Studycafe | Dec 19, 2019 |

PPF Scheme 2019 : Brief on new Public Provident Fund (PPF) Scheme

The Public Provident Fund (PPF) is a tax-free investment avenues which are open to all individuals. The Government had brought the scheme to encourage the saving and investment habits among the individuals. Originally the scheme was notified vide GSR 1136, dated 15-06-1968 and many amendments have been carried since then in the scheme. Now, the Government has notified a new scheme vide G.S.R. 915(E), dated 12-12-2019.

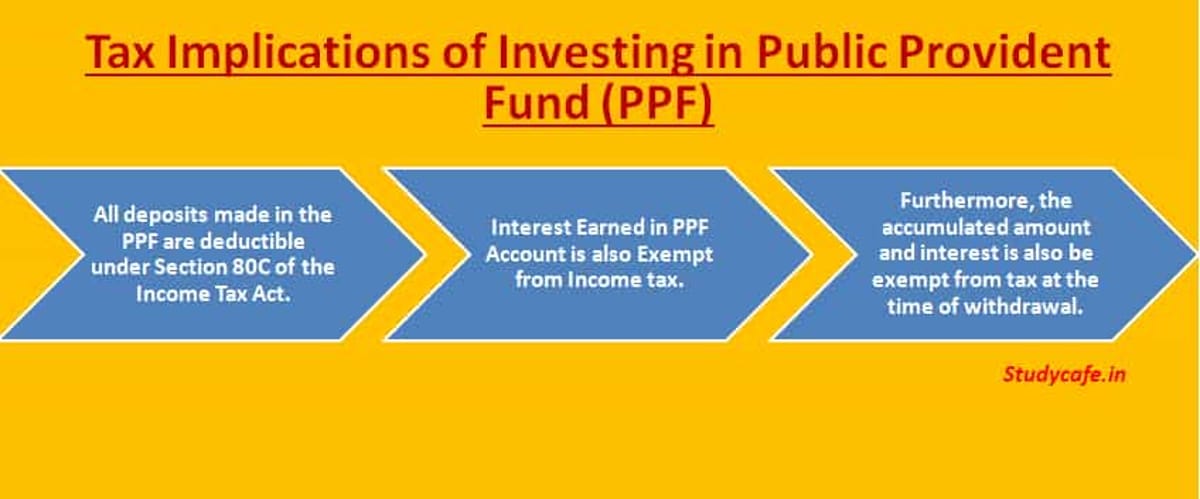

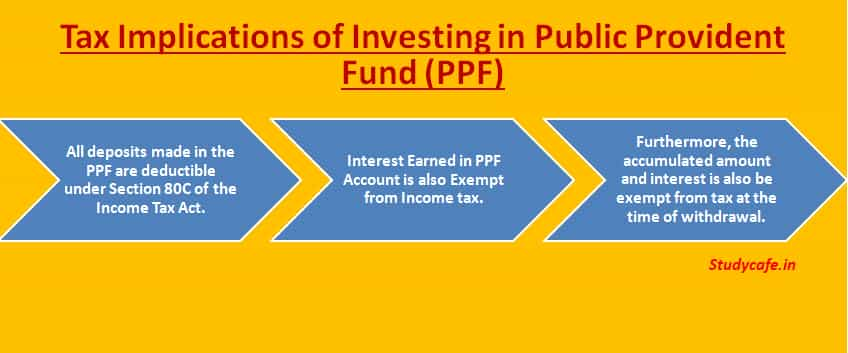

Amount deposited in PPF accounts are eligible for tax deduction under Section 80C. Interest earned on deposits in the PPF account are tax free. This makes the PPF one of the most tax efficient investments in India

PPF Scheme 2019 : Brief on new Public Provident Fund (PPF) Scheme

Some of the Brief updates on New PPF Scheme are as follows:

1) Interest on Loan reduced

If you took a loan against your PPF Account, the PPF Scheme 1968 laid down an interest rate of 2% per annum above the prevailing PPF interest rate. PPF Scheme 2019 has reduced this rate to 1%.

| Comparison | PPF interest rate | Interest on Loan to be Paid on Loan Against PPF |

| PPF Scheme 1968 | 8% | 10% |

| PPF Scheme 2019 | 8% | 9% |

In both cases, the interest is levied from the first day of the month in which the loan is taken to the last day of the month in which the last installment of the loan is paid.

2) Premature Closure

As per PPF Scheme 1968 Government had allowed premature closure of the PPF account on certain Grounds. This has been retained in PPF Scheme 2019 as well, but with certain changes.

| Comparison | PPF Scheme 1968 | PPF Scheme 2019 |

| After the expiry of 5 years | The account holder shall be allowed to prematurely close his account on or after the expiry of 5 years from the end of year in which the account was opened | This has been retained in PPF Scheme 2019 as well |

| Serious ailments | Government had allowed premature closure of the PPF account on grounds of serious ailments or life threatening diseases affecting the account holder, spouse, dependent children or parents. | This has been retained in PPF Scheme 2019 as well |

| Higher education of the account holder. | Premature Closure was allowed on ground of Higher Education of Account Holder | This has been retained in PPF Scheme 2019 as well but with certain reforms 1. Premature Closure is allowed on ground of Higher Education of Account Holder or dependent children. 2. Production of documents and fee bills in confirmation of admission in a recognized institute of higher education in India or abroad has been made mandatory. |

| Change in the residency status | Not there previously | Change in the residency status of account holder has been introduced by new PPF Scheme 2019 |

3) Deposits

PPF Scheme 1968 allowed deposits to be made in multiples of 5 and a maximum of 12 deposits were permitted in a period of 1 year.

PPF Scheme 2019 allows deposits in multiples of ₹50. No upper limit on number of deposits has been specified. In other words you can make deposits to the PPF account as many times as you want, subject to the maximum limit.

The requirement of minimum annual contribution of ₹500 and the maximum annual contribution of ₹1.5 lakh have been retained, as is.

4) Non Resident Indians

The previous PPF scheme prohibited the non-residents from making any investment in the PPF. The new scheme does not contain any provision which prohibits the non-resident. Thus, it appears that any individual, whether resident or non-resident, can opt for this scheme.

However, to open an account under the scheme, the applicant is required to file an application in Form 1 which contains a declaration that the applicant is resident citizen of India. It is not clear how this residential status shall be determined – as per Section 6 of the Income-tax Act or Section 2(v)/2(w) of the FEMA Act.

Thus, if the applicant is a non-resident of India (under both the Act), he will not be eligible to sign such declaration. So inspite of removal of prohibition from the scheme, the Form-1 will restrict a non-resident citizen to sign and submit the application in Form 1. If at any time after opting for the scheme, the account holder becomes a non-resident, then unlike the previous scheme he will not be required to close the accounts and he will be required to file a declaration to an accounts officer regarding his change in residency.

5) Form Changes in new Public Provident Fund

Changes in various forms required in new PF Scheme are as follows:

| Comparison | PPF Scheme 1968 | PPF Scheme 2019 |

| Account Opening Form | Form A | Form 1 |

| Contribution Form | Form B | Not Specified |

| Partial withdrawals | Form C | Form 2 |

| Account closure after maturity | Form C | Form 3 |

| PPF Loan | Form D | Form 2 |

| Extension Form | Form H | Form 4 |

| Premature Closure | NA | Form 5 |

| Nomination | Form E | Form 1 |

Click Here to Buy CA INTER/IPCC Pendrive Classes at Discounted Rate

Tags : News, Income Tax, Provident Fund, Income Tax, Income Tax Deduction, Deduction from Gross Total Income

For Regular Updates Join : https://t.me/Studycafe

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"