Sunil Kumar, 45, a daily wage labourer from Roorkee, was taken aback when he received a notice from the income tax (I-T) department demanding that he pay a whopping Rs 70 lakh as tax on his earnings.

Reetu | Mar 25, 2023 |

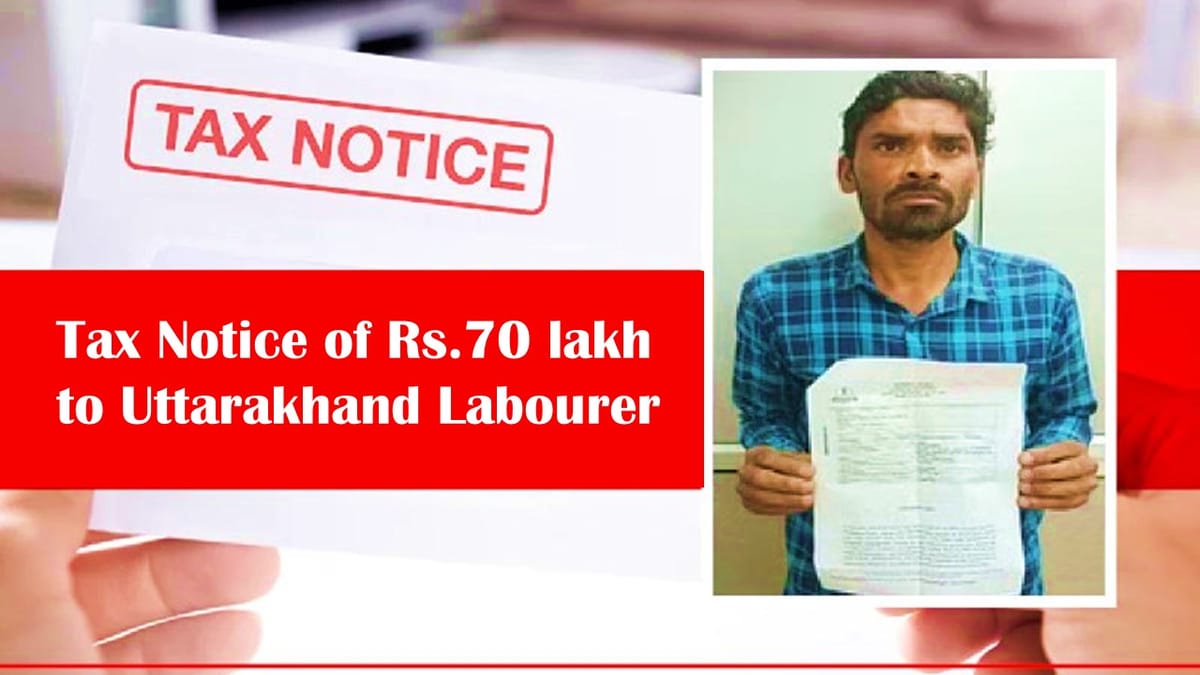

Shocking Income Tax Notice of Rs. 70 lakh to Uttarakhand Labourer

Sunil Kumar, 45, a daily wage labourer from Roorkee, was taken aback when he received a notice from the income tax (I-T) department demanding that he pay a whopping Rs 70 lakh as tax on his earnings.

Kumar, who makes about Rs 500 per day, received a notice from the I-T department on March 10. The notification, citing his PAN, asked that he pay Rs 70,03,235 under section 156 of the Income Tax Act for “supplying raw materials to a firm in 2018.” A local lawyer, Vikas Saini, who will represent the daily wager for bono, has responded to the I-T department. “It appears that some fraudsters used his PAN and set up a bogus firm,” Saini explained.

“In fact, the I-T department examined the accounts of a Meerut-based private firm and discovered it to be a proprietary firm operating under Sunil Kumar’s PAN number and supplying raw materials worth Rs 42 lakh to another Meerut-based firm. The department had previously sent Kumar notifications to appear before them, but he ignored them, believing the notices were unrelated to him. The I-T department then dismissed his case and issued an ex-parte order for the payment of more than Rs 70 lakh,” Saini stated.

Kumar, who is originally from Shamli in Uttar Pradesh, has lived in Roorkee for the past seven years. “A few years ago, I gave some agents papers of my Shamli-based property for a bank loan to build my house in Roorkee. I believe these loan agents used my PAN and other details to set up a bogus company in my name,” he explained.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"