Reetu | Apr 14, 2023 |

Model All India GST Audit Manual 2023

Goods and Services Tax in India has stepped towards the completion of five years. One of the main objectives of introduction of GST was to create one common market in the country by totally removing the wide disparities and compliance complexities of various laws of taxation of the States and Centre. In taxation of goods and services (not as “activities”, per se, but as “objects” or “events”), that had led to not only tax inefficiency but had also interfered in investment decisions of businesses. GST has provided a uniform structure in taxation of goods and services throughout the country. There is total uniformity in terms of the taxable event, tax rates, point of levy, provisions for registration, return filing, tax payment, refunds, audit, adjudication, appeals etc. In fact, the CGST and SGST laws are almost mirror images. GSTN, as an enabling organisation, has created the necessary digital backbone to ensure seamless uniformity in the process and procedures relating to registration of taxpayers, return filing, tax payment, refunds etc.

Self-assessment/self-compliance of the taxpayers is the edifice upon which the GST eco-system is built. Though it provides for audit of taxpayers, it does not make it mandatory in all cases. Audit is an important compliance verification tool that complements anti-evasion action and constructive taxpayer engagement to improve tax compliance. Unless the processes and procedures of selection of cases for audit and the consequent proceedings are grounded in sound principles of neutrality, transparency, accountability and sustainability, and proper analysis and appreciation of audit, the purpose of audit would not be served. Uniform adoption of tried and tested best practices of audit procedures and processes by all the States as well as the Centre would enable consolidation of the outcomes of the individual States and Central authorities and their analysis for any consequential policy decisions sub-serves the primary objectives of GST and ensures stable revenues to the States as also to the Centre. Experience and knowledge gained through audit can be efficiently and gainfully shared among the States and replicated only if the procedures and processes adopted converge toward commonly agreed norms. Such convergence can lead to efficient deployment of limited human resources by the States in focused and productive activities.

Audit is also a specialized exercise which requires not only sound knowledge in law but also demands adequate skill. To facilitate all the States and the Centre in respect of audit in GST a task of preparation of a comprehensive All India Model GST Audit Manual was allotted to the Committee of Officers on GST Audit. For this purpose, a sub-committee of officers was constituted to compile existing and desirable audit practices and to draft a model audit manual. Inputs have been taken from both Centre and States from various sources like (i) GST Audit Manual 2019 published by DG Audit, Government of India, (ii) CBIC Quality Assurance Review Manual 2021, (iii) West Bengal State Tax GST AUDIT MANUAL_2021 (iv) Bihar State Tax Audit SOP, (v) Maharashtra State Tax GST Audit Manual 2020, (vi) Punjab Audit-Manual, Punjab Audit Administrative Instruction, Punjab Audit Checklist Documents – Value of Supply, Punjab Audit Checklist Documents And Returns – Supply, (vii) Karnataka State Tax GST Audit Model, (viii) GSTN Audit Process Flow, (ix) Uttar Pradesh GST Tax Audit, (x) further suggestions from States and Centre during compilation. On the basis of all such valuable inputs, the State of West Bengal has compiled this audit manual which has been accepted by the Committee of Officers.

The guidelines provided in the manual are intended to enable audit officers to carry out effective audits in a uniform, efficient and comprehensive manner adopting the best practices of the States and the Centre, as well as international practices. Audit processes envisaged under the GST regime are ably assisted by a technological tool named “BI Tools” developed by GSTN, tools of “DGARM”, concept of “Registered Person Master File (RPMF)” of DG Audit. Various States also developed technological and analytical tools, such as “e-Shodhane Audit Module” of Karnataka, “Tax Payers at a Glance” by West Bengal, Standard Operating Procedure of Bihar focusing areas of concern in Audit which not only complements and enhances the knowledge of the Audit officers also provides data backups and analysis. The technological tool is intended to encompass verification, examination, investigation, scrutiny and the like. Members of the Committee, as well as all the Members of the Sub-Committees and their leadership deserve kudos for forging a consensus consistent with the best audit practices. We congratulate them all. We sincerely hope that the model manual in your hands would lead to implementation of an effective audit mechanism consisting of best practices and procedures tried and tested by the various indirect tax authorities in the country in the interest of revenue, to improve internal control at work in organisations of taxpayers and reduced burden of compliance upon taxpayers.

While emphasis has been placed in this Manual on developing a well-established audit procedure based on sound principles, it is needless to say that there cannot be a uniform approach to the audit of every taxpayer. Occasions may arise when a fact or figure apparent on the documents may need an examination with reference to some other sets of documents or even other sources. Therefore, the scope of audit in GST may vary depending on facts and circumstances of audit. An attempt has been made to address these issues in this document.

Definition of audit under CGST/SGST Act, 2017

Audit is defined in sub-sec 13 of sec 2 of the CGST/SGST Act, 2017 as – “detailed examination of records, returns and other documents maintained or furnished by the taxable person under this Act or Rules made thereunder or under any other law for the time being in force to verify, inter alia, the correctness of turnover declared, taxes paid, refund claimed and input tax credit availed, and to assess his compliance with the provisions of this Act or rules made thereunder.”

Hence, GST audit is not restricted to the reconciliation of only the tax liability & payment of tax by a taxable person, but its scope is also extended to assessment with reference to the provisions of GST laws.

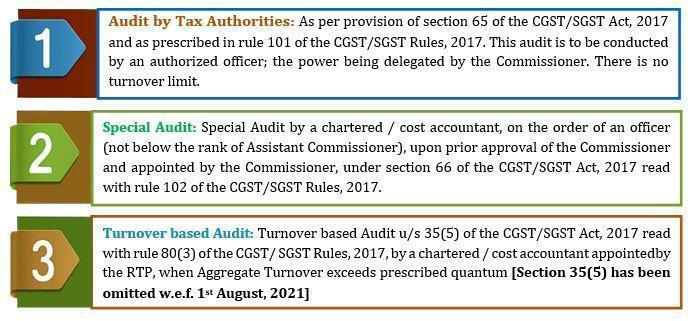

Types of Audit in GST

Three types of Audit are prescribed in GST:

Note: This Model GST Audit Manual is focused on audit by Tax Authorities only. The audited books of accounts and audit report submitted by the taxpayer in prescribed Form(s) are also subject to audit u/s 65.

Legal Provisions of Audit by Tax Authorities: This section aims to familiarise auditors with salient provisions of GST law.

To Read More Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"