Restriction on set-off of loss from House property [Finance Act 2017]

Bare Act

Deductions from income from house property.

24. Income chargeable under the head “Income from house property” shall be computed after making the following deductions, namely:—

(a) a sum equal to thirty per cent of the annual value;

(b) where the property has been acquired, constructed, repaired, renewed or reconstructed with borrowed capital, the amount of any interest payable on such capital:

Provided that in respect of property referred to in sub-section (2) of section 23, the amount of deduction [or, as the case may be, the aggregate of the amount of deduction]shall not exceed thirty thousand rupees :

Provided further that where the property referred to in the first proviso is acquired or constructed with capital borrowed on or after the 1st day of April, 1999 and such acquisition or construction is completed within five years from the end of the financial year in which capital was borrowed, the amount of deduction [or, as the case may be, the aggregate of the amounts of deduction]under this clause shall not exceed two lakh rupees.

Explanation.—Where the property has been acquired or constructed with borrowed capital, the interest, if any, payable on such capital borrowed for the period prior to the previous year in which the property has been acquired or constructed, as reduced by any part thereof allowed as deduction under any other provision of this Act, shall be deducted under this clause in equal instalments for the said previous year and for each of the four immediately succeeding previous years:

Provided also that no deduction shall be made under the second proviso unless the assessee furnishes a certificate, from the person to whom any interest is payable on the capital borrowed, specifying the amount of interest payable by the assessee for the purpose of such acquisition or construction of the property, or, conversion of the whole or any part of the capital borrowed which remains to be repaid as a new loan.

Explanation.—For the purposes of this proviso, the expression “new loan” means the whole or any part of a loan taken by the assessee subsequent to the capital borrowed, for the purpose of repayment of such capital.

Following proviso shall be inserted after the Explanation to the third proviso of section 24 by the Act No. 7 of 2019, w.e.f. 1-4-2020 :

Provided also that the aggregate of the amounts of deduction under the first and second provisos shall not exceed two lakh rupees.

Carry forward and set off of loss from house property.

71B. Where for any assessment year the net result of computation under the head “Income from house property” is a loss to the assessee and such loss cannot be or is not wholly set off against income from any other head of income in accordance with the provisions of section 71, so much of the loss as has not been so set-off or where he has no income under any other head, the whole loss shall, subject to the other provisions of this Chapter, be carried forward to the following assessment year and—

(i) be set off against the income from house property assessable for that assessment year; and

(ii) the loss, if any, which has not been set off wholly, the amount of loss not so set off,

shall be carried forward to the following assessment year, not being more than eight assessment years immediately succeeding the assessment year for which the loss was first computed.

Conclusions

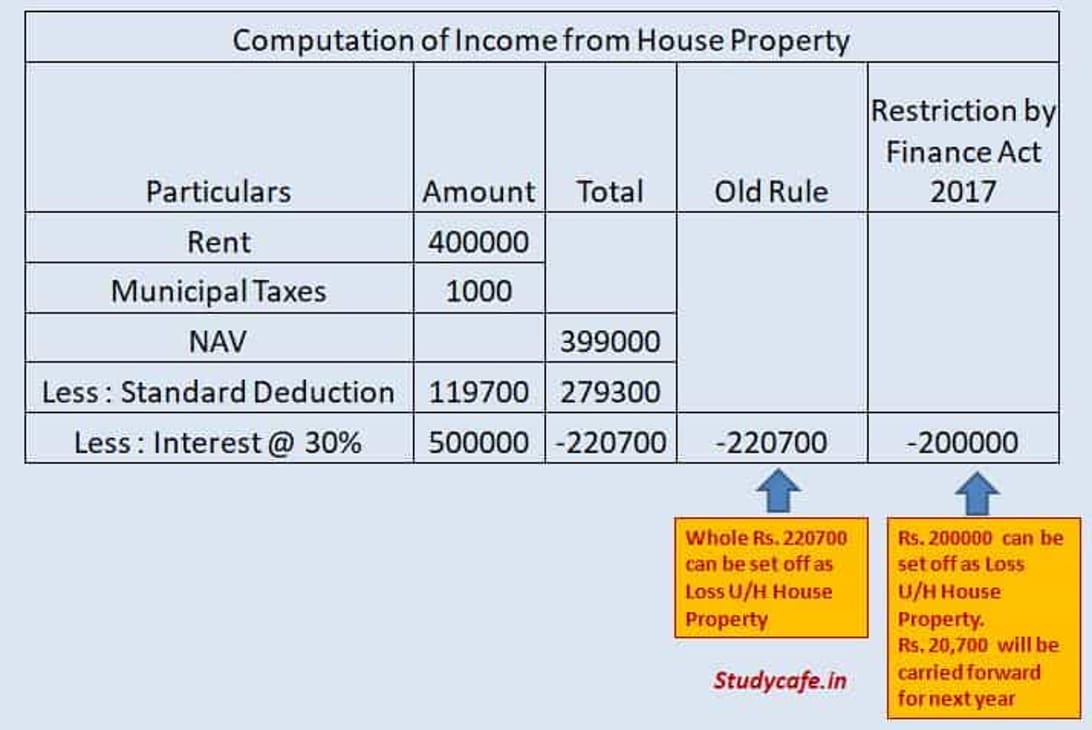

From FY 2017-18, the Tax benefit on loan repayment of second house is restricted to Rs 2 lakh per annum only (even if you have multiple houses the limit is still going to be Rs 2 Lakh only and the ceiling limit is not per house property).

The unclaimed loss if any will be carried forward to be set off against house property income of subsequent 8 years. In most of the cases, this can be treated as ‘dead loss‘.

I believe that this is a major blow to the investors who have bought multiple houses on home loan(s) with an intention to save taxes alone.

Until FY 2016-17, interest paid on your housing loan is eligible for the following tax benefits ;

Municipal taxes paid, 30% of the net annual income (standard deduction) and interest paid on the loan taken for that house are allowed as deductions.

After these deductions, your rental income can be NIL or NEGATIVE and is called ‘loss from house property’ in the latter case.

Such loss is currently allowed to be set off against other heads of income like Income from Salary or Business etc. which helps you to lower you tax liability substantially.

Restriction on set-off of loss from House property

Tags : Income Tax, Income Tax Deduction, Deduction from Gross Total Income

For Regular Updates Join : https://t.me/Studycafe

Click Here to Buy CA INTER/IPCC Pendrive Classes at Discounted Rate

Restriction on set-off of loss from House property, house property loss set off, Carry Forward and Set off of Losses, income from house property

StudyCafe Membership

Join StudyCafe Membership. For More details about Membership Click Join Membership Button

Join MembershipIn case of any Doubt regarding Membership you can mail us at [email protected]