The Ministry of Corporate Affairs(MCA) has notified Process of Making Offline ROC Payment.

Reetu | Jul 8, 2023 |

MCA: Process of Making Offline ROC Payment

The Ministry of Corporate Affairs(MCA) has notified Process of Making Offline ROC Payment.

While filling a form and on reaching the payment page, the following steps need to be formed for offline payment:

Note: The form used to depict the Offline Payment process is that of SH-Z

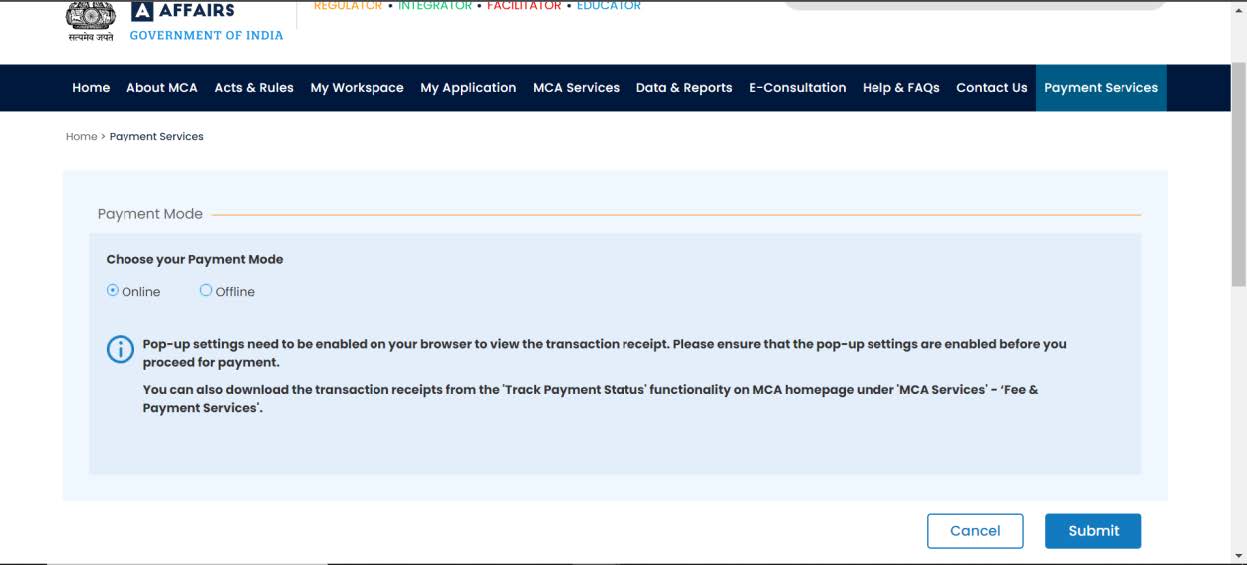

1) User selects the Offline Payment and click on ‘Submit’:

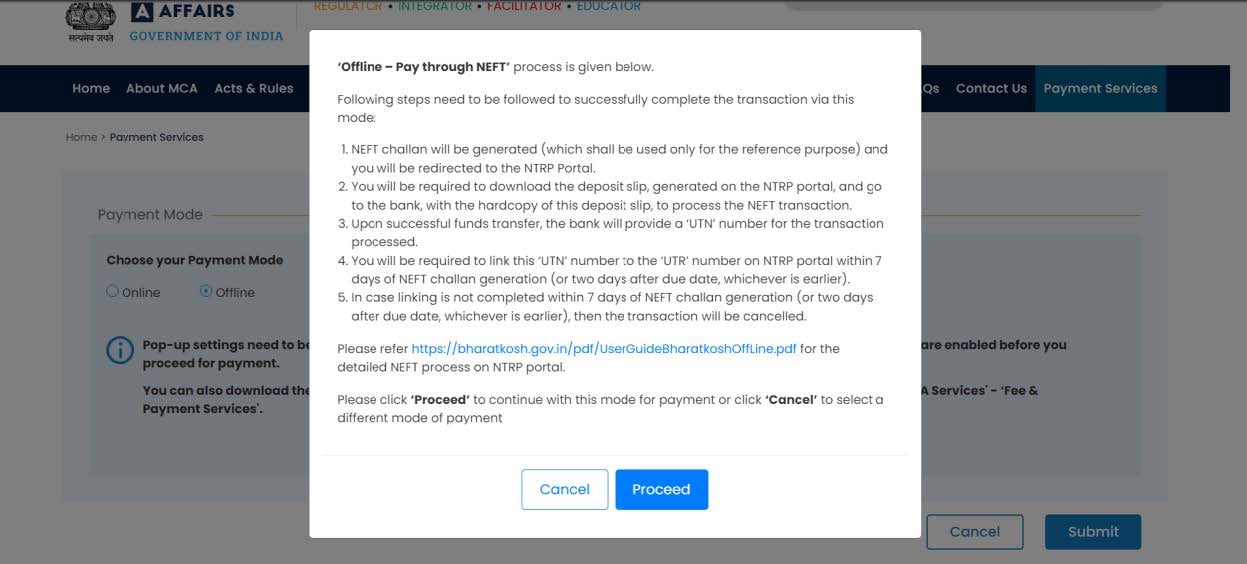

2) A pop up is shown to the user. Click ‘Proceed’.

a. On proceeding 2 windows will populate:

i. Challan of the offline payment

ii. Bharatkosh website

3) User needs to provide the following details inorder to proceed:

a. Bank account no:

b. Bank name (from the dropdown):

c. Bank IFSC Code:

4) Click on ‘Submit to Validate Account’. Post validation user will be able to see Depositor Details and Purpose Details

5) Click on ‘Confirm’. User will be able to see Response Status Offline having payment details:

6) User can click on ‘Download Depositer Slip’ to download Pay-in-Slip:

7) User would receive an email with ‘Username’ and ‘Password’ on their MCA registered email id:

8) User shall click on login link provided in the email body. On clicking user will be required to login with provided credentials:

9) User has to update the password post the first login. Click ‘Submit’ once the details are provided:

10) Login with new password on bharatkosh portal:

11) Click on ‘Track your Payment’. Tracking page opens up:

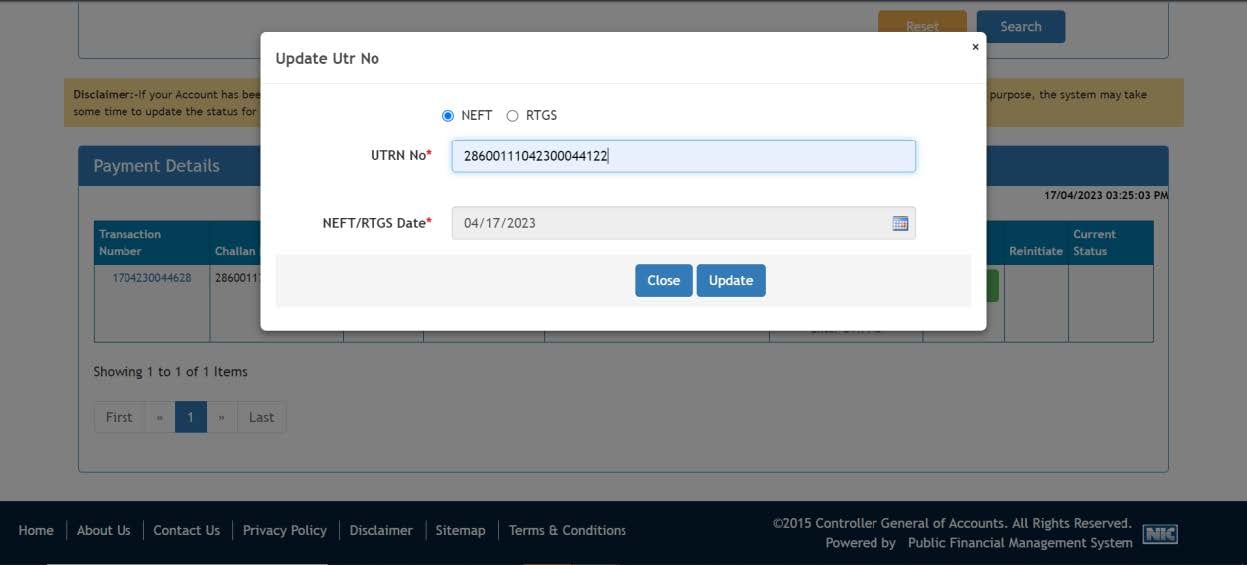

12) Click on ‘Enter UTR NO’ provided by bank after the payment is done offline. A pop up appears, Select the payment option and provide the UTRN No. Click on ‘Update’.

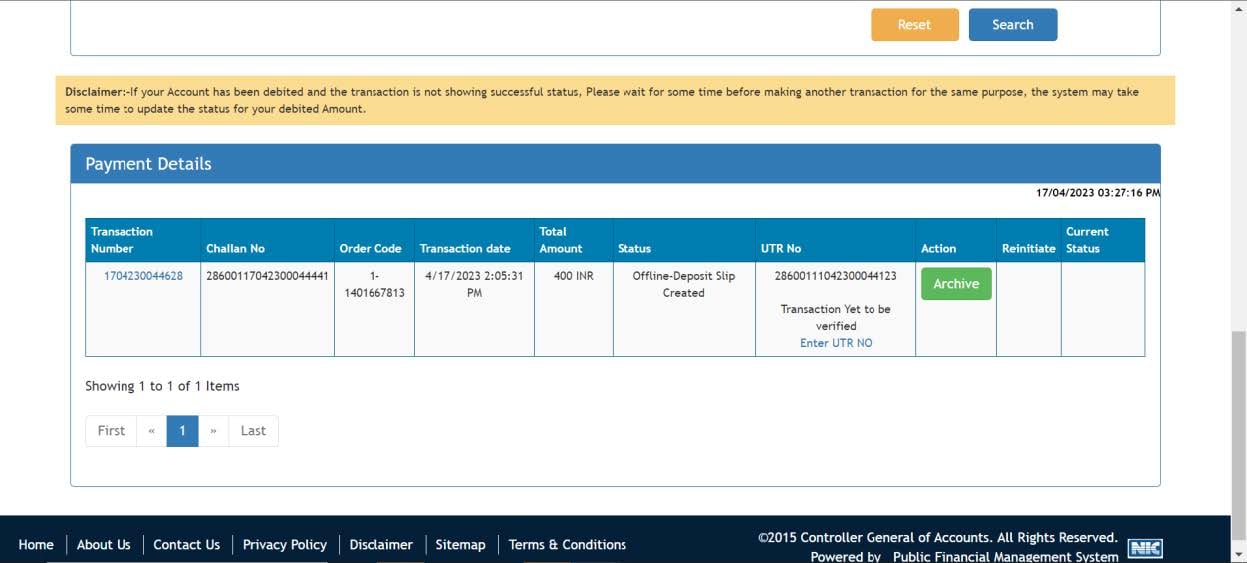

13) The UTRN No get update against the Transaction Number which will get verified with RBI:

14) Once RBI verifies the payment, the status will get updated in MCA portal as well.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"