FAQs on V3 Company Forms

Reetu | Aug 17, 2022 |

FAQs on V3 Company Forms

The Ministry of Corporate Affairs(MCA) has released Frequently Asked Questions on V3 Company Forms (Director KYC, Charge & Deposit Forms).

Check the Frequently Asked Question Below:

Set 1 forms covering 9 forms are being migrated to V3 while remaining Company forms are still in the V2 portal. This phased migration is done to enable smooth transition of the portal. Both Version2 and Version3 are now working seamlessly.

Effective from 31st August 2022, Director KYC, Charge & Deposit forms (For complete list of Set 1 forms please refer question no. 02 below) for Company are required to be filed in Version 3 post log in on the MCA21 V3 Portal and other remaining company forms will be continued to be filed in the same manner as earlier in Version 2. You can download the other company forms from <> and proceed with the filing of the same as per previous process.

Forms covered in Set 1 forms are:

a. CHG-1

b. CHG-4

c. CHG-6

d. CHG-8

e. CHG-9

f. DIR-3 KYC E-form

g. DIR-3 KYC web

h. DPT-3

i. DPT-4

Set 1 forms will be rolled out on 31st August 2022 on MCA21 V3 Portal and will be available post log-in.

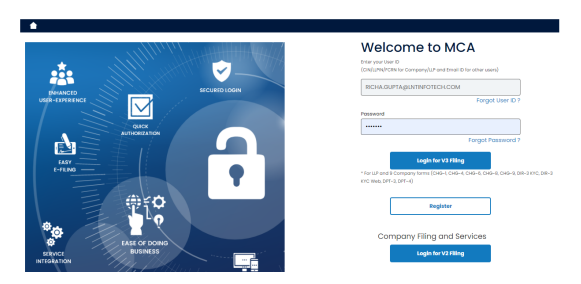

What is the process of login to file Set 1 Company forms in V3?

Users must click on Sign In/Sign up and then select ‘Login for V3 filings’ as mentioned in the below screen shot.

If you are an already existing LLP user of V3, same user id/password can be used to login for filing V3 Company forms. No need to create a fresh login id for accessing V3 Company forms.

If you are existing Business user of V2, please use the same user id/password and click on button ‘Login for V3 filing’.

If you are existing Registered user of V2, please use the same user id/password and click on button ‘Login for V3 filings’ for the first time. Now upgrade your profile to Business user in V3 and then start filing V3 Company forms.

For remaining Company Form filing (except these 9 forms), please click on button ‘Login for V2 filing’ and use your already existing V2 credentials.

Remaining company forms excluding Set 1 forms to the new V3 will be intimated in due course.

In the V2, forms are required to be filled and uploaded in the portal while in V3 the forms are to be filled online. This enables user convenience including the ability to save a half-filled form and file it later.

Further in V2, there was only a My Workspace which had a list of notices from MCA and circulars issued by them. In V3, there is a personalised “My Application” feature which allows one to view all the forms filed by them till date along with the status of the forms such as pending for DSC upload and Payment, Under Processing, Pay fees, Resubmission etc.

When a user logs in to V3, the login is through the email id whereas in V2 it was possible with the user id.

When a business user logs in to the MCA system, an OTP will be sent to your mobile and e-mail address to ensure the authenticity of the user.

Please refer below mentioned link for FAQs on user registration

Please refer below mentioned link for FAQs on DSC association

All Set 1 forms excluding DIR-3 KYC web are required to be filed through Business users accounts only. Filing of the SET 1 forms through registered user account has been discontinued.

All Forms have been made Web-based.

Few attachments have been removed and the required information is either captured in machine readable format within the form itself or in the form of declaration.

Signing by IRP/RP/liquidator of Charge Forms for companies under liquidation/Under CIRP.

Automatic notification to RoC of CHG-8 form filed to RD and removal of hardship of filing the same manually / through GNL-2 form.

Functionality for online payment of cost (if imposed by RD in order made pursuant to CHG-8).

System based email and automated reply in case of CHG-1/CHG-9/CHg-4 filing is done by the charge holder (i.e., form not signed by the company or its representative).

Addition of few new charged assets under the head “Type of Charge” in CHG-1 and CHG-9 forms.

DPT-3 form filed with purpose ‘Onetime Return’ will be processed in STP mode.

DPT-4 form will be processed in STP form.

Other miscellaneous enhancements like pre-filling of data, repositioning of fields, declaration changes etc.

To Read Full FAQs Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"