CA Pratibha Goyal | Dec 12, 2023 |

![No DRC-01C Notice if ITC mismatch is less than 25L or 20% [Read GST Council Discussion]](/cdn-cgi/image/fit=contain,format=webp,gravity=auto,metadata=none,quality=80,width=1200,height=730/wp-content/uploads/2023/12/No-DRC-01C-Notice-if-ITC-mismatch-is-less-than-25L-or-20.jpg)

No DRC-01C Notice if ITC mismatch is less than 25L or 20% [Read GST Council Discussion]

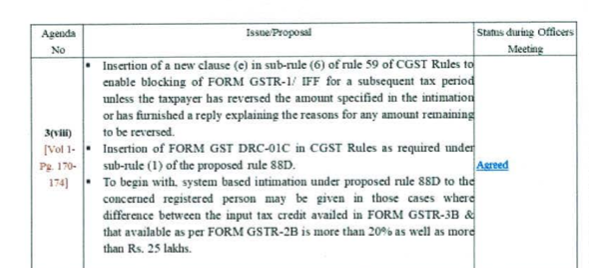

The Central Board of Indirect Taxes and Customs (CBIC) has notified rule 88D for Manner of dealing with difference in input tax credit available in auto-generated statement containing the details of input tax credit and that availed in return by the Central Goods and Services Tax (Second Amendment) Rules, 2023, w.e.f. 4-8-2023.

As per the rule, Where the amount of input tax credit availed by a registered person in the return for a tax period or periods furnished by him in FORM GSTR-3B exceeds the input tax credit available to such person in accordance with the auto-generated statement containing the details of input tax credit in FORM GSTR-2B in respect of the said tax period or periods, as the case may be, by such amount and such percentage, as may be recommended by the Council, the said registered person shall be intimated of such difference in Part A of FORM GST DRC-01C, electronically on the common portal, and a copy of such intimation shall also be sent to his e-mail address provided at the time of registration or as amended from time to time.

Decoding by such amount and such percentage

As per the minutes book of the 50th GST Council meeting, the system-based intimation under proposed rule 88D to the concerned registered person may be given in those cases where the difference between the input tax credit availed in FORM GSTR-3B & that available as per FORM GSTR-2B is more than 20% as well as more than Rs. 25 lakhs.

GST Portal is also following the above-mentioned limits. Please note that since the word ‘Prescribed’ has not been used in Rule 88D, which means that the limits need not be notified by a separate notification & a recommendation in the Council meeting would suffice.

On his Twitter account, CA Abhas Halakhandi has made these observations.

For Official GST Council Discussion Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"