Studycafe | Mar 18, 2021 |

Mandatory to Quote HSN/SAC Code in GST Invoice from 01.04.2021

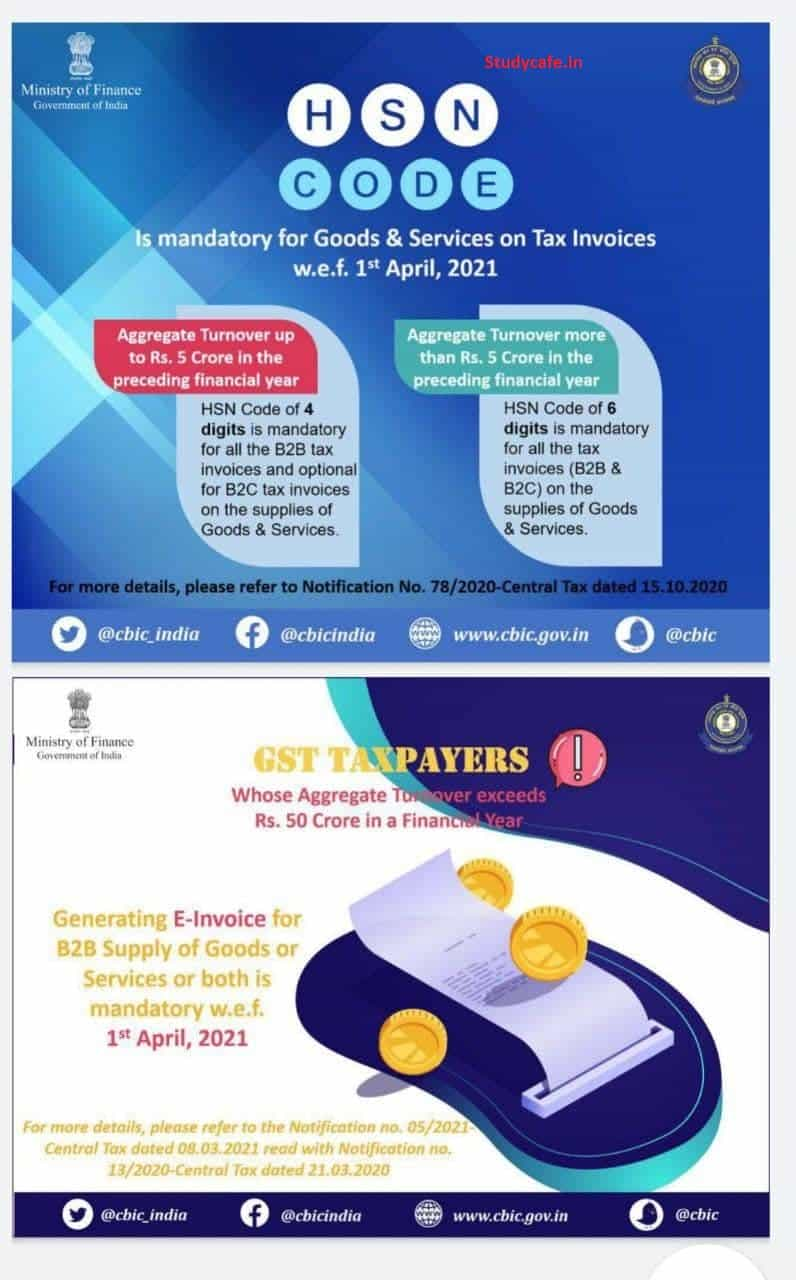

The Change-related to Quoting of HSN Code on Tax invoice is given below:

| HSN Code Change | B2B Transactions | B2C Transactions |

| For Turnover upto Rs 5 Cr | 4 – Digit HSN | NA |

| For Turnover of more than Rs 5 Cr | 6 – Digit HSN | 6 – Digit HSN |

| For Exports | 8 – Digit HSN | 8 – Digit HSN |

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"