CBIC has made an important clarification in respect of ITC availed by electronic commerce operators where services specified under Section 9(5) of CGST, 2017.

CA Pratibha Goyal | Jan 3, 2025 |

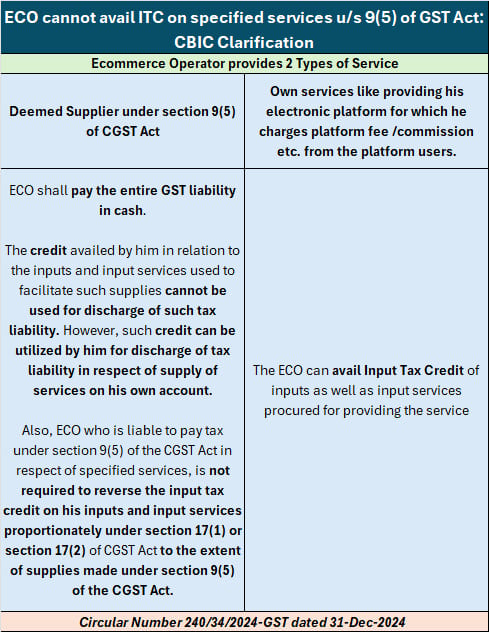

ECO cannot avail ITC on specified services u/s 9(5) of GST Act: CBIC Clarification

Circular Number 240/34/2024-GST dated 31-Dec-2024

CBIC has made an important clarification in respect of input tax credit availed by electronic commerce operators where services specified under Section 9(5) of the Central Goods and Services Tax Act, 2017 are supplied through their platform.

Issue: Whether an electronic commerce operator, required to pay tax under section 9(5) of the CGST Act, is liable to reverse the proportionate input tax credit on his inputs and input services to the extent of supplies made under section 9(5) of the CGST Act?

It is clarified that an Electronic Commerce Operator, who is liable to pay tax under section 9(5) of the CGST Act in respect of specified services, is not required to reverse the input tax credit on his inputs and input services proportionately under section 17(1) or section 17(2) of the CGST Act to the extent of supplies made under section 9(5) of the CGST Act.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"