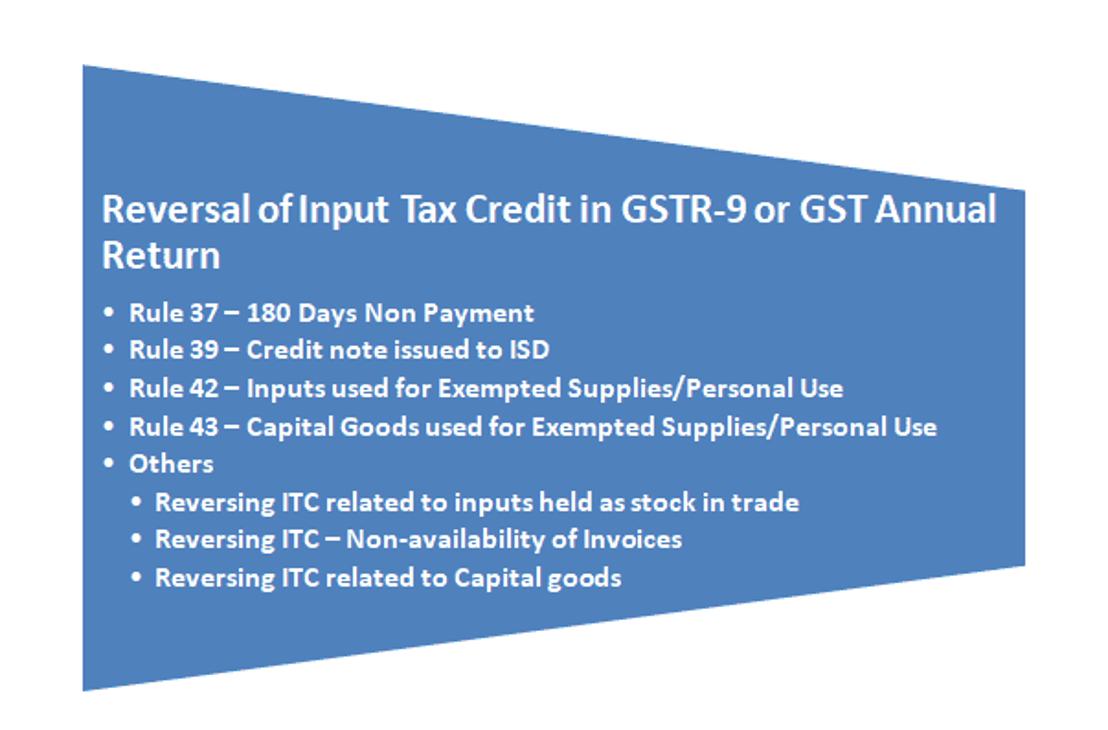

Reversal of Input Tax Credit in GSTR-9 or GST Annual Return

Reversals explained in Detail are as Follows-

1. Rule 37 180 Days Non Payment

2. Rule 39 Credit note issued to ISD

3. Rule 42 Inputs used for Exempted Supplies/Personal Use

4. Rule 43 Capital Goods used for Exempted Supplies/Personal Use

5. Others

Reversal of Input Tax Credit in GSTR-9 or GST Annual Return

As a dealer, you would have availed

ITCon inward supplies. But if you fail to pay the invoice amount to the supplier within 180 days the ITC has to be reversed. If part of the invoice is paid the ITC will be reversed on a proportionate basis.

This means that the business has to maintain the creditors aging and basis on that they have to reverse the

Input Tax Credit. In big organizations it will be very challenging as they have lot transactions and maintained from various locations. This process would be very easy if the accounting or ERP they are using supports the same. Though it looks like a complex process but it would be simple if the technology is used in the process.

The reversal of the ITC is based on the provisions given in Section 16 of the

CGST Act

Provided further that where a recipient fails to pay to the supplier of goods orservices or both, other than the supplies on which tax is payable on reverse chargebasis, the amount towards the value of supply along with tax payable thereon within aperiod of one hundred and eighty days from the date of issue of invoice by the supplier, an amount equal to the input tax credit availed by the recipient shall be addedto his output tax liability, along with interest thereon, in such manner as may beprescribed:

All the supplier invoices which are issued from 1st July 2017 to 3rd July 2017, if they are unpaid, ITC has to be reversed along with interest.

Also, amount of ITC to be reversed should be further segregated into IGST, CGST, SGST and Cess.

For example

Mr. A received goods on 1st July 2017 worth Rs. 10000 on which GST Rs. 1800 was charged.

Mr. A claimed the GST of Rs 1800 as ITC in his GSTR 3B

Mr. A could not pay the invoice amount till December 2017.

This means that Mr. A will have to reverse the ITC of Rs 1800 while filing GSTR 3B for December 2017 in January 2018.

2. Rule 39(1)-Credit note issued to ISD

When an ISD receives a Credit Note from a supplier the ITC distributed previously has to be reversed. The dealers to whom the credit was distributed also have to reverse this ITC. This reversal of input tax credit shall be in the same proportion as in the original ITC distribution by the ISD.

Also, amount of ITC to be reversed should be further segregated into IGST, CGST,SGSTand Cess.

For example

M/s X receives services worth Rs 100000 on which GST of Rs 18000 was paid.

M/s X distributed this credit to 2 dealers A and B in the ratio of 1:2

A and B claimed the ITC in the GSTR 3B.

Now M/s X has received a credit note worth Rs 23600 (including GST of Rs 3600)

This GST of Rs 3600 has to be reversed by A & B in the ratio of 1:2

A will reverse ITC of Rs 1200 (3600 * 1 / 3)

B will reverse ITC of Rs 2400 (3600 * 2 / 3)

This will be included in the GSTR 3B by both A and B in the reversal of input tax credit section.

3. Rule 42(1) – ITCon input suppliespartly used for business and partly for exempt supplies or personal use

The ITC used for exempt supplies and personal purpose has to be reversed in GSTR 3B.

How to

Calculate ITC reversal on Exempt Supplies

Step 1 Calculate Common Credit

Common Credit= Total ITC on Input Supplies

(less) ITC on supplies used for

exclusivelyPersonal purposes

(less) ITC on supplies used for providing

exclusivelyexempt supplies

(less) ITC on which credit is not available

(less) ITC on supplies other than exempted but including zero rated supplies (ITC on normal supplies)

In simple words, Common Credit is ITC on inputs partly used for exempt supplies or personal use.

Step 2 Amount of reversal of input tax credit attributable to inputs partly used for Exempt supplies = (Value of Exempt Supplies* Common Credit) /Total Turnover in the State

How to

Calculate ITC onPersonal Use5 % of Common Credit

Both these ITC amounts as calculate have to be reversed in the GSTR 3B filed by the dealer.

4. Rule 43(1)- ITC onCapital Goodspartly used for business and partly for exempt supplies or personal use

ITC on capital goods used for the supply of exempt supplies and non-business purposes will also be reversed.

The calculation will be similar to the calculation for ITC on inputs used for exempt supplies and personal use.

Step 1 Calculate Common Credit

Common Credit = ITC on Capital Goods

(less) ITC on capital goods put to

exclusivelypersonal use

(less) ITC on capital goods used for

exclusivelyexempted goods

(less) ITC on capital goods used in supplies other than exempted but including zero rated supplies (ITC on normal supplies)

Step 2 Amount of ITC reversal attributable to capital goods partly used for Exempt supplies and Personal use

= (Value of Exempt Supplies *Common Credit)/Total Turnover in the State

Step 3 This reversal of input tax credit has to be done on a monthly basis. The life of any asset is considered as 5 years. So the amount of ITC reversal every month will be

=Amount arrived at in Step 2 /60 (months)

5. Others

– Reversing ITC related to inputs held as stock in trade: For inputs in stock, the input tax credit reversal amount shall be calculated proportionately on the basis of corresponding invoices on which credit had been availed.

– Reversing ITC Non-availability of Invoices: Where aforesaid tax invoices are not available, credit reversal amount shall be based on the prevailing market price of the goods on the date of relevant event, based on which reversal is required.

– Reversing ITC related to Capital goods: For capital goods, the input tax credit involved in the remaining residual life in months shall be computed on pro-rata basis, taking the residual life as five years.

Illustration – Capital goods have been in use for 4 years, 6 month and 15 days.

The residual remaining life in months= 5 months (60 55 months) ignoring a part of the month Input tax credit taken on such capital goods = 12000

Input tax credit attributable to remaining residual life= 12000 X 5/60 = 1000.