CA Pratibha Goyal | Feb 2, 2023 |

New and Old Tax Regime Comparision for FY 2023-24, Income Tax Slab FY 2023-24

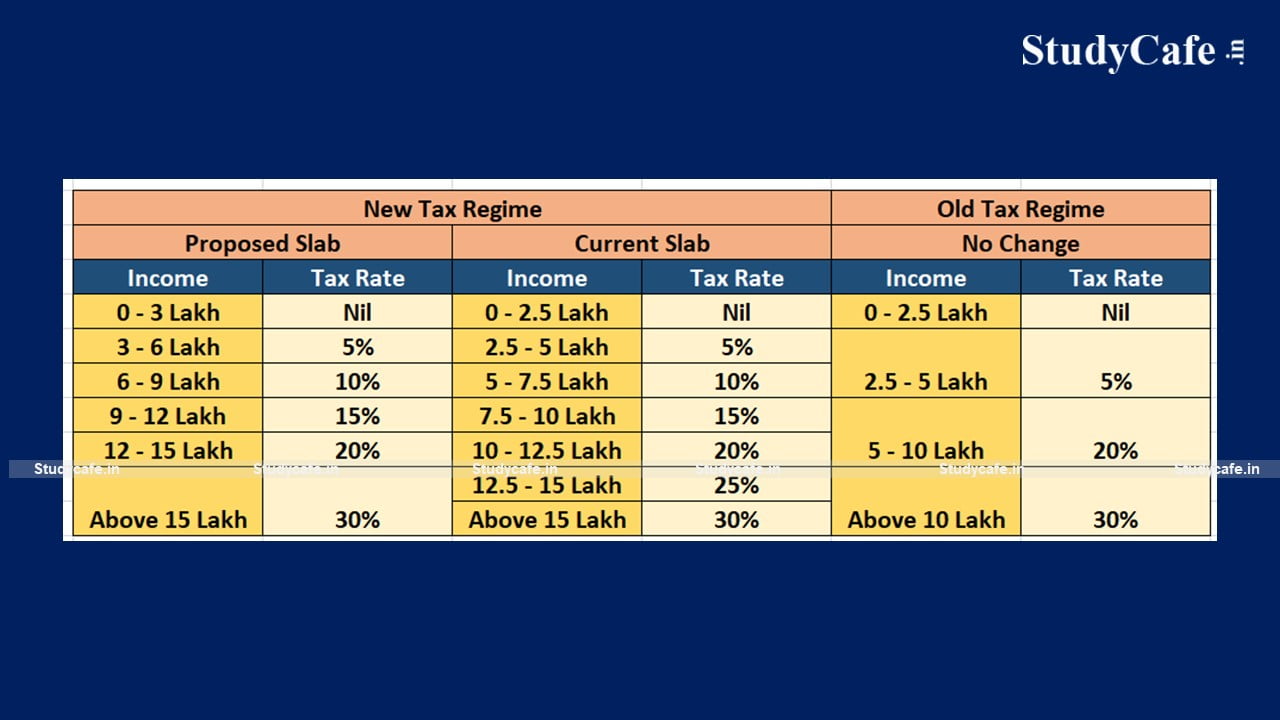

The basic Exemption Limit has been hiked to Rs. 3 Lakh from Rs. 2.5 Lakh by Budget 2023, in New Tax Regime. The Income Tax Slabs in New Tax regime have been changed. As per the proposed amendment, 5 income tax slabs will be there in Financial Year 2023-24, from 6 income tax slabs currently.

1. Upto Rs. 3,00,000 Nil

2. From Rs. 3,00,001 to Rs. 6,00,000 5 percent.

3. From Rs. 6,00,001 to Rs.9,00,000 10 per cent.

4. From Rs. 9,00,001 to Rs. 12,00,000 15 percent.

5. From Rs. 12,00,001 to Rs. 15,00,000 20 percent.

6. Above Rs. 15,00,000 30 percent.

The Rebate u/s 87A of Income Tax has been enhanced in the New Tax regime from Rs. 500,000 to Rs. 700,000. Thus individuals who opted for the new Tax regime are not required to pay tax for Income up to Rs. 700,000.

Further, the New Tax regime is the Default Regime. Taxpayers have the option to choose the old Tax Regime if they want. Their is no change in income Tax slabs of old Tax regime.

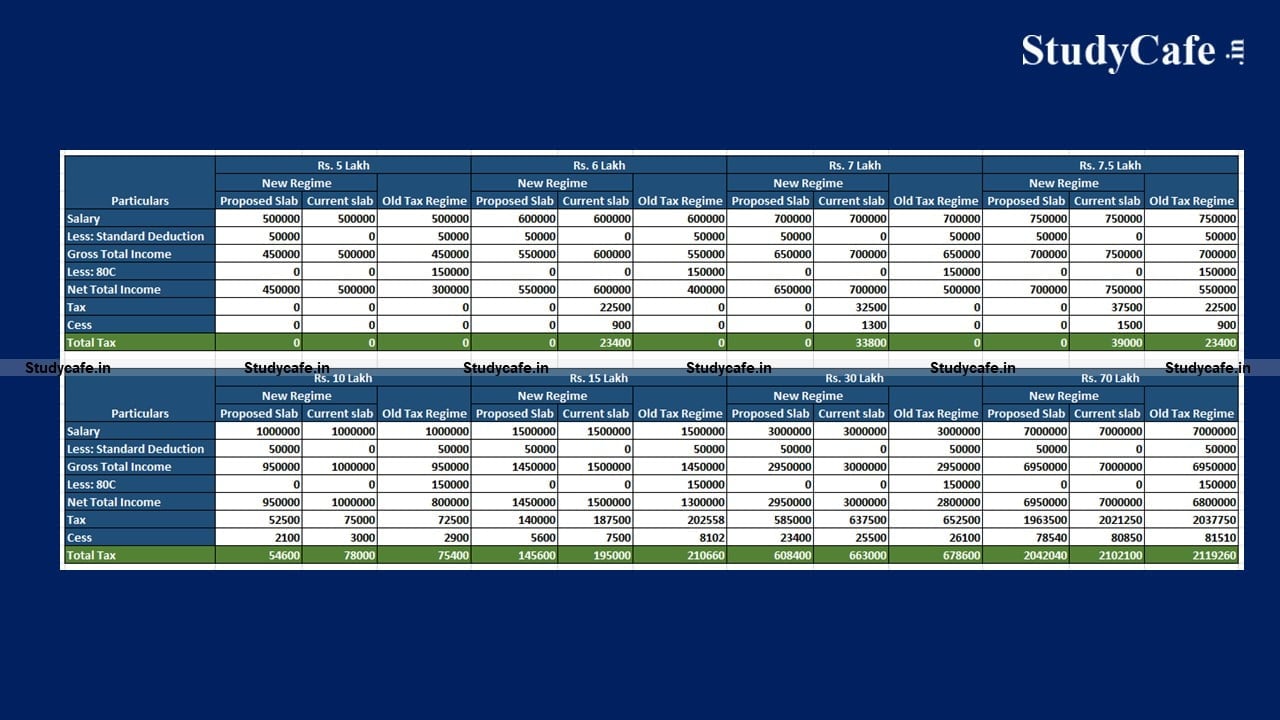

The Standard Deduction of Rs. 50,000 will be there for salaried employees in both new and old regimes. This also means that if a salaried employee has a salary of up to Rs. 7.5 Lakh, the same would be exempt from Tax if he or she opts for New Tax Regime.

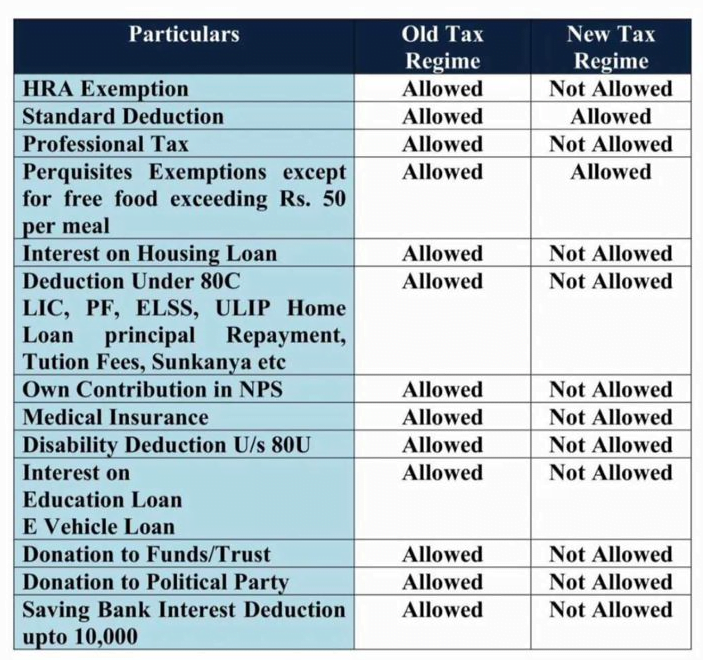

Lot many Income Tax Deductions and Exemptions that are allowed in Old Tax regime are not allowed in New Tax Regime.

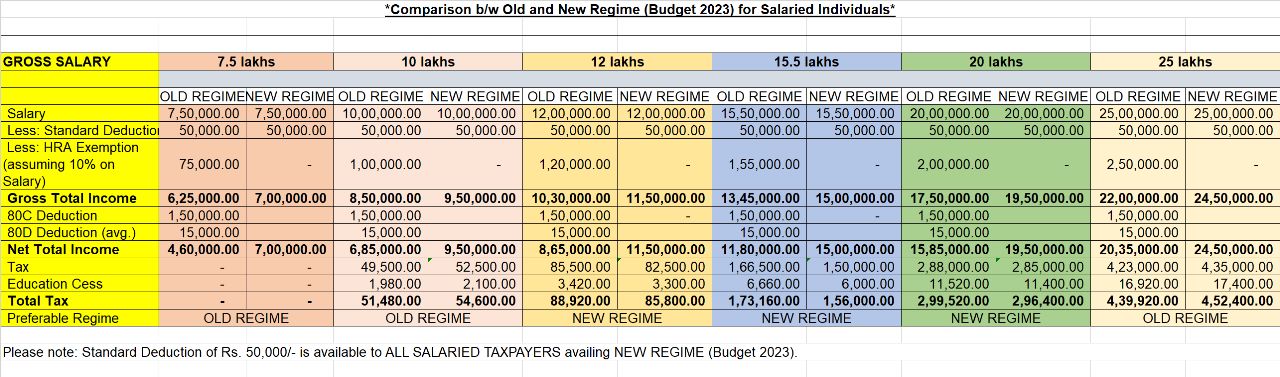

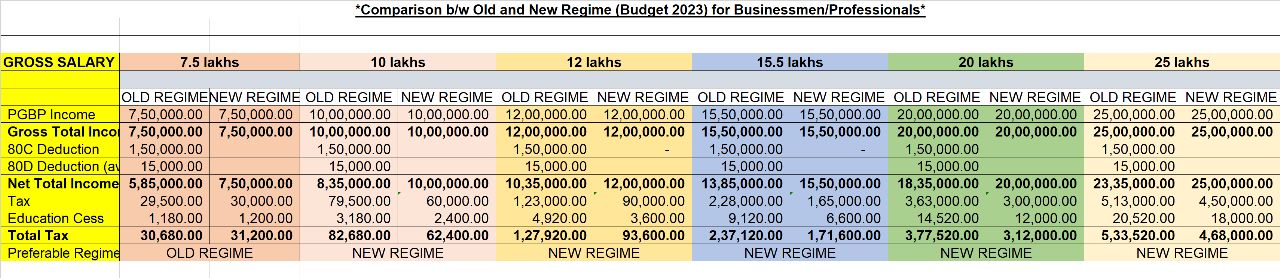

Tax Payer has to decide as per the investments, Exemptions, and Deductions available to him. In a small analysis made below, for taxpayers having only 80C deductions, shows that the New Tax regime saves more Tax.

Another Analysis done by CA Himank Singla in which Taxpayer has HRA and 80D Deduction along with the 80C Deduction shows that Old Tax Regime in Better.

Slab Analysis for Salaried Individuals

Slab Analysis for Businessman

As per the analysis, both the regimes have their pros and cons. The taxpayer needs to check whats their in his kitty and accordingly do the Tax Planning in Advance.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"