ROC has fined Divyam Infracon Private Limited and its directors Rs. 4,00,000 in total for violating Section 12(1) of the Companies Act, 2013.

Nidhi | Apr 7, 2025 |

ROC Levies Penalty of Rs. 400,000 For Non-Filing of E-Form ACTIVE (INC-22A)

As per an official penalty order issued by the Registrar of Companies (RoC), Gujarat, Divyam Infracon Private Limited and its directors have been fined Rs. 4,00,000 in total for violating Section 12(1) of the Companies Act, 2013, read with Rule 25A of the Companies (Incorporation) Rules, 2014.

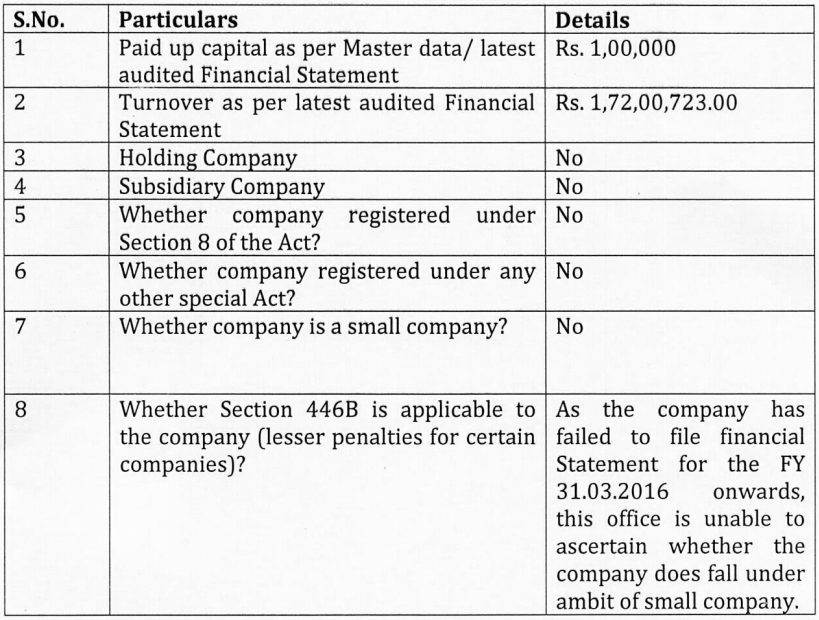

Financial and other information of the company as per the latest Financial Statement for the year ended 31.03.2015 available on MCA21 portal are as follows

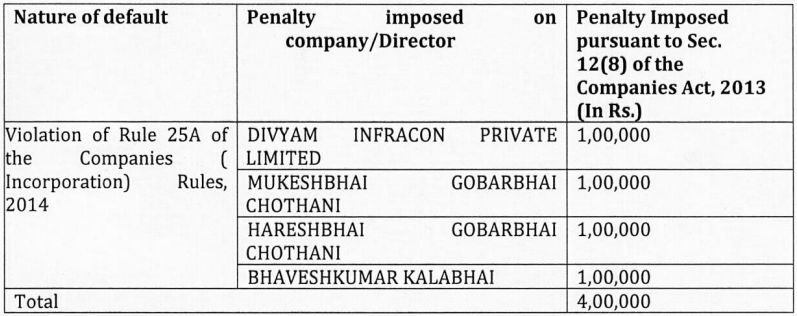

After reviewing all the details of the case and the explanation given by the presenting officer and considering all relevant factors, the authority has a valid reason to believe that the company has not complied with the requirements of Rule 25A of the Companies (Incorporation) Rules, 2014, read with Section 12(1) of the Companies Act, 2013. Therefore, it was decided that a fine of Rs. 1,00,000 would be levied on the company as well as each of the officers in default. The table below shows who the fine is charged to and for what reason.

Refer to the official order for more information.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"