Studycafe | Apr 1, 2021 |

Rs 123902 crore gross GST revenue collected in the month of March 2021

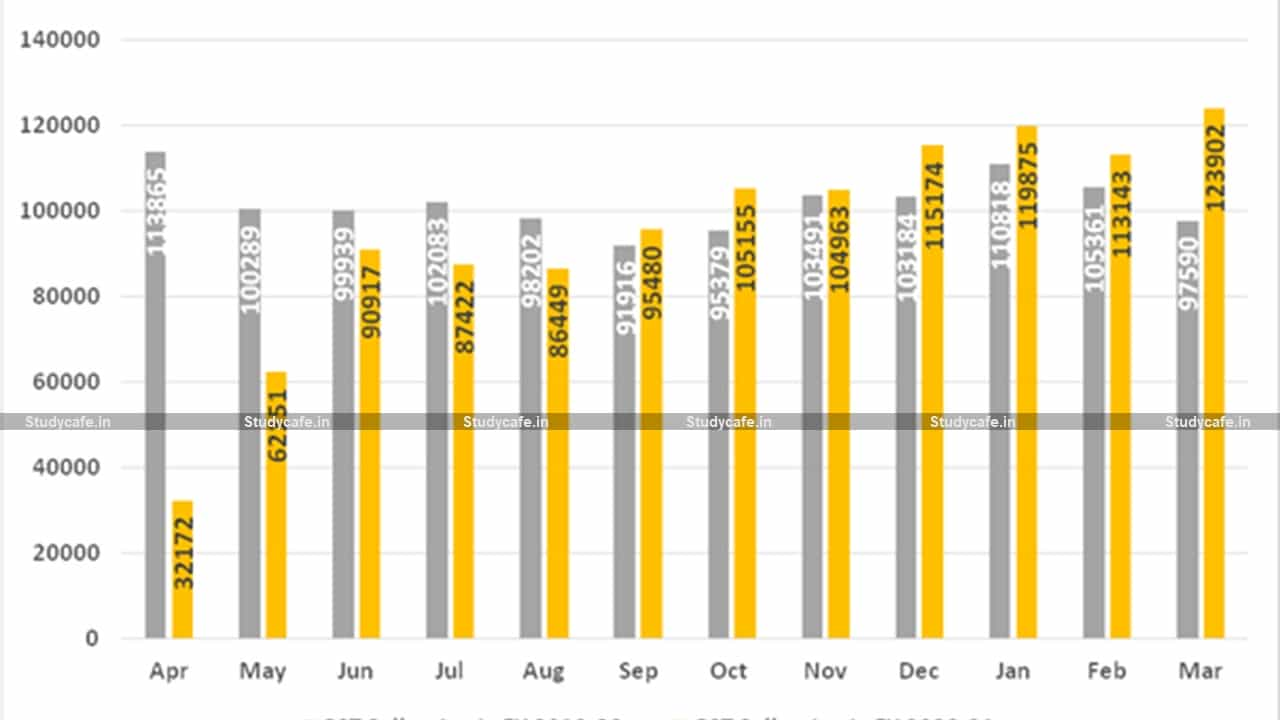

The gross GST revenue collected in March 2021 is at a record of ₹ 1,23,902 crore of which CGST is ₹ 22,973 crore, SGST is ₹ 29,329 crore, IGST is ₹ 62,842 crore (including ₹ 31,097 crores collected on import of goods) and Cess is ₹ 8,757 crore (including ₹ 935 crores collected on import of goods).

The government has settled ₹ 21,879 crores to CGST and ₹ 17,230 crores to SGST from IGST as a regular settlement. Also, the Centre has settled ₹ 28,000 crores as IGST ad-hoc settlement in the ratio of 50:50 between Centre and States/UTs. The total revenue of Centre and the States after regular and ad-hoc settlements in March 2021 is ₹ 58,852 crore for CGST and ₹ 60,559 crores for the SGST. The Centre has also released a compensation of ₹ 30,000 crores during March 2021.

The GST revenues during March 2021 are the highest since the introduction of GST. In line with the trend of recovery in the GST revenues over the past five months, the month of March 2021 is 27% higher than the GST revenues in the same month last year. During the month, revenues from import of goods were 70% higher and the revenues from the domestic transaction (including import of services) are 17% higher than the revenues from these sources during the same month last year. The GST revenue witnessed a growth rate of (-) 41%, (-) 8%, 8%, and 14% in the first, second, third, and fourth quarters of this financial year, respectively, as compared to the same period last year, clearly indicating the trend in the recovery of GST revenues as well as the economy as a whole.

GST revenues crossed above ₹ 1 lakh crore mark at a stretch for the last six months. A steep increasing trend over this period is clear indicators of rapid economic recovery post-pandemic. Closer monitoring against fake-billing, deep data analytics using data from multiple sources including GST, Income-tax, and Customs IT systems, and effective tax administration has also contributed to the steady increase in tax revenue over the last few months.

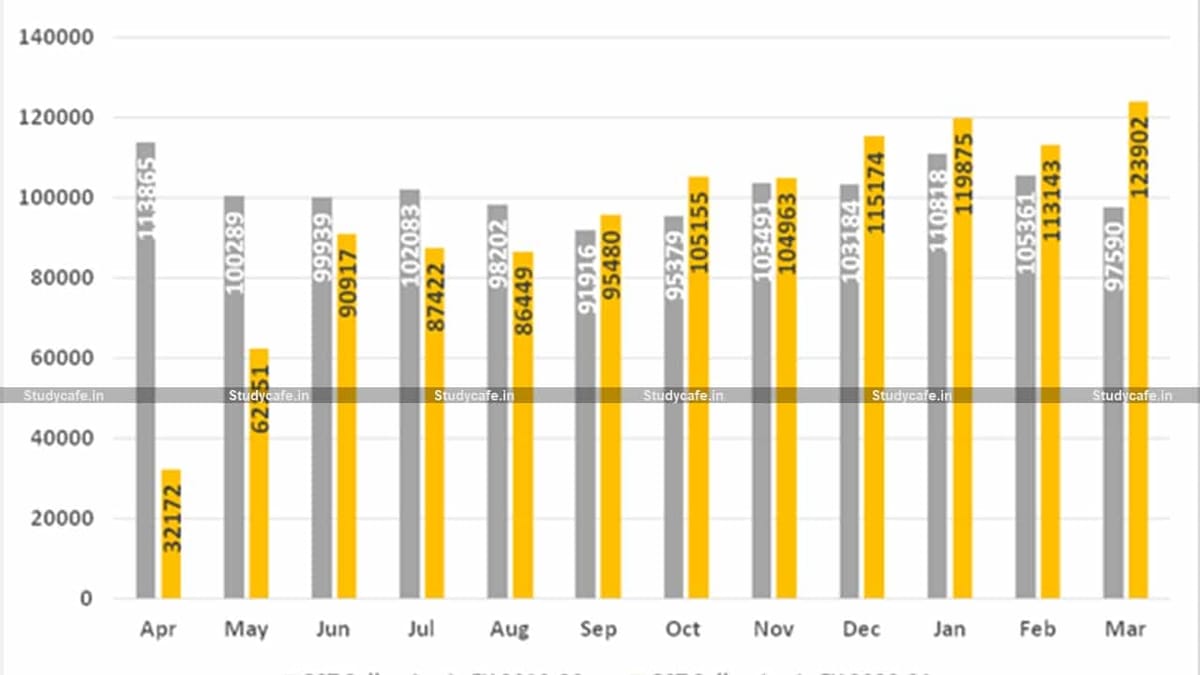

The chart below shows trends in monthly gross GST revenues during the current year. The table shows the state-wise GST figures collected in each State during March 2021 compared to March 2020.

Rs 123902 crore gross GST revenue collected in the month of March 2021

| S.No. | State | Mar-20 | Mar-21 | Growth |

| 1 | Jammu and Kashmir | 276.17 | 351.61 | 27% |

| 2 | Himachal Pradesh | 595.89 | 686.88 | 15% |

| 3 | Punjab | 1,180.81 | 1,361.85 | 15% |

| 4 | Chandigarh | 153.26 | 165.27 | 8% |

| 5 | Uttarakhand | 1,194.74 | 1,303.57 | 9% |

| 6 | Haryana | 4,874.29 | 5,709.60 | 17% |

| 7 | Delhi | 3,272.99 | 3,925.97 | 20% |

| 8 | Rajasthan | 2,820.44 | 3,351.79 | 19% |

| 9 | Uttar Pradesh | 5,293.72 | 6,265.01 | 18% |

| 10 | Bihar | 1,055.94 | 1,195.75 | 13% |

| 11 | Sikkim | 189.33 | 213.66 | 13% |

| 12 | Arunachal Pradesh | 66.71 | 92.03 | 38% |

| 13 | Nagaland | 38.75 | 45.48 | 17% |

| 14 | Manipur | 35.89 | 50.36 | 40% |

| 15 | Mizoram | 33.19 | 34.93 | 5% |

| 16 | Tripura | 67.1 | 87.9 | 31% |

| 17 | Meghalaya | 132.72 | 151.97 | 15% |

| 18 | Assam | 931.72 | 1,004.65 | 8% |

| 19 | West Bengal | 3,582.26 | 4,386.79 | 22% |

| 20 | Jharkhand | 2,049.43 | 2,416.13 | 18% |

| 21 | Odisha | 2,632.88 | 3,285.29 | 25% |

| 22 | Chhattisgarh | 2,093.17 | 2,544.13 | 22% |

| 23 | Madhya Pradesh | 2,407.40 | 2,728.49 | 13% |

| 24 | Gujarat | 6,820.46 | 8,197.04 | 20% |

| 25 | Daman and Diu | 94.91 | 3.29 | -97% |

| 26 | Dadra and Nagar Haveli | 168.89 | 288.49 | 71% |

| 27 | Maharashtra | 15,002.11 | 17,038.49 | 14% |

| 29 | Karnataka | 7,144.30 | 7,914.98 | 11% |

| 30 | Goa | 316.47 | 344.28 | 9% |

| 31 | Lakshadweep | 1.34 | 1.54 | 15% |

| 32 | Kerala | 1,475.25 | 1,827.94 | 24% |

| 33 | Tamil Nadu | 6,177.82 | 7,579.18 | 23% |

| 34 | Puducherry | 149.32 | 161.04 | 8% |

| 35 | Andaman and Nicobar Islands | 38.58 | 25.66 | -33% |

| 36 | Telangana | 3,562.56 | 4,166.42 | 17% |

| 37 | Andhra Pradesh | 2,548.13 | 2,685.09 | 5% |

| 38 | Ladakh | 0.84 | 13.67 | 1527% |

| 97 | Other Territory | 132.49 | 122.39 | -8% |

| 99 | Centre Jurisdiction | 81.48 | 141.12 | 73% |

| Grand Total | 78693.75 | 91869.7 | 17% |

[1] Does not include GST on the import of goods

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"