Reetu | May 5, 2023 |

Ministry of Finance notifies Aadhaar Authentication for purpose of Money Laundering

The Ministry of Finance has notified Aadhaar Authentication for purpose of Money Laundering via issuing Notification.

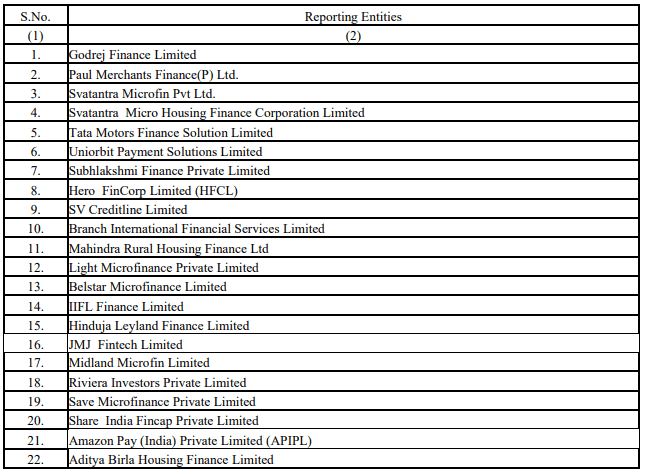

The Notification Stated, “In exercise of the power conferred by proviso to sub-section (1) of section 11A of the Prevention of Money-Laundering Act, 2002 (15 of 2003) (hereinafter referred to as the Money-Laundering Act), the Central Government being satisfied that the reporting entities other than banking companies mentioned in the TABLE below shall comply with the standards of privacy and security under the Aadhaar (Targeted Delivery of Financial and Other Subsides, Benefits and Services) Act, 2016 (18 of 2016) (hereinafter referred to as the Aadhaar Act), and it is necessary and expedient to do so, after consultation with the Unique Identification Authority of India established under sub-section (1) of section 11 of the Aadhaar Act and the appropriate regulator, namely, the Reserve Bank of India, hereby permits the said Reporting Entities to perform authentication under the Aadhaar Act for the purposes of section 11A of the Money Laundering Act.”

For Official Notification Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"