MSME has issued a circular regarding the reduction of Annual Guarantee Fee Structure to benefit the MSEs.

Reetu | Mar 27, 2025 |

MSME Circular on reduction of Annual Guarantee Fee

The Micro, Small and Medium Enterprise (MSME) has issued a circular regarding the reduction of Annual Guarantee Fee Structure to benefit the MSEs.

The Circular Reads as Follows:

Please refer to our Circular No. 221/2022-23 dated March 31, 2023, on the reduction in the Annual Guarantee Fee (AGF) Structure, wherein the AGF was reduced to benefit the MSEs. In view of the recent enhancement in the ceiling of guarantee coverage from Rs.5 crore to Rs.10 crore as communicated vide CGTMSE Circular No. 250/2024-25 dated March 18, 2025.

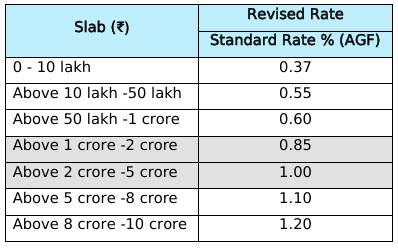

In order to further lower the cost of credit for MSEs, it has been decided to bring down the Annual Guarantee Fee for guarantees above Rs.1 crore to Rs.5 crore. Accordingly, the revised fee structure is as below:

The above revised fee structure shall be applicable to all the guarantees approved or renewed on or after April 1, 2025, including enhancements in existing working capital accounts already covered under the Guarantee Scheme.

The contents of this circular may please be brought to the notice of all your offices.

For Official Circular Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"