cachanchal | Jun 8, 2020 |

New Disclosures of ITR-1/ITR-4 for Assessment Year-2020-21

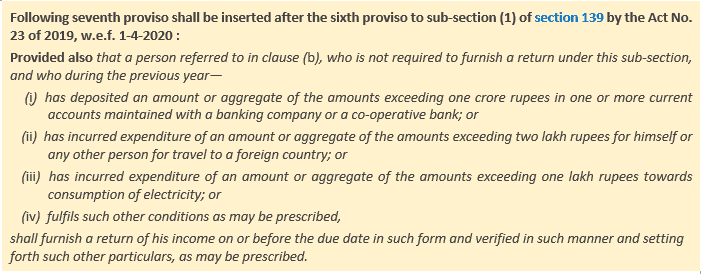

The time has finally come for filing of Income Tax Return (ITR) for Financial Year 2019-20. New disclosures have been introduced in the ITR form this time to comply with provisions announced by Finance Act, 2019. The seventh proviso was inserted by Finance Act, 2019 so as to provide detail of expenditure in respect of electricity bills, foreign travelling, cash deposit, etc. The proviso defines the limits wherein individual is liable to furnish ITR, even if income is not chargeable to tax. If expenditure exceeds the defined limits, then disclosure is required. Here is an excerpt of the proviso reproduced below:

ITR-1 (Sahaj) can be filed by all individuals except for an individual who is a director in a company or has invested in unlisted equity shares. Moreover, individual, who is resident and not ordinarily resident could not file ITR-1.

An individual is liable to file ITR-1/ITR-4 even if taxable income does not exceed maximum amount chargeable to tax but have incurred expenditure on electricity, foreign travelling, exceeding the limit mentioned in seventh proviso to section 139(1).

In a nutshell, the following disclosures are appearing while filing ITR-4/ITR-1 for Assessment Year 2020-21

1. Are to liable to furnish return of income under seventh proviso to section 139(1) but otherwise not required to file return of income. (Figure 1)

2. The seventh proviso was introduced w.e.f 1-4-2020, wherein if person has done below listed things during the financial year then liable to furnish return of income (Figure 1):

a. Deposited an amount or aggregate of amounts exceeding one crores in current account

b. Incurred expenditure on foreign travel exceeding 2 lakhs

c. Incurred expenditure on electricity exceeding one lakhs

3. There is separate column for declaration of investments made between 01-04-2020 to 30-06-2020 under the name DI. (Figure 2)

You can download ITR-1/ITR-4 forms from incometaxindiaefiling.gov.in. The direct link for the same is given here:

The above article is written by CA Chanchal Jain in full-time practice and could be reached at [email protected] or [email protected] or call at +91-9873266410.

Disclaimer: The above article is meant for informational purpose only and does not purport to be advice or opinion, legal or otherwise, whatsoever. While due care has been taken during the compilation of this article to ensure that the information is accurate to the best of our knowledge and belief, the contents of such article do not substitute for professional advice that may be required. The individual expressly disclaims all and any liability to any person who has read this document or otherwise, in respect of anything, and of consequences of anything done, or omitted to be done by any such person in reliance upon the contents of this article.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"