Reetu | May 16, 2022 |

Many banks including PNB, ICICI and Axis changed interest rates of FD; Check Where to Get Maximum Interest

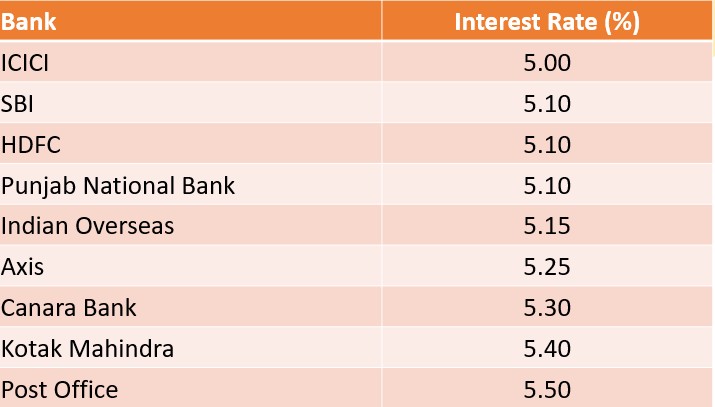

HDFC, ICICI, Indian Overseas Bank, Punjab National Bank, Canara Bank, Axis and Kotak Mahindra Bank have changed fixed deposit (FD) interest rates after RBI’s change in repo rate. In such a situation, if you are planning to get FD these days, then it is important for you to know about the new rates. With this you will be able to earn maximum return on your investment.

If the interest earned on a bank FD in a fiscal year is less than forty thousand rupees, no tax is due. This restriction applies to anyone under the age of 60. At the same time, income from FDs of elderly individuals over the age of 60 is tax-free up to 50,000 rupees. TDS of 10% is deducted on earnings in excess of this amount.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"