CA Pratibha Goyal | Sep 22, 2019 |

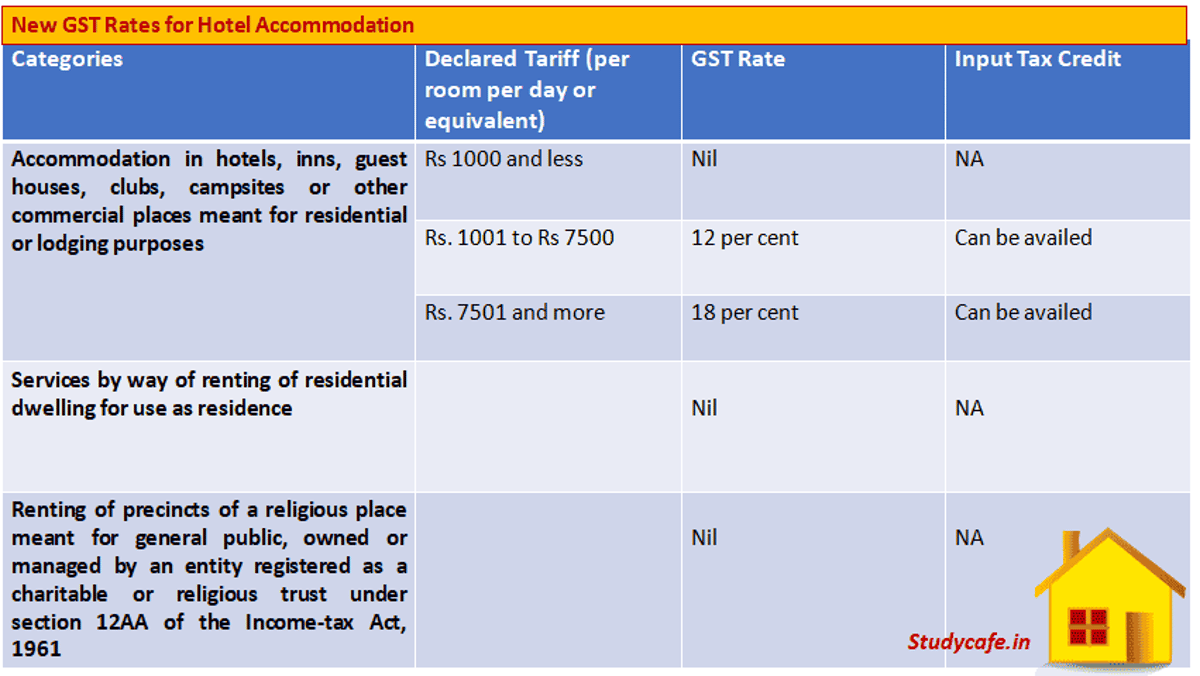

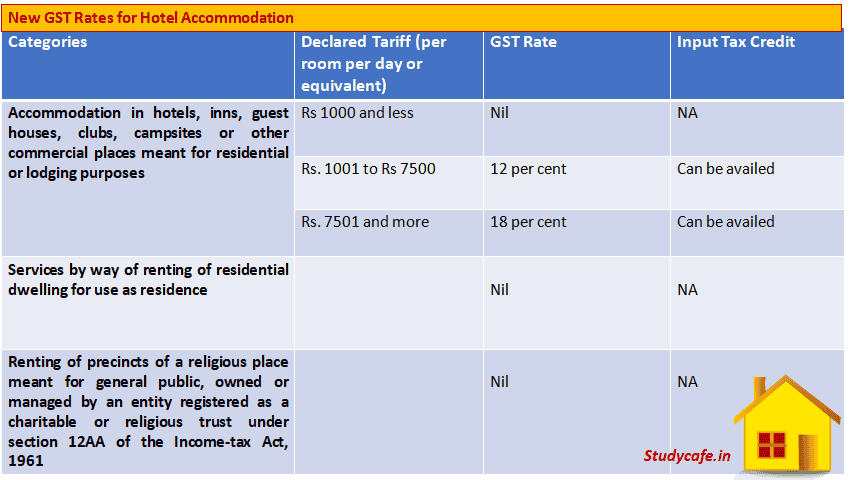

New GST Rates for Hotel Accommodation

GST Council has given a huge relief to Hotel Industry. The council has recommended to change GST tariff rate for Hotel Accommodation and Restaurants.

As per the new rates, Hotels with room tariffs of up to Rs 1,000 need not pay any GST. For those with tariffs of Rs 1,001-7,500, the tax will be 12%, and for those offering rooms at more than Rs 7,500 a night, the levy will be 18%.

For better understanding, first let s quickly go through the New hotel gst rate slab given below

Declared tariff includes charges for all amenities provided in the unit of accommodation (given on rent for stay) like furniture, air conditioner, refrigerators or any other amenities, but without excluding any discount offered on the published charges for such unit.

The Concept of Declared Tariff is very important. For checking the GST Rate Applicability, Declared Tariff term is used and not what we have paid to the Hotel. This has been explained with the help of an example.

Mr A has stayed in a hotel for one night and has paid Rs. 7000 although declared tariff is Rs. 8000.

Ans 1. GST Rate of 18% will be applicable on Rs. 7000. Here we have Chosen GST Rate as per declared Tariff Rate and not on basis of actual payment.

Ans 2. GST Rate of 18% will be applicable on Food of hotel restaurant ordered inside the Room. This service will be covered in definition of Composite sully wherein, Hotel supply being the principle component and the food service being ancillary supply

I hope you enjoyed the article. You can Follow us on our twitter channel for regular updates https://twitter.com/castudycafe

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"