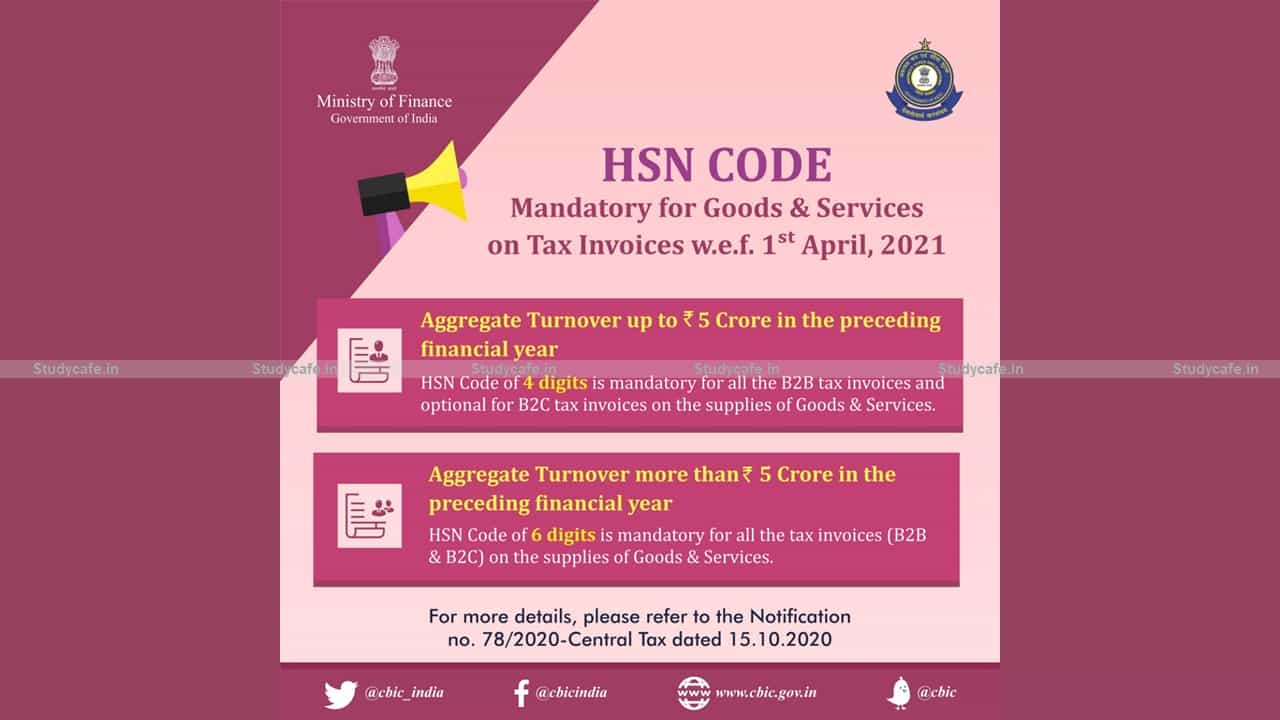

The Central Broad of Indirect Tax and Custom (CBIC) mandates HSN Code/SAC for GST Taxpayer.

Requirement of HSN/Service Accounting Code for Goods and Services on B2B Tax Invoices is mandatory w.e.f 01/04/21.

Turnover more than 5 crore in preceding FY – 6 Digits HSN Code

Turnover upto 5 crore in preceding FY – 4 Digits HSN Code

Goods, Services, Services (Exempt)

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"