The Ministry of Corporate Affairs in matter of M/s KONWERT INDIA MOTORS PRIVATE LIMITED has levied Penalty of Rs.400000 on Startup Company for default in Filing MGT-14.

Reetu | Jun 26, 2023 |

MCA Levies Penalty of Rs.400000 on Startup Company for default in Filing MGT-14

The Ministry of Corporate Affairs (MCA) in the matter of M/s KONWERT INDIA MOTORS PRIVATE LIMITED has levied Penalty of Rs.400000 on Startup Company for default in Filing MGT-14.

M/s KONWERT INDIA MOTORS PRIVATE LIMITED having CIN: U31909TZ2019PTC032612 (Herein after to as “the Company”) is company incorporated under the Companies Act, 2013, and it’s having registered office address “DR No9/5, Ramaswamy Nagar, J.M Bakary, Vadavalli Bu Post, Coimbatore, Tamil Nadu,641046,lndia.”

Adjudication Notice under Section 454 for the violations of Section 42 (3) of the Companies Act, 2013 read with Rule 14(8) of the Companies (Prospectus and Allotment of Securities) Rules, 2014 were issued vide No. ROC/CBE/ADJ/42/ 032612/2023 dated 07.03.2023 to the Company and its Two Directors in default, viz., 1.SENTHIL NICKENDRA MANIKANDAN ( DIN: 08233059), 2. KRISHNAKUMAR SIVA SUBRAMANIAM (DIN: 7875830).

Whereas it is observed that the Company has passed the special resolution for issue of private placement on 24.04.2021 and filed the MGT-14 vide SRN T37126851 on 24.08.2021. However, the company has issued the Private placement offer letter in PAS-4 on 24.04.2021, before filing the relevant Special resolution in form MGT-14 in the registry which is resulted in violation of Section 42{3) of Companies Act 2013 read with Rule 14 {8) of the Companies {Prospectus and Allotment of Securities) Rules,2014.

Sub-Section (3) of Section 42 of the Act provides that a company making private placement shall issue private placement offer and application in such form and manner as may be prescribed to identified persons, whose names and addresses are recorded by the company in such manner as may be prescribed.

As per Rule 14{8) (Appointment of Key Managerial Personnel) of the Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014, a company shall issue private placement offer cum application letter only after the relevant special resolution or Board resolution has been filed in the Registry.

Provided that private companies shall file with the Registry copy of the Board resolution or special resolution with respect to approval under clause (c) of subsection (3) of section 179].

Sub-section (10) of Section 42 of the Act provides that if a company makes an offer or accepts monies in contravention of this section, the company, its promoters and Directors shall be liable for a penalty which may extend to the amount raised through the private placement or two crore rupees, whichever is lower, and the company shall also refund all monies with interest as specified in sub-section (6) to subscribers within a period of thirty days of the order imposing the penalty.

Section 446B of the Act begins with a non-obstande clause and provides for lessor penalties in case of OPC, Small Company, Startup companies and Producer companies which read as under, “Notwithstanding anything contained in this Act, if penalty is payable for non-compliance of any of the provisions of this Act by a One Person Company, small company, start-up company or Producer Company, or by any of its officer in default, or any other person in respect of such company, then such company, its officer in default or any other person, as the case may be, shall be liable to a penalty which shall not be more than one-half of the penalty specified in such provisions subject to a maximum of two lakh rupees in case of a company and one lakh rupees in case of an officer who is in default or any other person, as the case may be”.

Thus, provisions of Section 446B gives overriding effect over sub-Section (10) of Section 42 of the Act. The company, being a startup company registered in Startup India portal as well as small company as verified from the filings made by the company, the penal provisions of Section 446B of the Act, is considered for levying “penalty” for violation of Section 42 of the Act and accordingly the order is made hereunder.

As per Section 454 read with Rule 3(4) of the Companies Act, 2013 the reply to such notice shall be filed in electronic mode only within the period as specified in the notice. The company have ·not made replies to this office so far.

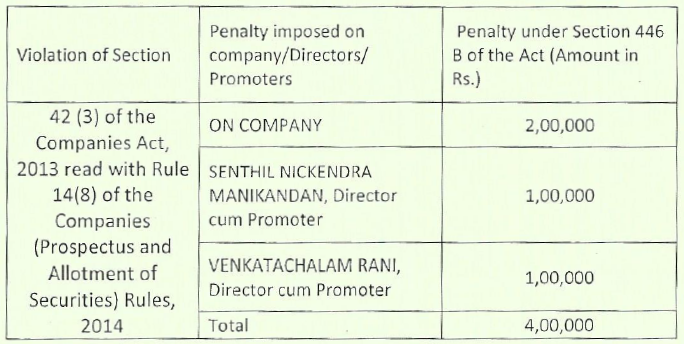

Having considered the facts and circumstances of the case of default by company in filing the MGT-14, being a startup company registered in Startup India portal as well as small comp.my, the Adjudicating Officer do hereby impose penalty under Section 446B of the Act on Company and its Directors cum promoters as per Table Below for violation of Section violation of Section 42(3) of Companies Act 2013 read with Rule 14 (8) of the Companies (Prospectus and Allotment of Securities) Rules,2014.

The Penalty imposed shall be paid through the Ministry of Corporate Affairs portal (www.mca.gov.in under Miscellaneous Fee) only, within a period of ninety days from the date of the receipt of the copy of the order.

Appeal, if any against this order may be filed in writing with the Regional Director, Southern Region, Ministry of Corporate Affairs, 5th floor, Shastri Bhavan, 26, Haddows Road, Chennai – 600 006 within a period of sixty days from the date of receipt of this order, in Form ADJ setting forth the grounds of appeal and shall be accompanied by a certified copy of this order (Section 454 of the Companies Act, 2013 read with the Companies (Adjudicating of Penalties) Rules, 2014).

Also invited to Section 454(8) of the Act regarding the consequences of nonpayment of penalty.

For Official Order Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"