Reetu | Mar 20, 2025 |

Rs.8,487 Crores settled from IGST portion to State of Odisha

The Minister of State in the Ministry of Finance, Shiri Pankaj Chaudhary, in a written reply to a question asked in Lok Sabha, said, “Rs.8,487 Crores settled from the IGST portion to the State of Odisha.”

The Minister Shri Manas Ranjan Mangara asked the following questions:

Will the Minister of FINANCE be pleased to state-

(a) the implementation status of the Goods and Services Tax (GST) in Odisha;

(b) the total GST revenue collected by Odisha in the last fiscal year;

(c) whether there have been any challenges in GST collection in Odisha; and

(d) the steps being taken to improve GST compliance and revenue generation in the State?

The Minister of State in the Ministry of Finance, Shiri Pankaj Chaudhary, replied:

(a) GST has been implemented in the whole country, including the State of Odisha, w.e.f. 1st July, 2017.

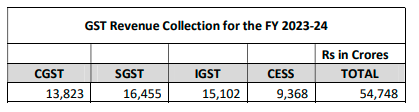

(b) The details of the GST revenue collection for the State of Odisha during the FY 2023-24 are as under:

Further, an amount of Rs 8,487 Crores has been settled from IGST portion to the State of Odisha during FY 2023-24.

(c) and (d) Specific state-wise challenges are not examined. However, GoM has been constituted to analyse state-wise revenue trends, suggest policy recommendations for revenue augmentation and analyse the impact of economic and other factors on GST revenue.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"