Reetu | Oct 7, 2022 |

Revenue Deficit Grant of Rs.7183.42 crore released to 14 States

The Department of Expenditure, Ministry of Finance has on Thursday released the 7th monthly instalment of Post Devolution Revenue Deficit (PDRD) Grant of Rs.7,183.42 crore to 14 States. The grant has been released as per the recommendations of the Fifteenth Finance Commission.

The Post Devolution Revenue Deficit Grant to 14 States for the financial year 2022–2023 has been recommended by the Fifteenth Finance Commission at a total of Rs. 86,201 crore. The Department of Expenditure disburses the proposed amount in 12 equal monthly instalments to the suggested States. With the disbursement of the seventh instalment for the month of October 2022, the total amount of Revenue Deficit Grants made available to the States in 2022–23 has increased to Rs. 50,283.92 crore.

According to Article 275 of the Constitution, the States are given Post Devolution Revenue Deficit Grants. To fill the gap in the States’ revenue accounts following devolution, grants are disbursed to the States in accordance with the recommendations of the subsequent Finance Commissions.

The Fifteenth Finance Commission made its decisions regarding the eligibility of States to receive this grant and the amount of grant for the years 2020–2021 to 2025–2026 based on the gap between the State’s estimated revenue and expenditures after accounting for the estimated devolution during this time.

Following states have been recommended by the Fifteenth Finance Commission for the Post Devolution Revenue Deficit Grant for the fiscal years 2022–2023: Andhra Pradesh, Assam, Himachal Pradesh, Kerala, Manipur, Meghalaya, Mizoram, Nagaland, Punjab, Rajasthan, Sikkim, Tripura, Uttarakhand, and West Bengal.

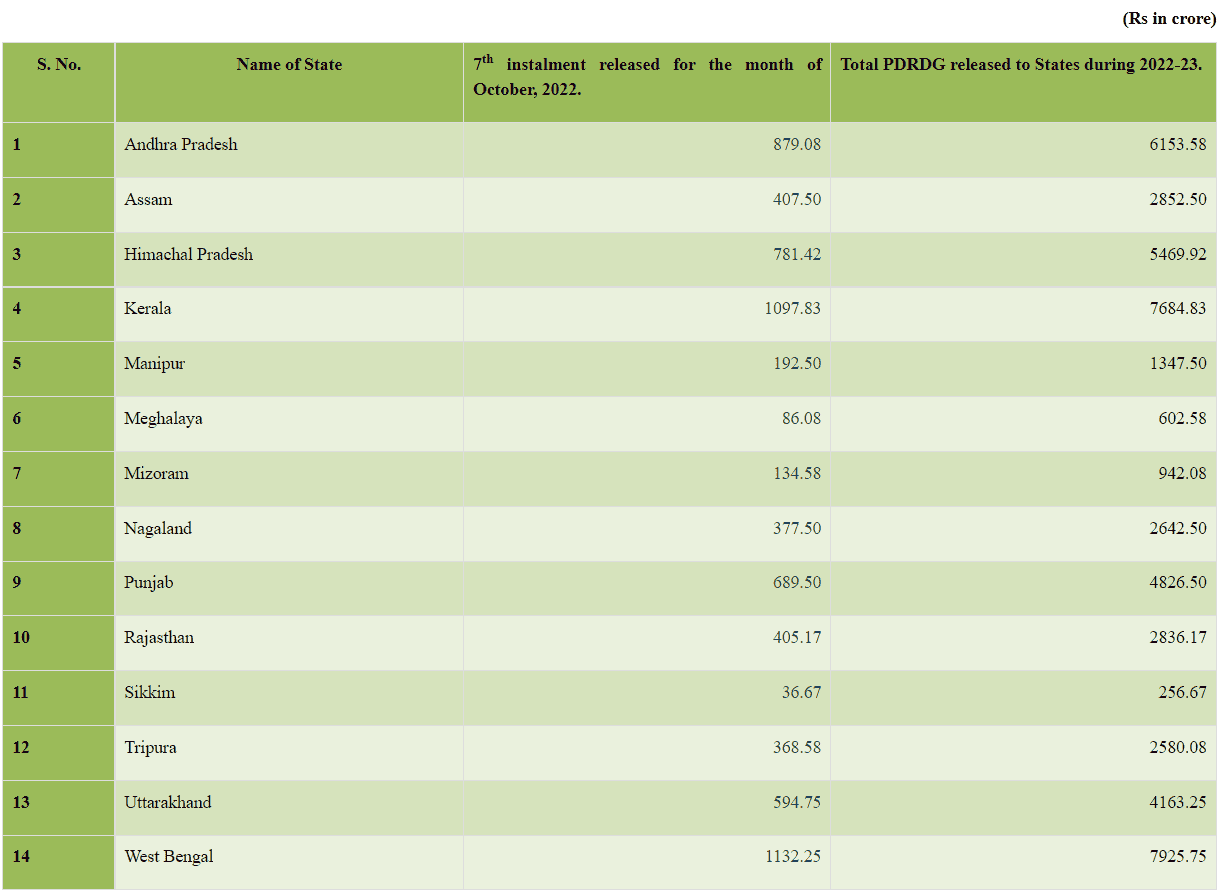

State-wise details of Post Devolution Revenue Deficit Grant recommended for 2022-23 and the amount released to States as 7th instalment are as under:

State-wise Post Devolution Revenue Deficit Grant (PDRDG) Released

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"